Uddrag fra DB, Morgan Stanley, Goldman og Zerohedge

Presidential Race

- On Tuesday November 5th, Americans will go to the polls to vote in the Presidential Election with the winner taking office in January 2025 for a four-year term.

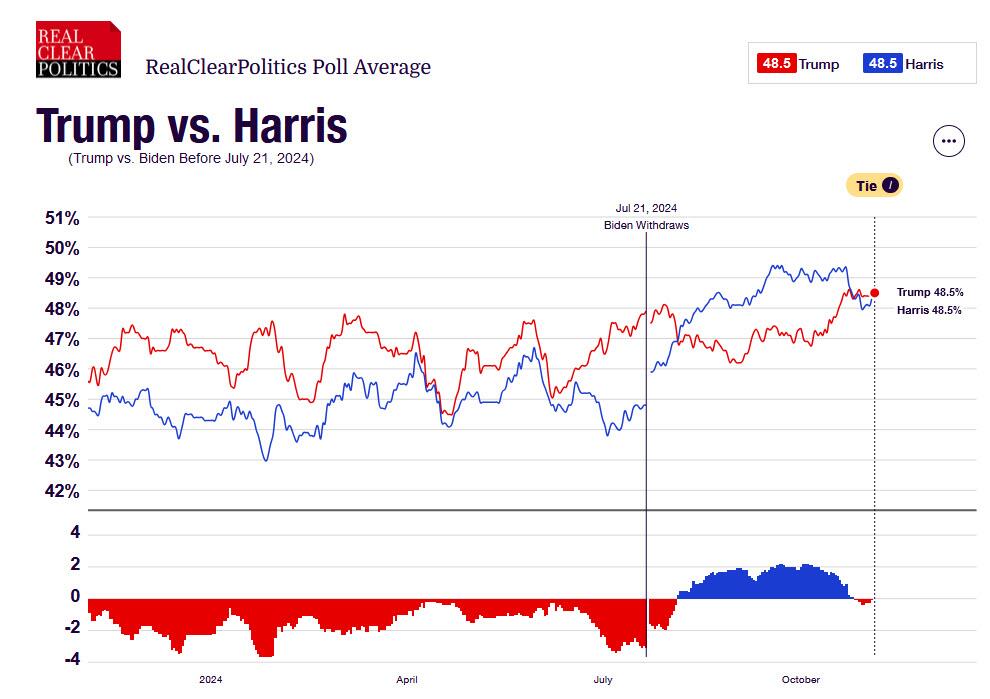

- Republican candidate Donald Trump and Democratic candidate Kamala Harris are locked in a very tight race, and while national polls have Harris slightly in front, betting markets are now mixed after a dramatic weekend before the election. Polls in swing states overall, show Trump leading by a thin margin. What is certain is how momentum has shifted towards the former President in recent weeks and months, albeit with a slight late shift back in favour towards Harris.

- In terms of averages, FiveThirtyEight’s model assigns an 53% probability of a Trump win, and a 46% probability of Harris winning; pollster Nate Silver sees a 54% and 46% chance respectively. Republicans are clearly favoured to win the Senate, with FiveThirtyEight averages assigning a 90% probability, while the House is neck and neck, with Republicans seeing a 52% likelihood and Democrats 48%.

- On the night, the pivotal swing states (Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania, and Wisconsin) will be

- viewed to see how the election is playing out, with Pennsylvania seen as the key state, as it is likely, but not impossible, that a

- candidate will not win the election without it. In the polls and in recent weeks (via 538 and Nate Silver) PA has flipped to Trump.

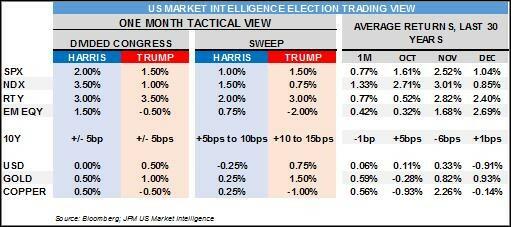

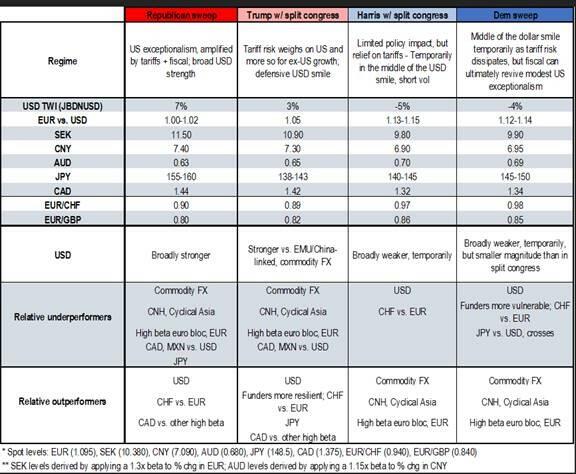

- For traders, focus will be on the Dollar, with a Trump win and a Republican sweep seen as the most bullish case for the Buck, with Commodity FX, the Yuan, and MXN amongst EMFX heavily weighed on. If Harris won, the Greenback is expected to be weaker, with commodity FX outperforming along with the EUR. Below we detail scenarios, and more nuanced trades.

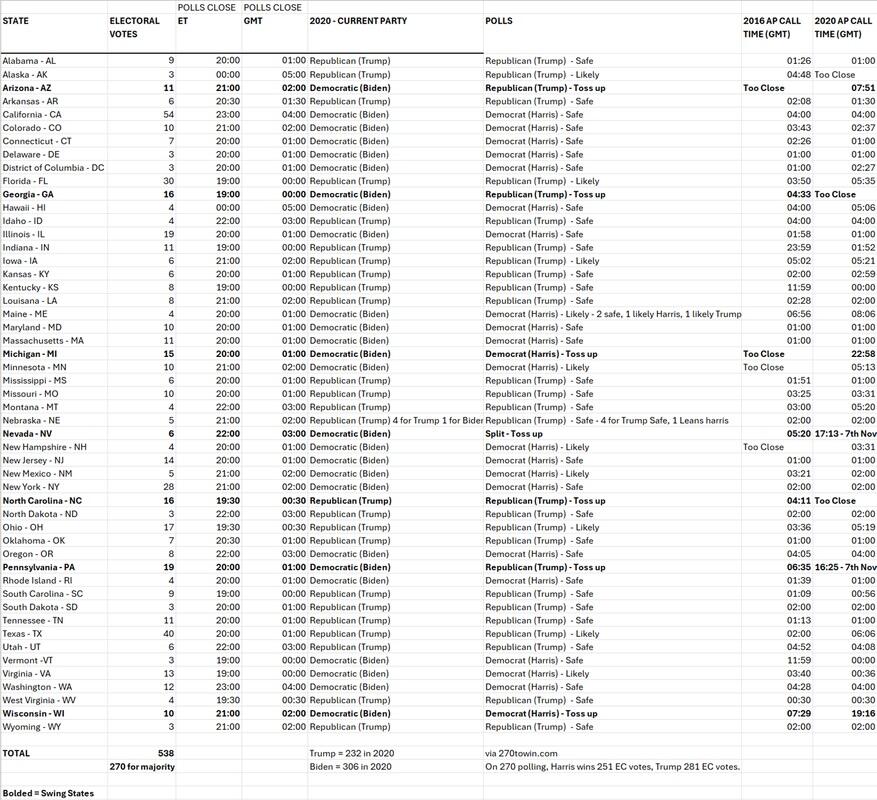

- For reference, the Presidential nominee with the most electoral votes becomes the President of the US. The Electoral College is a process in which electors or representatives from each state in number proportional to the state’s population cast their vote and determine who will be president. Each state gets a certain number of electors based on its representation in Congress, and there are a total of 538 electors, and the candidate who gets more than half (270) wins. As such, a candidate could win the popular vote but lose the election if they do not receive 270 EC votes.

