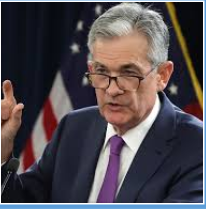

Den amerikanske centralbank fortsætter sine opkøb, der er på 120 milliarder dollar om måneden, og det vil formentlig vare til udgangen af 2021. Centralbankchefen Powel er bekymret over forværringen af coronakrisen og økonomien, og han mere end indikerer, at skal der pumpes markant flere midler i økonomien, må regeringen gør det og ikke centralbanken.

Fed Watch – New forward guidance, but maturity lengthening does not look imminent

Clearer forward guidance suggests QE will last at least until the end of 2021 – The Fed provided greater clarity on its forward guidance, making an explicit link between continued asset purchases and the need for ‘substantial further progress towards the Committee’s employment and price stability goals’ before the Fed might consider tapering those purchases.

While ‘substantial progress’ is open to interpretation, the new guidance suggests to us that purchases – currently $120bn per month – will continue at their current pace at least through to the end of next year, and potentially longer if the vaccine roll-out is slower than expected and the unemployment rate falls more gradually as a result.

In the press conference, Powell also affirmed that the Fed could provide extra accommodation by either increasing the pace of purchases or by tilting the purchases towards longer-dated bonds, should progress be slower than Fed expectations.

Indeed, those expectations are notably higher now with the latest SEP projections, which saw upgrades to growth and employment forecasts on the back of the unexpectedly rapid recovery in the US so far.

Powell nodded to the recent surge in covid-19 cases and the renewed hit to the hospitality sector as posing downside risks to the outlook, but he continued to bat responsibility for tackling this to Congress, noting that the parts of the economy that are struggling are not due to a lack of accommodative financial conditions, but rather due to government measures.

Maturity lengthening now looks more like a ‘just in case’ tool – In news that would have disappointed some market participants, Powell sounded cautious on the prospects for the Fed altering the maturity profile of its asset purchases, as had been discussed and hinted at in the November FOMC minutes.

He explicitly referred to such a move as something that would provide additional accommodation, and therefore would be contingent on the outlook worsening. In other words, it is something the Fed would like to keep in its back pocket for a rainy day rather than definitely being in the pipeline.

He also poured cold water on the case for combining a maturity lengthening with tapering (as the Bank of Canada is doing) saying the views on the efficacy of this were ‘mixed’ on the FOMC. Despite the recent rise in 10y yields, Powell continued to refer to overall financial conditions as ‘highly accommodative’.

With that said, we suspect the Fed is approaching the limit to how much of a rise in 10y yields it will tolerate given the need to meet its ambitious new inflation target. It looks as though its first choice will be to rely on the threat of potentially higher asset purchases (its guidance still says that the $120bn monthly pace is a minimum, and could therefore be higher) before taking the extra step of committing to a specific composition of purchases. If this fails to keep a lid on yields, we doubt the Fed would hesitate to make such a step.