Risikoen for globale recessioner er aftaget, og Pimco forudser en moderat fremgang i den globale økonomi. Amerikansk økonomi kommer først i sving lidt senere.

Uddrag fra Pimco:

Recession risks have diminished, and we are more confident in our baseline forecast of a moderate recovery in global growth this year against a backdrop of benign inflation.

But monetary policymakers have less space left to guard against future recessions, and the possibility of disruptions due to trade conflicts, political tensions, or unforeseen events such as the emergence of the new coronavirus loom over the outlook.

As discussed in our Cyclical Outlook, “Seven Macro Themes for 2020,” investors should watch the interplay of forces such as global growth, inflation, and potential disruptors for clues on how to adjust their portfolios in the year ahead.

The world leads, the U.S. lags

Just as the U.S. cycle lagged behind the global cycle during 2018 and 2019 with the U.S. economy slowing later and by less than the rest of the world, we expect global growth to trough out and rebound earlier than U.S. growth this year.

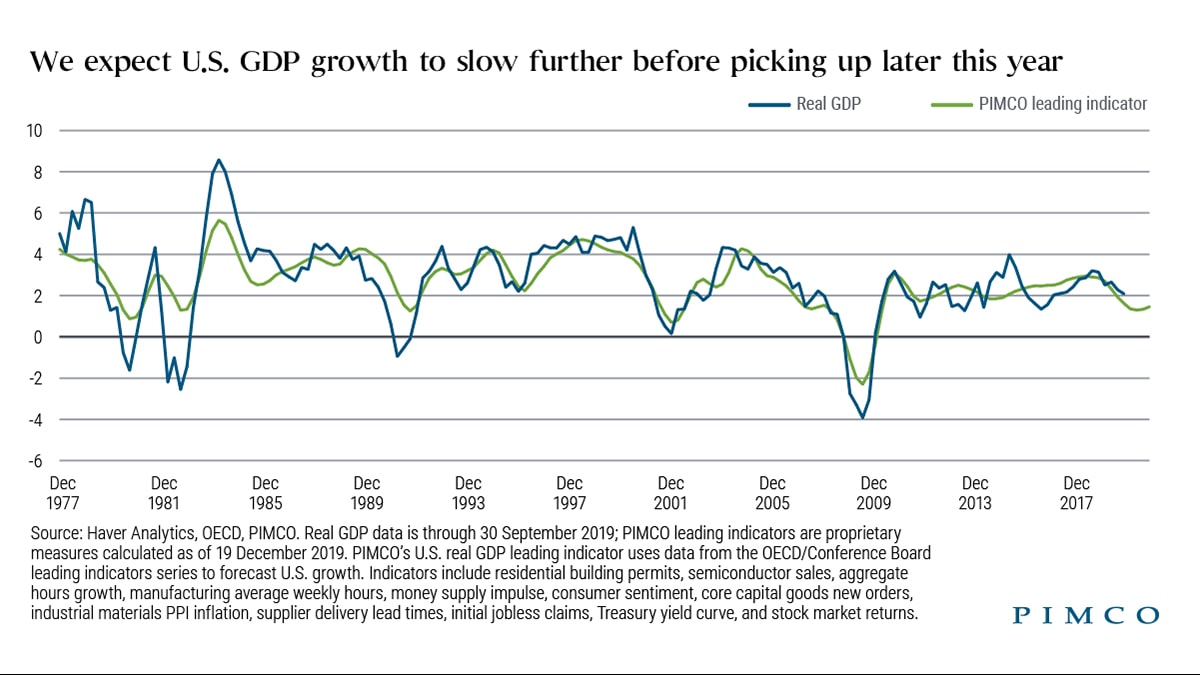

Signs of a rebound already started to show up late last year in the global purchasing managers’ indices (PMIs), particularly in emerging markets, and in other business surveys that are sensitive to global trade and manufacturing, such as the German Ifo survey. Meanwhile, in the U.S. our leading indicators suggest that GDP growth could slow further to around 1% annualized in the first half of this year before picking up again (see chart).

Moreover, temporary production cuts in the U.S. airline industry could shave off another 0.5 percentage points from first-quarter annualized GDP growth, though this would likely be largely recovered assuming production resumes in the second quarter as is widely expected.

Another factor that could hold back U.S. animal spirits and growth this year would be a possible increase in political uncertainty ahead of the U.S. elections, particularly if progressive high-tax, high-regulation Democratic candidates gain more support during the primaries. This would most likely weigh on business sentiment and investment spending and could lead to a tightening of financial conditions via lower expected equity returns.

Taken together, U.S. growth momentum may lag global growth momentum at least for some time during the first half of 2020.