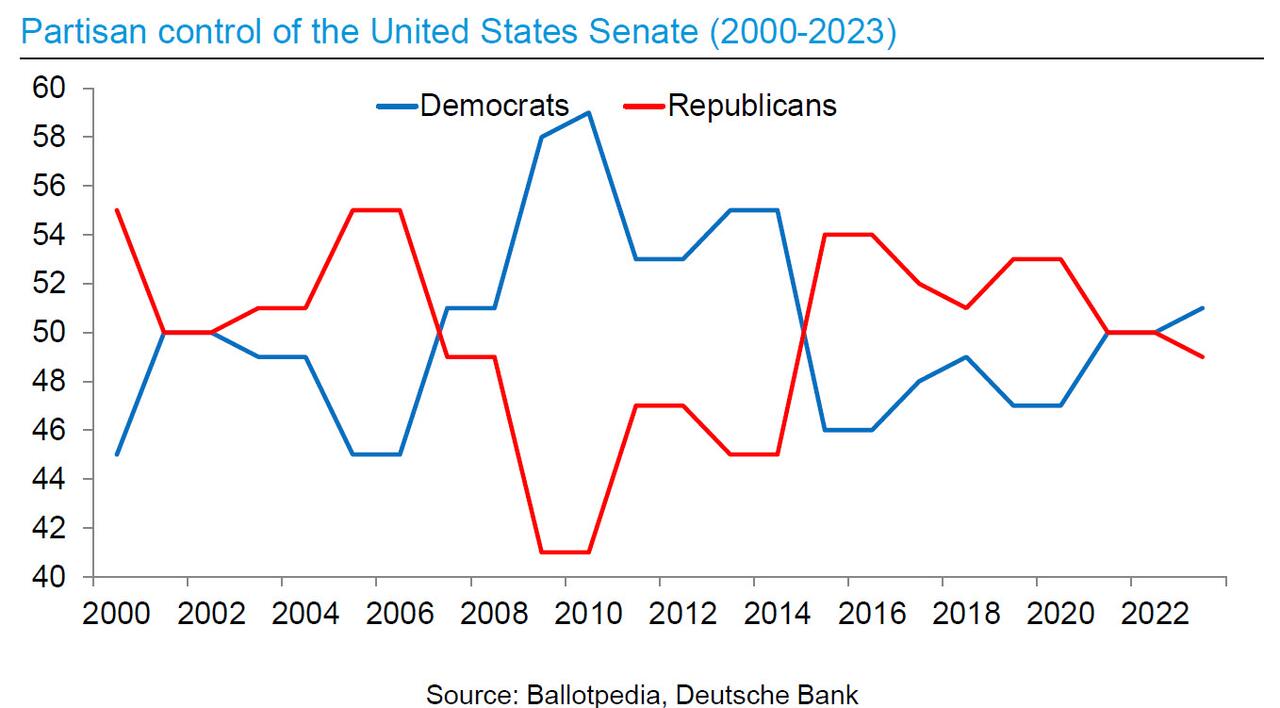

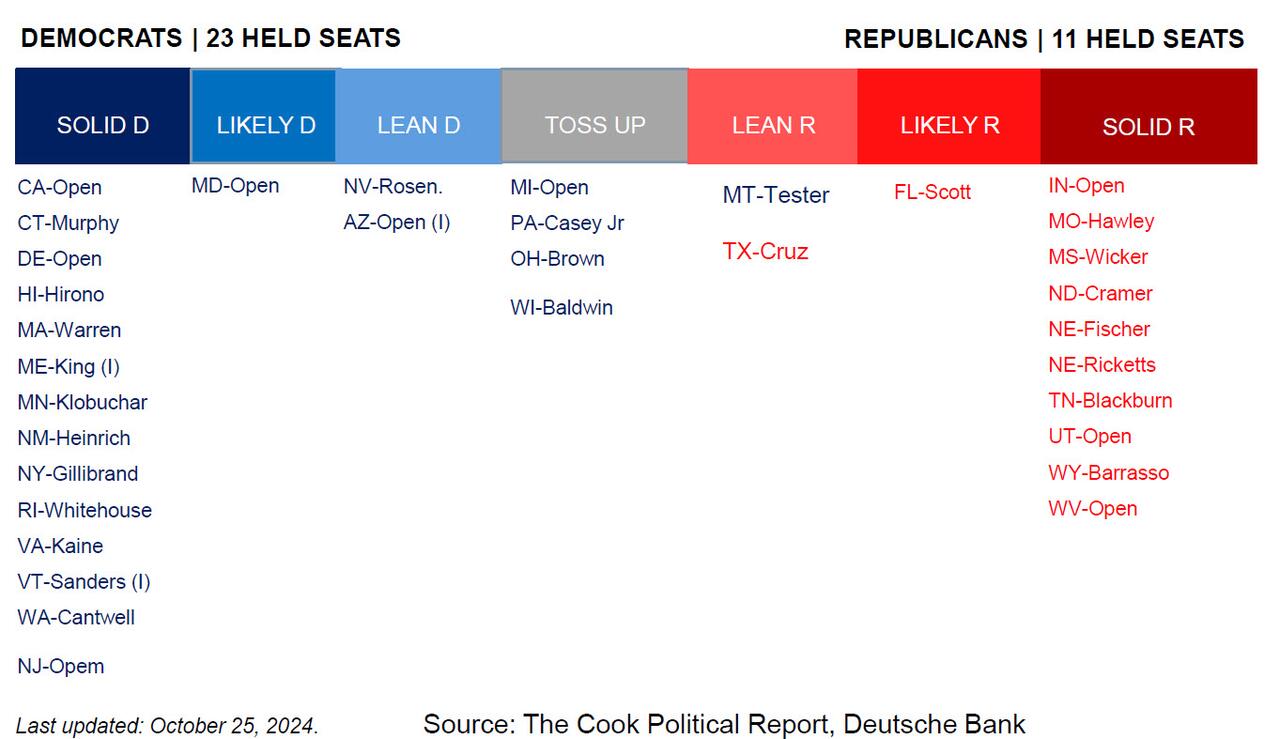

Senate Race

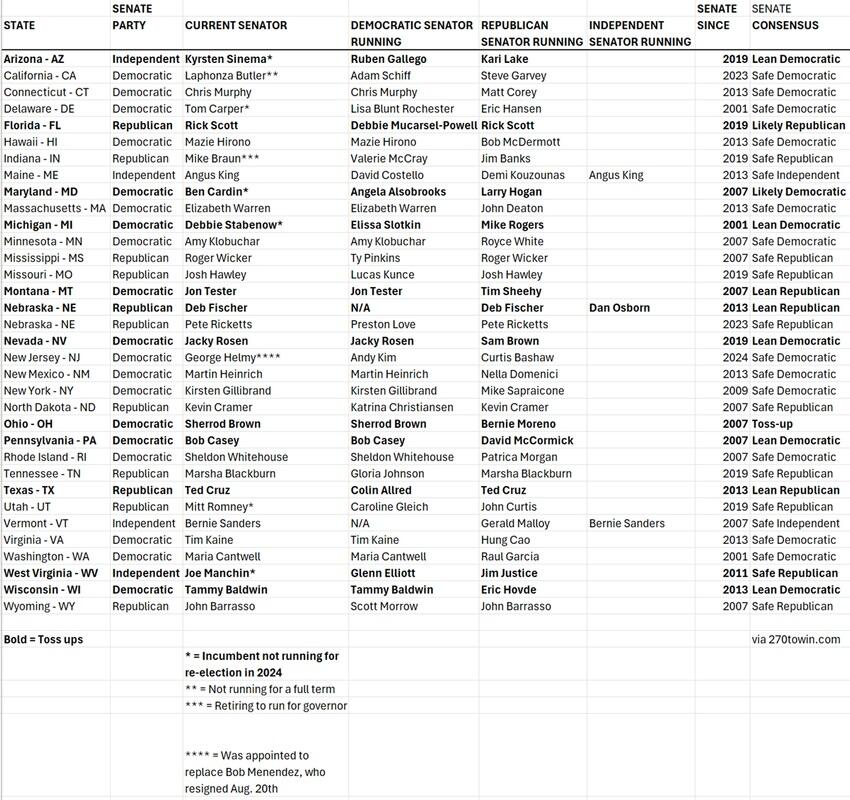

- Currently, the US Senate has 51 Democrats, including three independents, and 49 Republicans, so the body is controlled by Democrats. There are 34 seats up for grabs in 2024 (including a special election in Nebraska) of which 23 are held by Democrats or Independents. Republicans can retake control with a net gain of two seats or by winning the 2024 presidential election along with a net gain of one seat.

- Polls currently suggest that the Republicans will take control of the Senate with 51 Republicans vs. 49 Democrats . Within the 34 seats up for grabs, 12 are seen as ‘Safe Democrat’ (CA, CT, DE, HI, MA, MN, NJ, NM, NY, RI, VA, WA), 9 ‘Safe Republican’ (IN, MS, MO, NE, ND, TN, UT, WV, WY), 1 ‘Likely Democrat’(MD), 1 ‘Likely Republican’ (FL), 5 ‘Lean Democrat’ (AZ, MI, NV, PA, WI), 3 ‘Lean Republican’ (MT, TE, TX), 1 ‘Toss-up’ (OH), and 2 ‘Safe Independent’ (ME, VT). In the battlegrounds, using 270towin latest polling, Montana (MT) may flip Republican, with currently Democratic Ohio (OH), a toss-up. Independent West Virginia (WV) is a safe Republican flip.

