Den danske inflation stiger på grund af stigende priser på cigaretter og ferier. Inflationen steg i juli med 0,8 pct. svarende til en årsstigning på 0,5 pct. Det er kerneinflationen, der er steget mest. Kerneinflationen har i et par år ligget under euro-gennemsnittet, men nu er den danske inflation røget over EU-niveauet.

Uddrag fra Nordea:

Danish inflation: Higher prices of cigarettes start to kick in – and more will come

Higher prices of cigarettes and vacations have pushed Danish inflation higher. We expect this upward trend to continue, causing Danish inflation to move higher compared to the Euro area in the coming year.

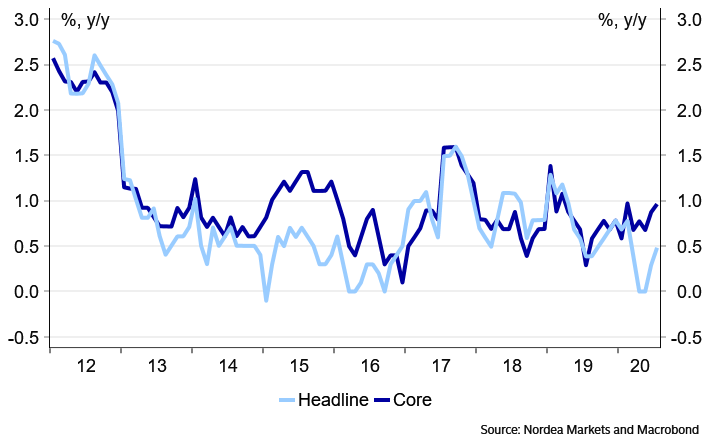

The Danish consumer price index increased by 0.8% m/m in July, equivalent to an increase of 0.5% year-over-year – the highest since February 2020. Core inflation increased to 1.0% y/y from 0.9% in June.

Chart 1: Both headline and core inflation tick higher

Higher prices of vacation and cigarettes

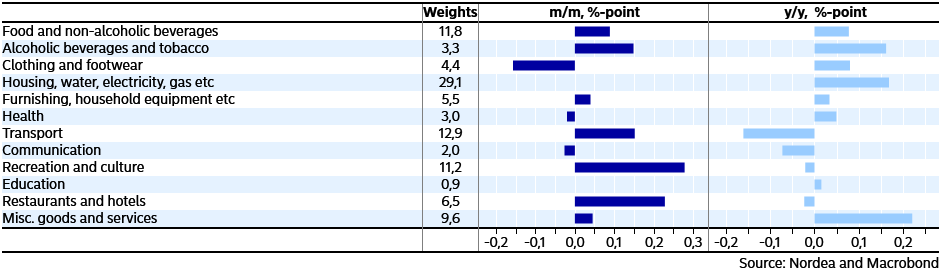

As always in July, higher prices of vacations made the single largest contribution to the increase in the consumer price index compared to the previous month. Rents on summer houses added 0.21% point to the increase, while package holidays added 0.36%. However, it should be noted that the price increase of package holidays is not based on actual numbers but due to the coronavirus estimated from the development in 2019.

Table 1: Contribution to inflation in July

Most interestingly, the large price increase of cigarettes that was officially implemented on 1 April has finally started to show up in the inflation numbers. Until last month most stores were able to sell cigarettes with the old tax stamp.

However, now that the stocks of “old” cigarettes have run out, the higher prices start to be visible in the CPI. In July this made a positive contribution to the year-over-year numbers of 0.16% point. Once fully implemented, we expect a positive contribution of close to 0.5% point to the year-over-year change in the CPI.

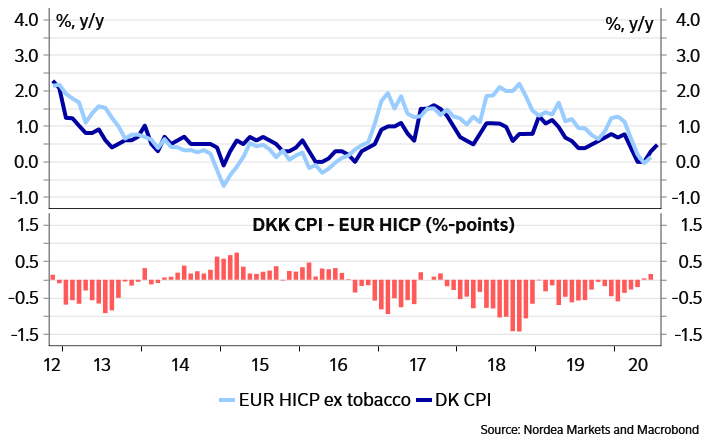

Chart 2: Even larger contribution from cigarettes is expected in coming months

Danish inflation is expected to be higher compared to the Euro area

Going forward, we expect Danish inflation to move higher over the coming months mainly as a result of the numbers starting to fully reflect the price increases of cigarettes. At the same time, the higher activity level in the Danish economy is expected to pave the way for small price increases especially of domestic services. All in all, we expect this to cause Danish inflation to move higher compared to the Euro area in the coming year.