- (See Figure 4 at the bottom for Senate composition)

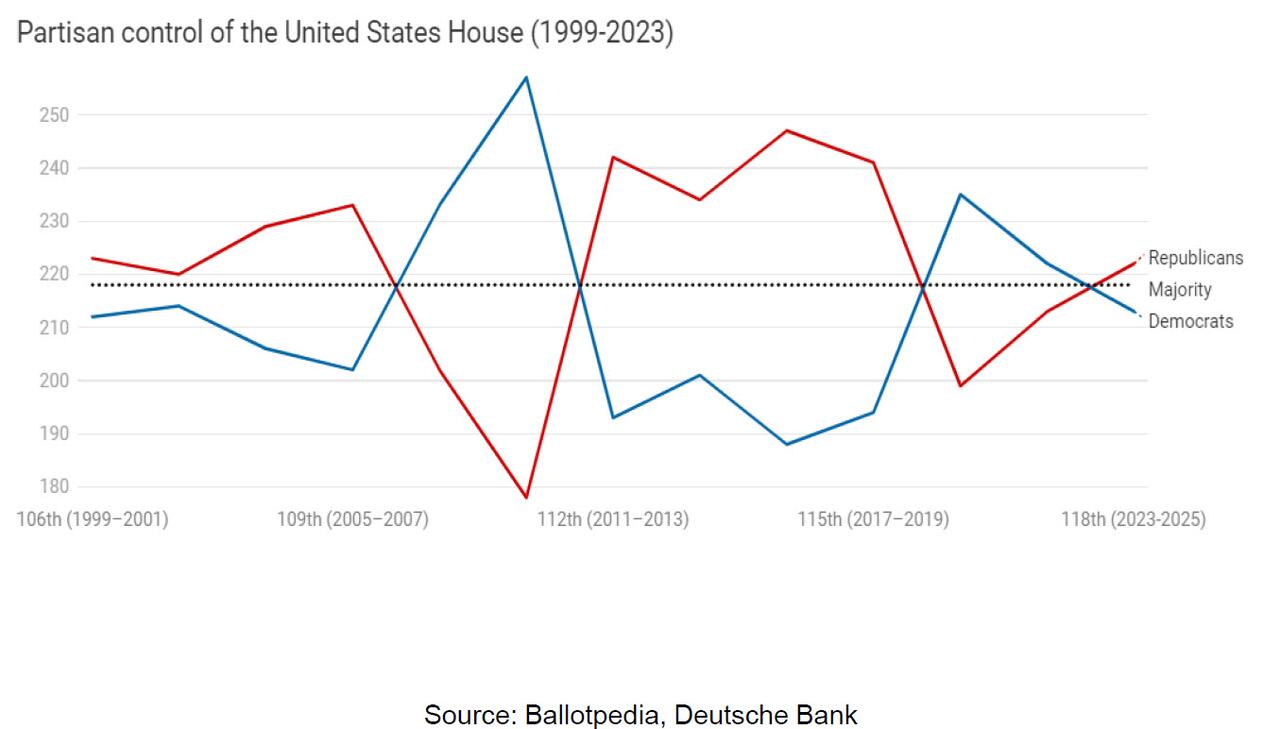

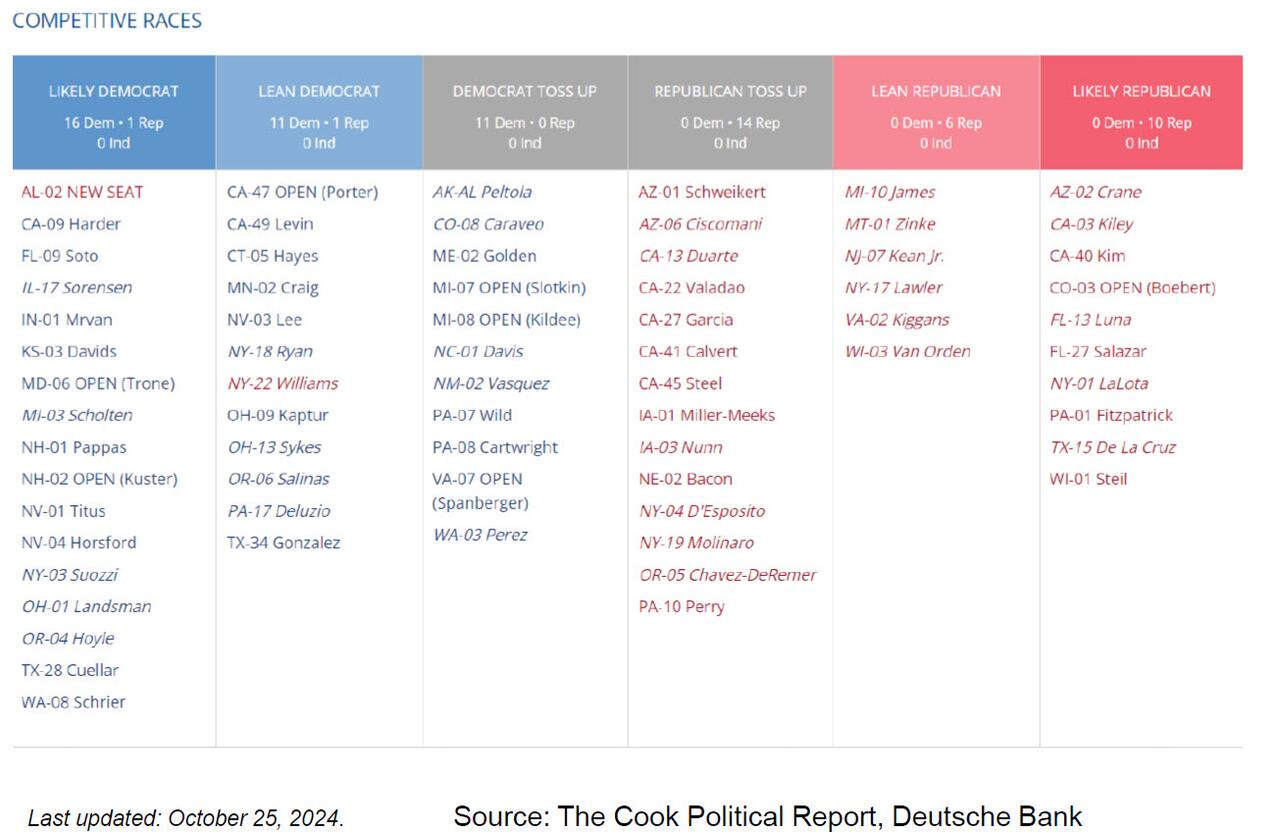

House Race

- All 435 seats are up for grabs, with 218 needed to win a majority. Entering the 2024 election, Republicans hold a slim majority with 220 seats, and Democrats hold 212, with 3 seats vacant.

- According to The Cook Political Report, 175 seats are seen as ‘Solid Democrats’, 191 ‘Solid Republican’, 17 ‘Likely Democrat’, 9 ‘Likely Republican’, 13 ‘Lean Democrat’, 8 ‘Lean Republican’, leaving 22 ‘toss-ups’ (10 of those are currently Democrat: AK-AL, CO-08, ME-02, MI-08, NC-01, NM-02, PA-07, PA-08, VA-07, WA-03; and 12 of those are currently Republican: AZ-01, AZ-06, CA-13, CA-22, CA-27, CA-41, CA-45, IA-01, IA-03, NY-19, OR-05, PA-10).

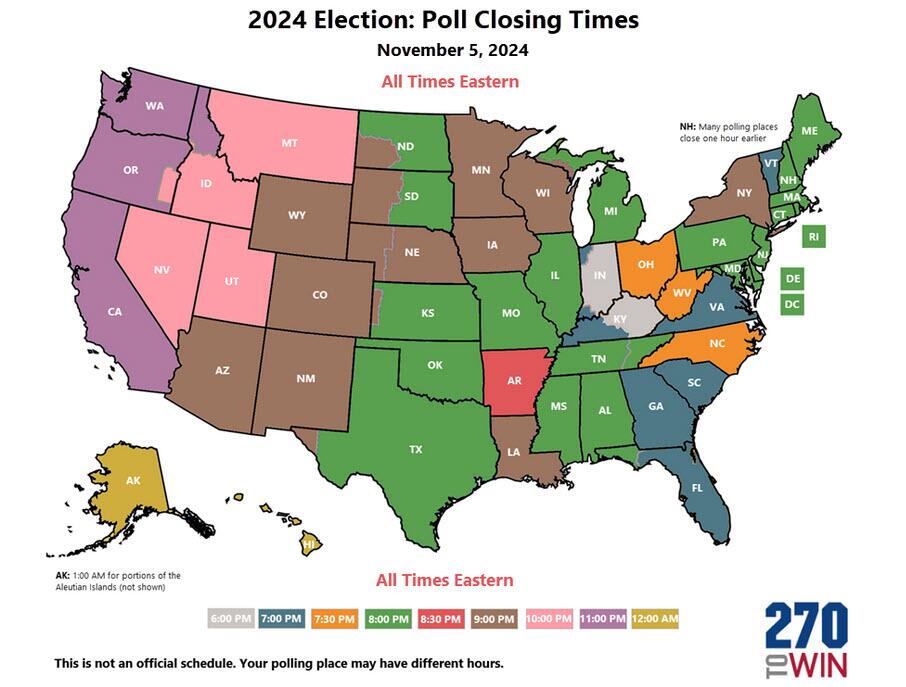

Poll Closing Times

- Arizona [11 EVs] – polls close at 9pm ET. Results do not begin to be reported until 10pm ET with ballots processed as they come in. Election day mail-in ballots could take multiple days to count. In 2020, the state was called early Weds morning.

- Georgia [16] – polls close at 7pm ET. Early voting and mail-in ballots will be the first counted with all results expected to be reported on election night. Ballot processing began on Oct 21. In 2020, the state was called on Nov 19 vs. Nov 3 Election Day.

- Michigan [15] – polls close at 9pm ET. Ballot processing began on Oct 28. All votes will be counted and reported by midday Weds with larger counties finishing earlier. In 2020, the state was called Weds night.

- Nevada [6] – polls close at 10pm ET. Ballot processing began on Oct 21. Results do not begin until all polling sites are closes with ballots counted if they are post-marked by Nov 5 and arrive by Nov 9. In 2020, the state was called on Saturday (Nov 7).

- North Carolina [16] – polls close at 7.30pm ET. Ballot processing began on Oct 1 and mail-in ballots will be processed first, followed by early voters, and then Election Day votes. The vast majority of ballots will be counted on Election Day but given the impact of Hurricane Helene, some mail-in ballots could be counted late. In 2020, the state was called more than a week later, on Friday (Nov 13).

- Pennsylvania [19] – polls close at 8pm. Mail-in ballots are not allowed to be processed until Election Day and that means the final reporting may take multiple days. In 2020, the state was called on Saturday (Nov 7).

- Wisconsin [10] – polls close at 9pm ET. Look for results to conclude no later than midday on Wednesday. In 2020, the state was called Weds afternoon.

Results

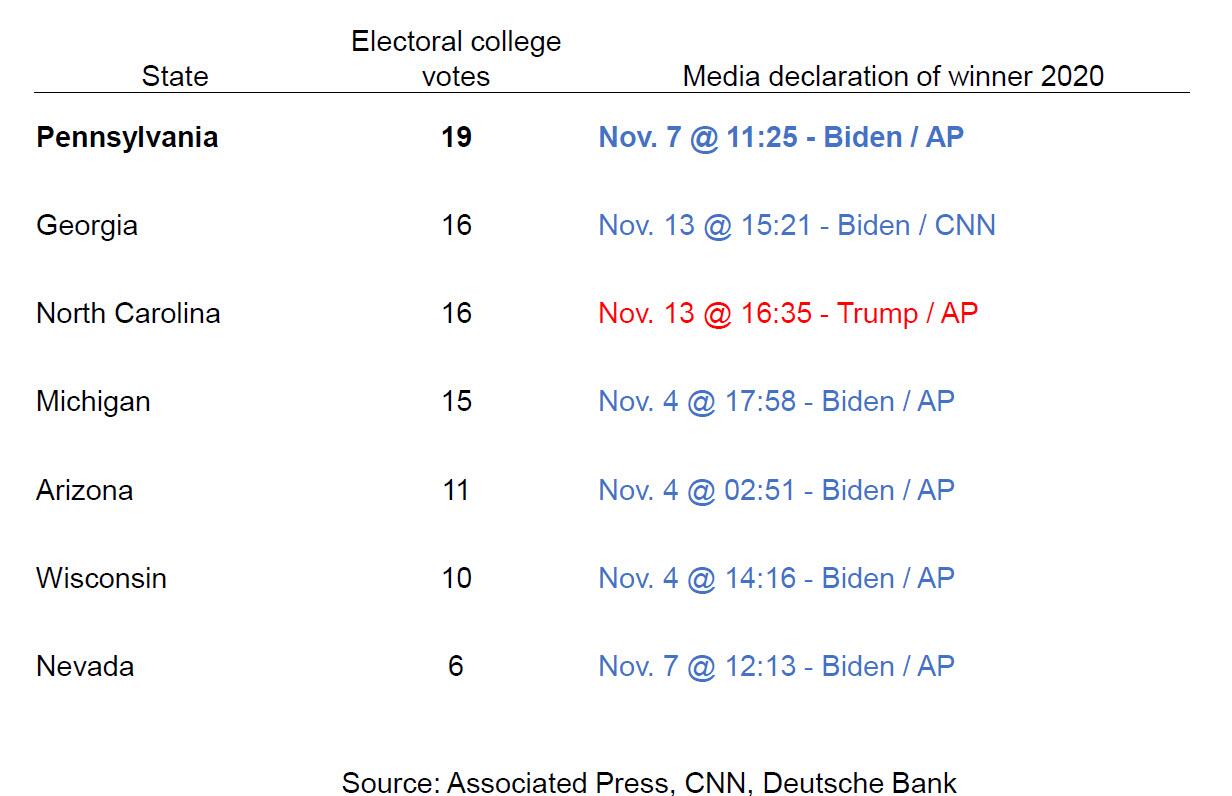

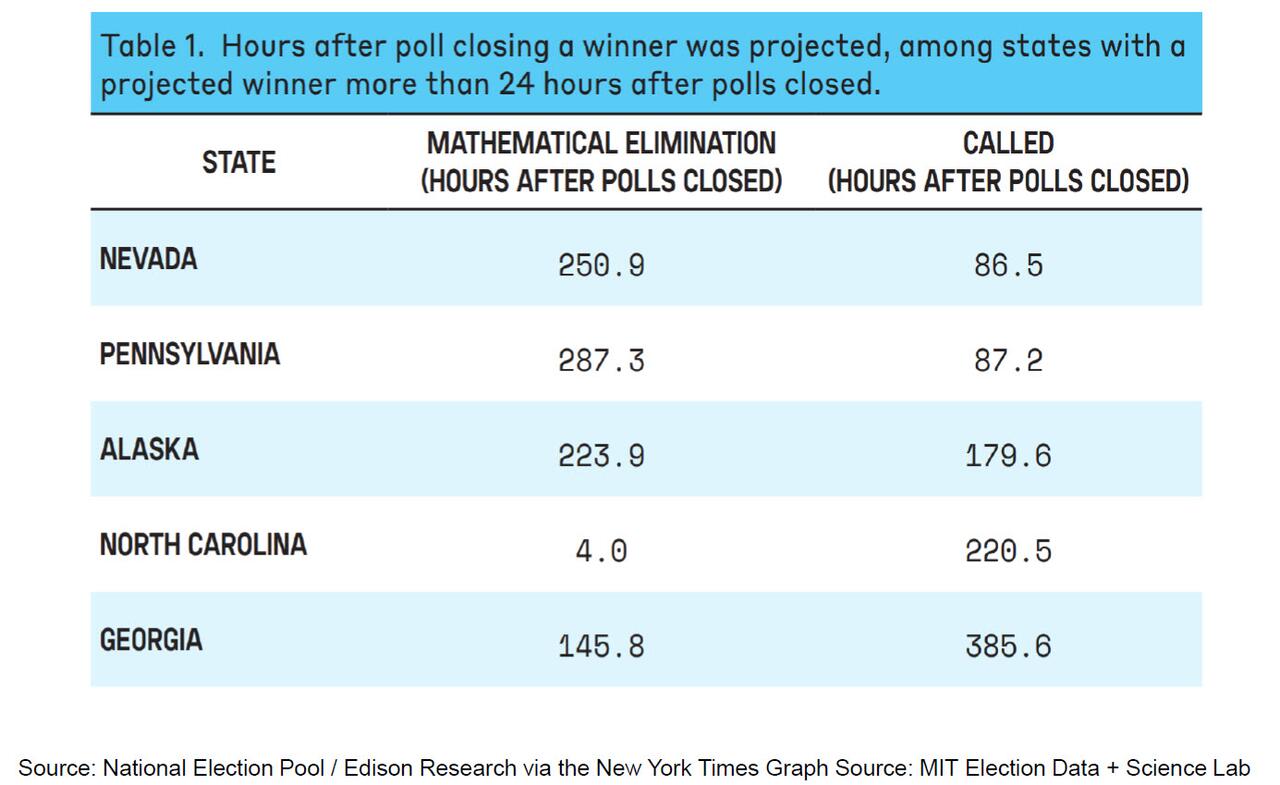

- Overall, it may take several days or even weeks to count and confirm the winner of the 2024 US Presidential Election due to varying state ballot-processing rules, potential recounts and anticipated high mail-in voting. As a reminder, in the 2020 election, AP declared Biden the official winner at 11:26 am on November 7th, roughly three and a half days after the polls closed on Election Day.

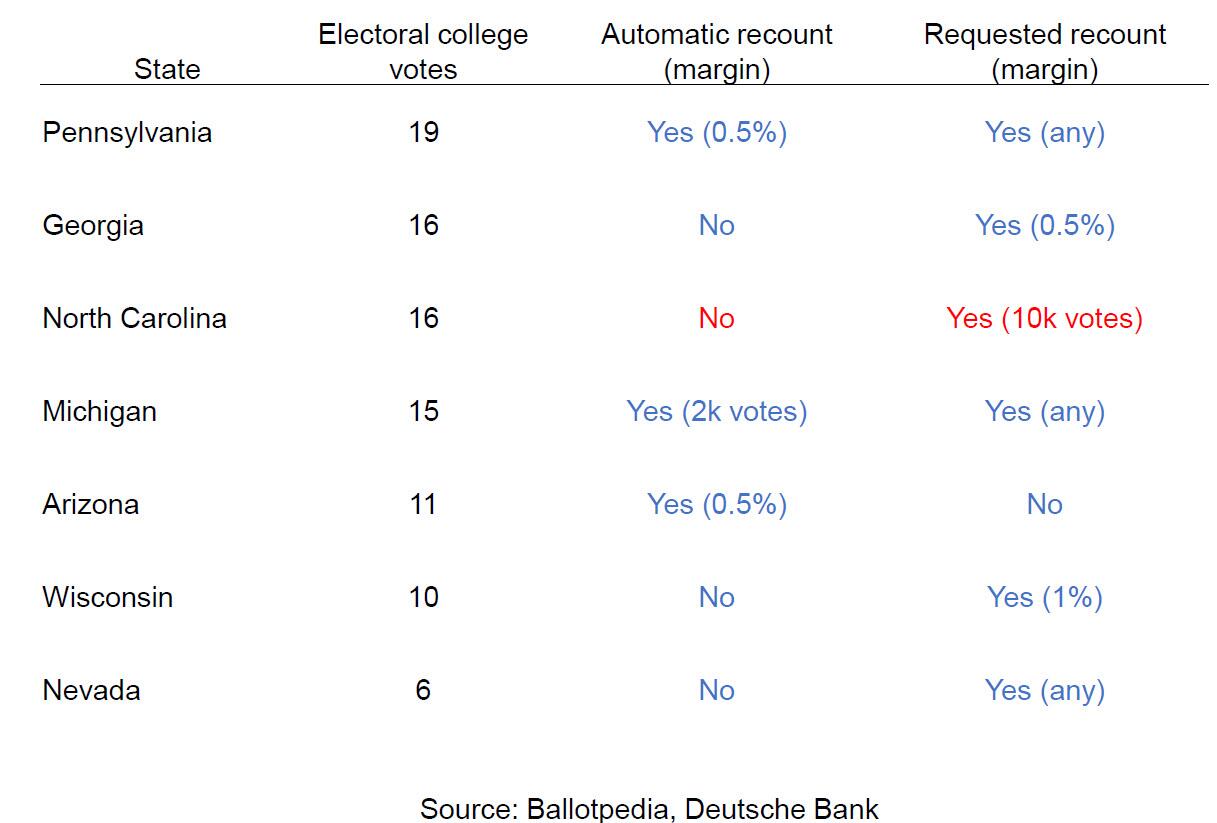

- In addition, an automatic statewide recount is mandated if the margin is 0.5% or less between candidates. Regarding Pennsylvania, the key swing state, final recount results must legally be submitted by November 26th, with the official announcement expected on November 27th.

- As of Monday morning (Nov. 4th), according to a tally by the Election Lab at the University of Florida, more than 78.023mln Americans had already voted in early in-person voting or via mail-in ballots.

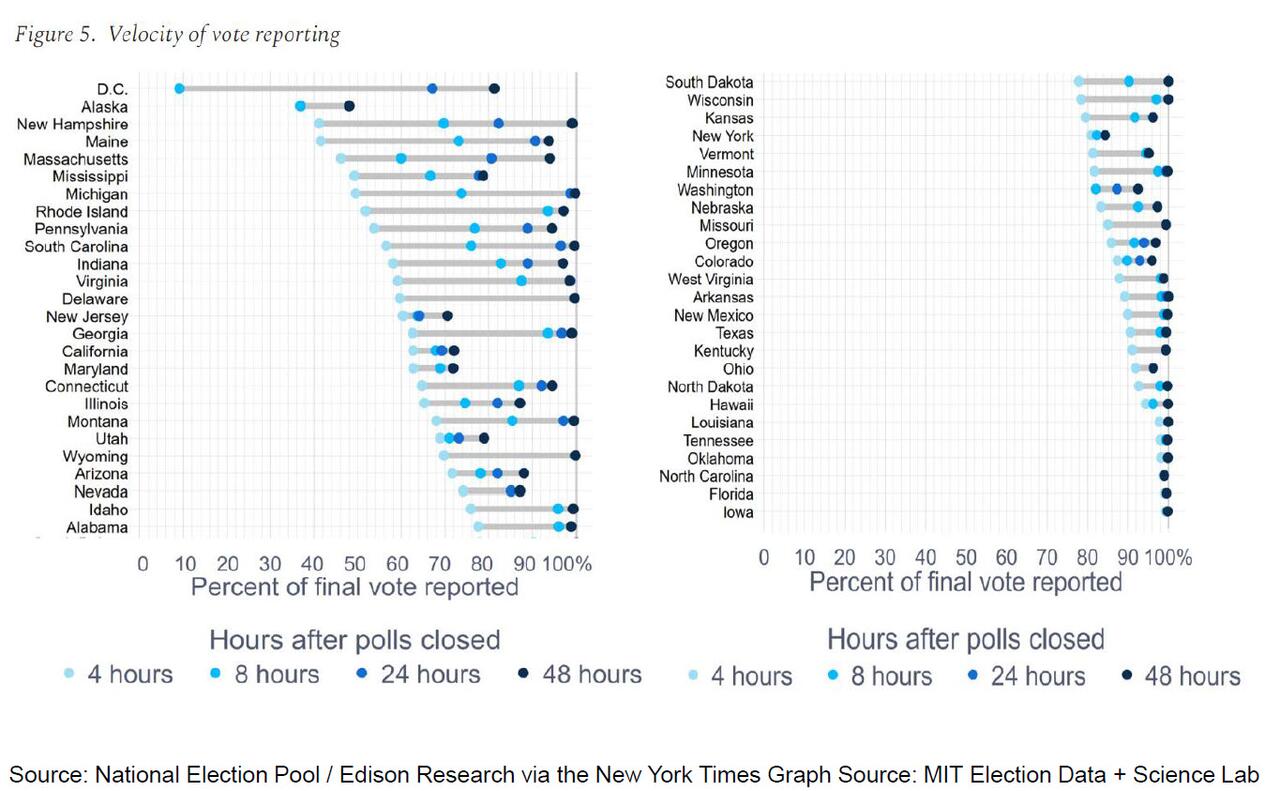

- Looking at polling results times in states from the last two elections, it can be extremely varied. Regarding the seven swing states, using media call time, Arizona was ‘Too Close’ in 2016 and 02:51 on Nov 4, 2020. Following the sequence of using 2016 time followed by 2020 time, Georgia was 04:33 and 15:21 on Nov 13, Michigan ‘Too Close’ and 17:58 on Nov 4, Nevada 05:20 and 12:13 on 7th November, North Carolina 04:11 and 16:45 on Nov 13, Pennsylvania 06:35 and 11:25 on 7th November, and Wisconsin 07:29 and 14:16.

- In other words, MI, AZ and WI were called within 24 hours of polls closing on Nov 3, 2020. PA was called the morning of Nov 7, clinching it for Biden

- In 2020, AP called the election for Biden on Sat. Nov 7 @11:26 AM – before the theoretical futility point (if the total # of votes known)

- Recount rules for Swing states

Key State Battlegrounds

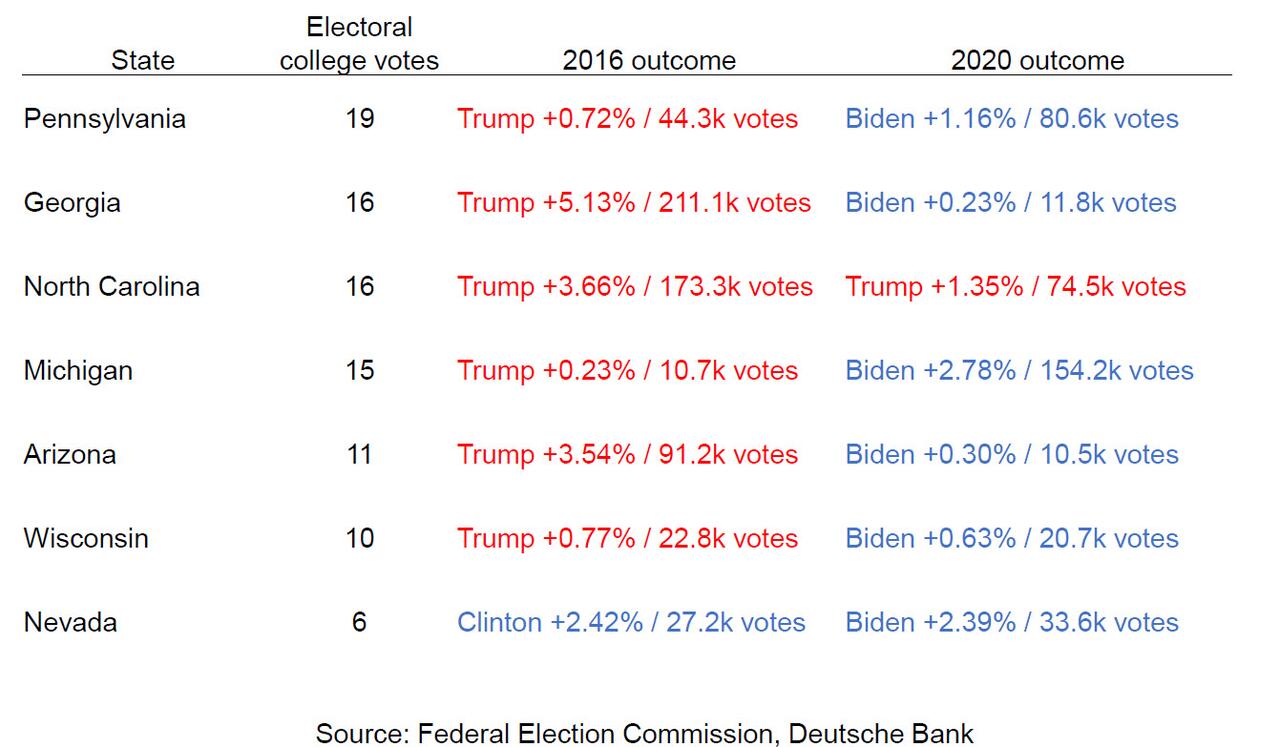

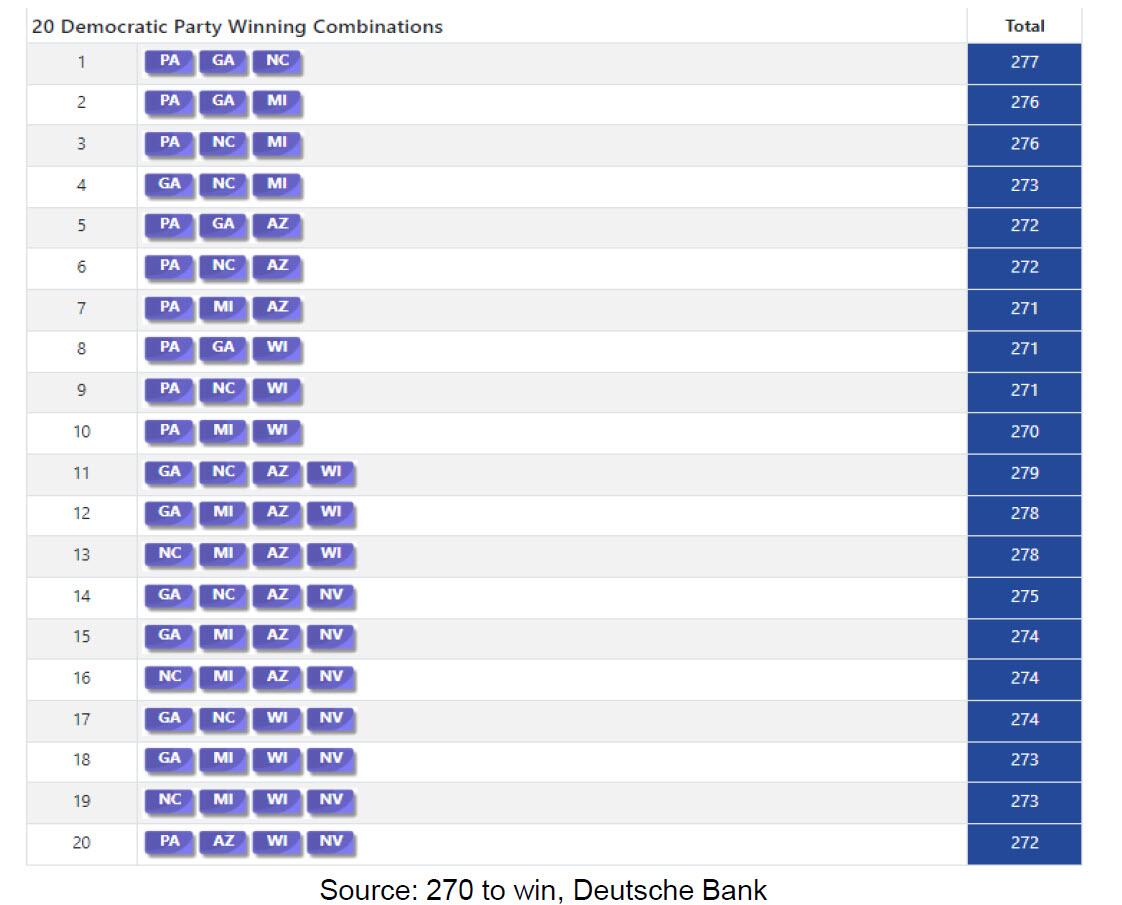

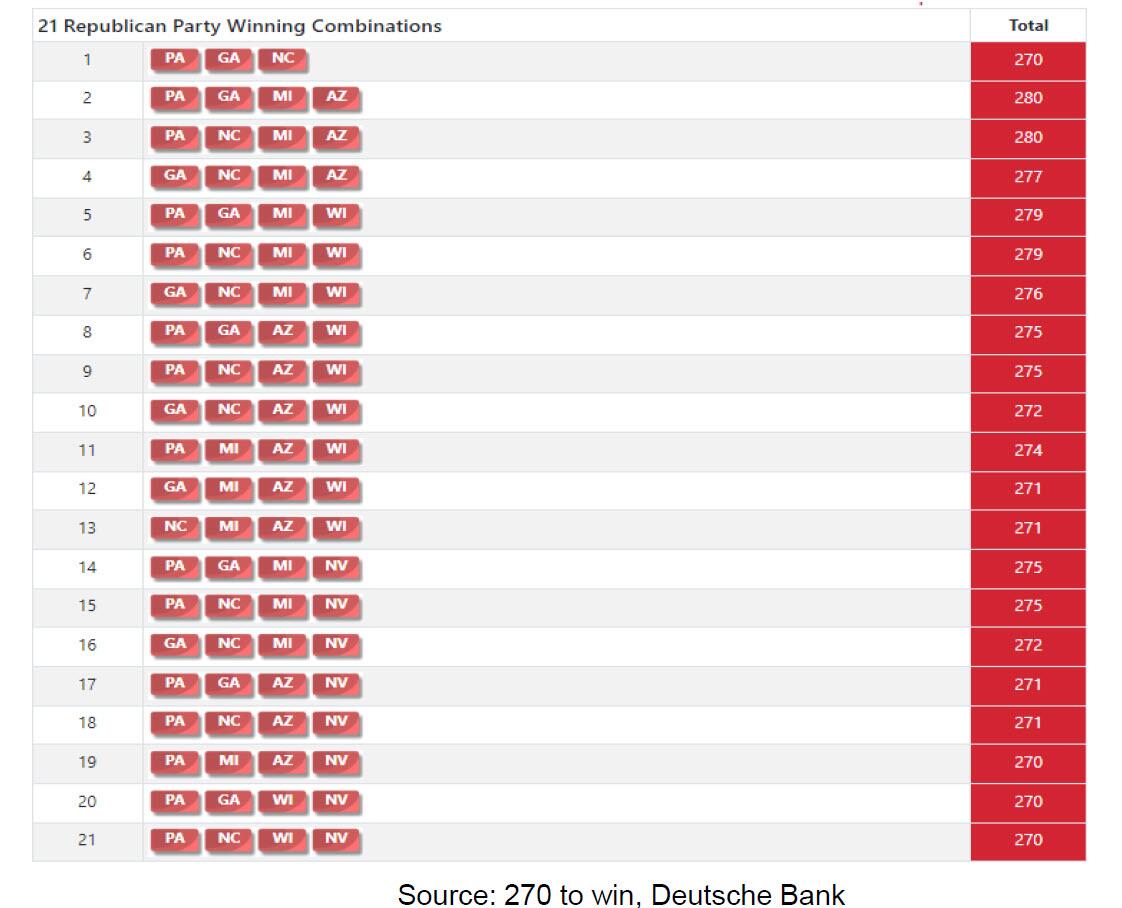

- Arizona, Nevada, Wisconsin, Michigan, Pennsylvania, North Carolina, and Georgia are the pivotal swing states with Pennsylvania arguably the most pivotal. Arizona, North Carolina, and Georgia are the ‘Sun Belt’ states and if Trump wins these three states, he wouldn’t need many more. If Trump wins these three states, he’d be on a path to 262 electoral votes, meaning he’d only have to take one of the blue-wall states (Michigan, Pennsylvania or Wisconsin) to win the White House.

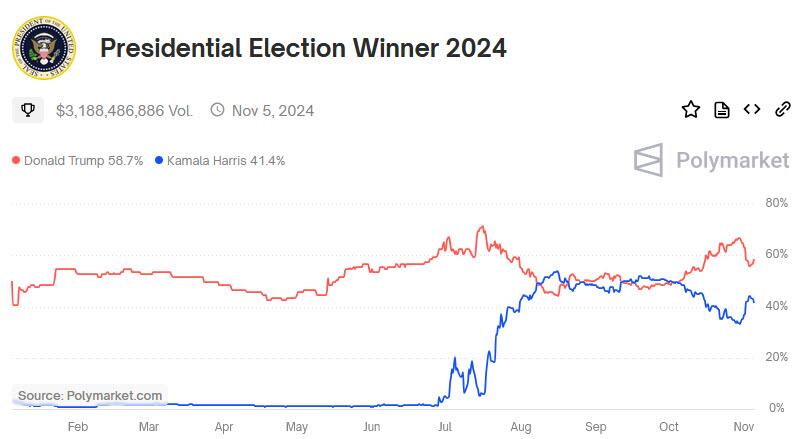

- Overall in recent weeks, momentum has dramatically shifted towards the former President Trump and he is still deemed the favourite across betting market Polymarket, but over the weekend (Nov 2nd-3rd) there was once again a notable tilt back towards Harris, with PredictIt actually having the VP back in front after some of the final polls before the election were released. Polls still have Harris up nationally but net down across the swing states, although the NYT/Siena final polls showed the race was deadlocked in six out of the seven battleground states and that all seven of them were within the margin of error. As such, the race still remains extremely close nationally and in the battleground states, with the vast majority of polls still within the margin of error.

- On the swing states, Harris leads in Wisconsin and Michigan, while Trump leads in Arizona, North Carolina, and Georgia, which are all bigger than any of Harris’ leads with Pennsylvania and Nevada also marginally in Trump’s favour, according to 538’s averages. Using RCP’s averages, Harris also leads in two of the Blue Wall states (Wisconsin and Michigan), with Trump leading in the other 5.

- Bottom line: 7 states will decide the election. The margins of victory in 2016 and 2020 were less than 5ppts ( ~200k votes) in most cases

- In 2020, it took 8 hours from polls closing for GA and WI to report 90%-plus of votes versus 24 in MI and 48 in PA

Pennsylvania

- Within the swing states, Pennsylvania is arguably the most pivotal as polls have the state neck-and-neck, albeit with Trump now eking out a lead. PA has 19 EC votes, so desks note a couple of tens of thousands voters in the State could decide the election, as it is unlikely, albeit not impossible, a candidate will win without PA. Pennsylvania is one of the three ‘Blue Wall’ states, alongside Michigan and Wisconsin, and in 2020.

- Biden carried PA by just over 1ppt point, a raw margin of only about 80,000 votes in a state that cast almost 7mln for President.

- Additionally, PA was called for Biden 87.2 hours after the polls closed in 2020. GA took far longer to be officially called because of a recount

Winning Combinations

- Winning combinations of battleground states for Harris

- Winning combinations of battleground states for Trump

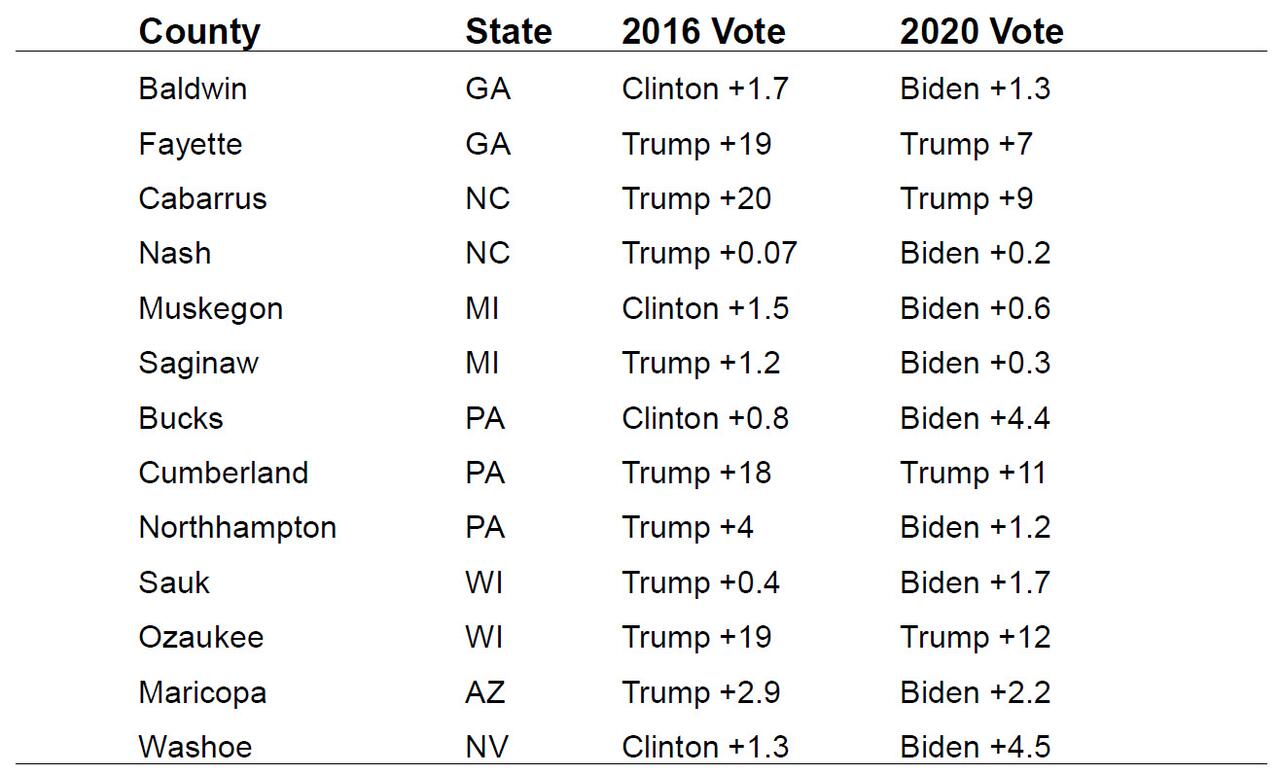

Key Battleground Counties

- These are the bellwether counties to monitor in swing states for clues as to how each candidate may be performing

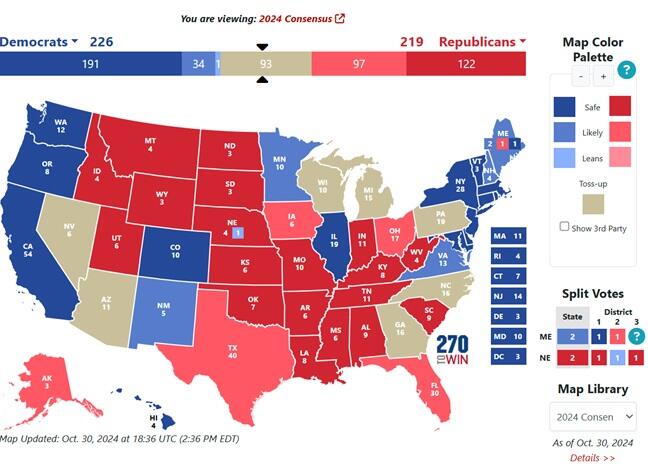

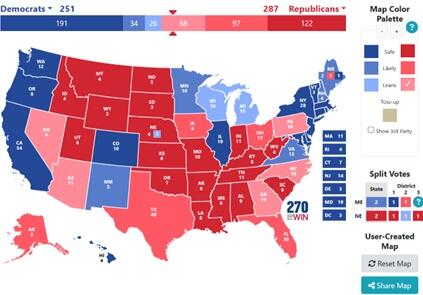

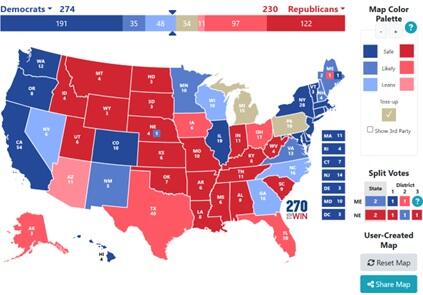

Electoral College

- If the election followed suit to either 538 or Nate Silver averages (details below), Trump would win the Presidential election. In the figures below, Figure 1 is the current map of the Electoral College, aside from the pivotal seven swing states. Figure 2 is using 538 and Nate Silver averages, as both have Trump and Harris having leads in the same swing states. However, on the flip side, Figure 3 is using the final NYT/Siena poll (details above) and that shows Harris coming out victorious.

- (Figure 5 at the bottom for EC composition)

Figure 1

Figure 2

Figure 3

What about election disputes? All recounts and/or disputes must be settled by December 11

- Safe harbor deadline for states to finalize results via certificates of ascertainment appointing electors is December 11

- Electors meet in the states and DC on December 17

- Congress meets to count electoral college results on January 6, 2025

- Electoral Count Reform and Presidential Transition Improvement Act of 2022

- Identifies each state’s Governor, unless otherwise specified in the laws or constitution of a state in effect on Election Day, as responsible for submitting the certificate of ascertainment identifying that state’s electors. Congress could not accept a slate submitted by a different official.

- Provides for expedited review, including a three-judge panel with a direct appeal to the Supreme Court, of certain claims related to a state’s certificate identifying its electors.

- Affirmatively states that the constitutional role of the Vice President, as the presiding officer of the joint meeting of Congress, is solely ministerial and that he or she does not have any power to solely determine, accept, reject, or otherwise adjudicate disputes over electors.

- Raises the threshold to lodge an objection to electors to at least one-fifth of the duly chosen and sworn members of both the House of Representatives and the Senate.

- Legislation specifies that a state could move its presidential election day, which otherwise would remain the Tuesday immediately following the first Monday in November every four years, only if necessitated by “extraordinary and catastrophic” events

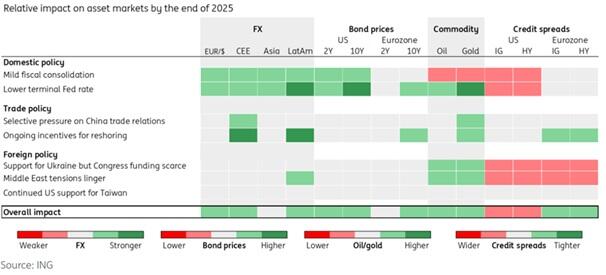

Election Impact on Financial Markets

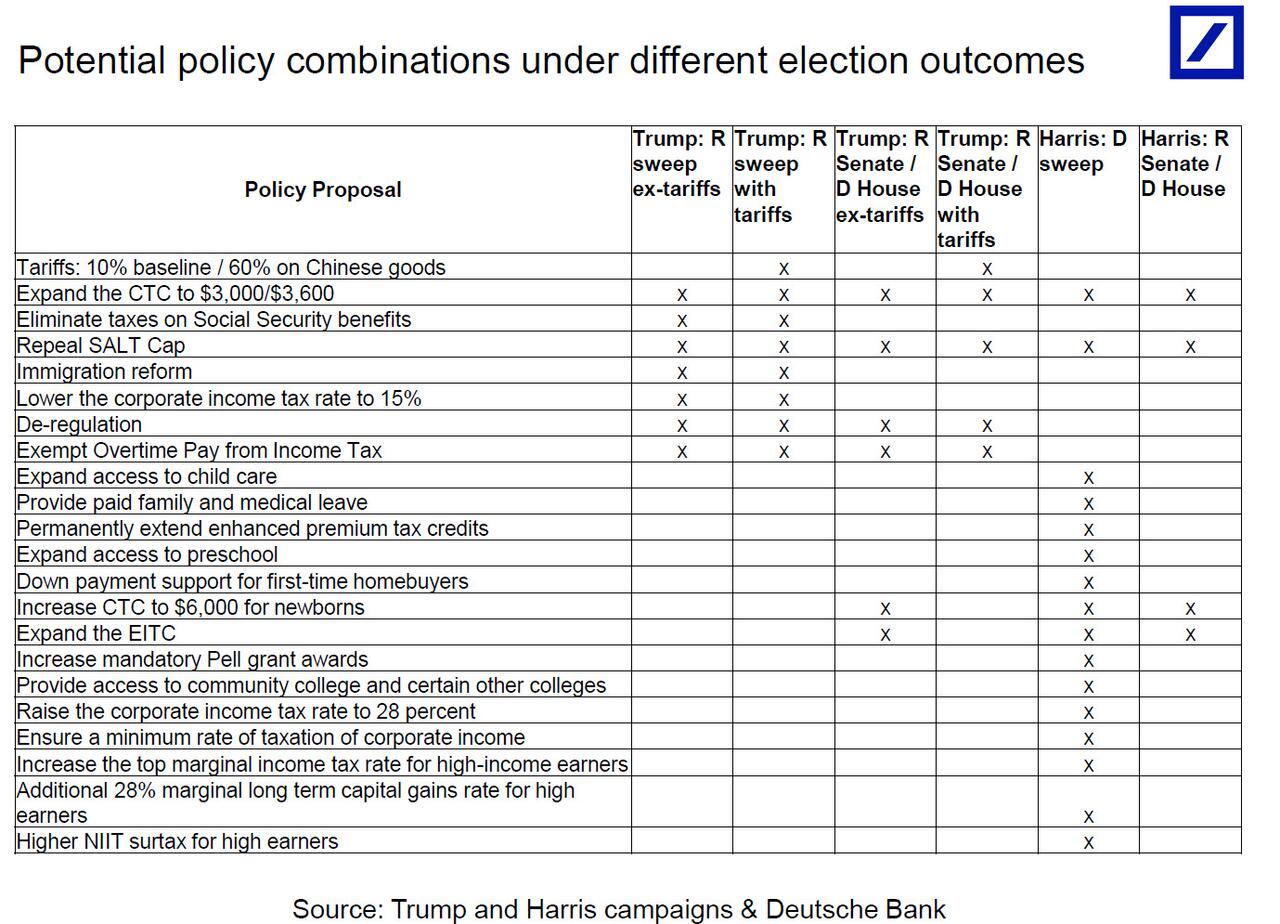

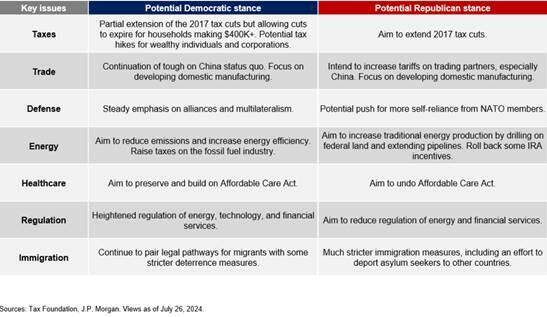

- Within the election, depending on whether there is a Republican Sweep, Trump win with split congress, Harris with split congress, or a Democrat sweep will massively impact the market reaction seen.

- In terms of broader market reaction , a Republican sweep is deemed the most Dollar bullish scenario as loose fiscal and tight monetary policy plus tariffs are all positive. The Greenback would be boosted with a Trump sweep amid US exceptionalism, which would be amplified by tariffs with countries exposed to China, such as AUD, also hit. If there was a Dem sweep, we would likely see Dollar weakness, with EMFX and the Yuan likely outperforming due to the removal of risk of large China tariffs. Note, the magnitude of the moves is likely larger in the former. Deutsche Bank sees the dollar rising across all currency pairs in a red sweep and sees the dollar strong, but FX carry trades are most likely to suffer in a Trump victory without Congress.

- Elsewhere, and also detailed below, Gold and Copper and expected to see greatest strength and losses, respectively, with a Republican sweep while for a Harris sweep both are seen gaining slightly.

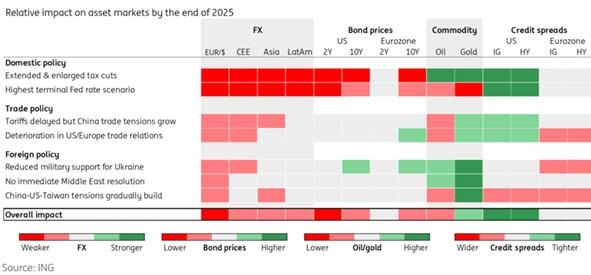

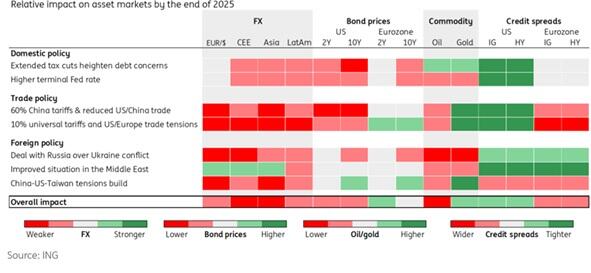

- In commodities, with a Republican sweep, ING notes tax cuts support oil prices in the short term, but focus on US energy independence and pressure on OPEC+ to increase supply sees weaker prices longer term. In addition, key upside risk is stricter sanction enforcement against Iran.

- In a Trump victory but split Congress, ING suggests that early focus on foreign policy sees easing tension in the Middle East weigh on oil prices. Pressure on Russia/Ukraine to come to a deal puts further downward pressure on prices through 2025. Regarding a Harris Presidency, the bank notes that lower growth prospects weigh on oil, short term, but longer-term will see lower prices than a Trump Presidency.

- In terms of what stocks “want” , some desks note there isn’t a particularly strong preference for either Trump or Harris (Trump has eroded a lot of the GOP’s historical edge on financial issues with his populist rhetoric, extreme tariff agenda, and disregard for fiscal conservativism). In terms of sector specifics, a Harris win would benefit solar names whilst it would be the opposite if Trump won, while the former President also said he would make the US the crypto capital of the world.

- Treasuries, under a Trump Presidency, are seen falling with a steeper yield curve, and most aggressively with a Red sweep, ING notes, and amid a risk-on theme, the bank sees a 5% handle for the US 10yr yield. On top of this, a gung-ho attitude to the ballooning fiscal deficit adds to issuance, and potentially pressuring bonds further. If Trump wins, but Congress is split, bonds will be hindered on inflation risk. With a Harris victory, the rise in yields is expected to be more muted, and rates lower because of a tighter fiscal response, which facilitates lower rates along the yield curve.

US Election Scenarios

JPM SCENARIOS: MARKET INTELLIGENCE ELECTION TRADING VIEW

JPM FX SCENARIOS UNDER VARIOUS US ELECTION OUTCOMES (JPM FX RESEARCH)

JPM Research Scenarios:

- Under either gridlock scenario, equities reprice higher as we clear the uncertainty, volatility decreases and hedges unwind, with investors refocusing on the Fed at a time when the economy and corporate earnings remain resilient.

- A Red Sweep scenario, which we view as the most positive for risk into year-end on prospects of pro-growth policies and deregulation across industries (e.g., Banks, Industrials, Transportation, Energy), as the upside potential is priced in first, while the uncertainty around policy execution would become more prominent in 2025. Under this scenario, we expect the largest impact to be from broadening equity leadership with a squeeze in crowded shorts (i.e., Momentum Unwind) amplified if the Fed continues to ease into this setup that is anchored by a still healthy economy. However, equity timing might be complex given a potentially greater sensitivity in Bond and FX markets this time around versus 2016. Our FX team sees ~7% upside in USD and our Rates team sees 10Y going up by another 30-40bps in a Red Sweep scenario (see Report and Report).

- On the contrary, a Blue Sweep scenario would likely be negative for the market, but odds of that scenario appear to be low. Amidst a positive setup for equities into year-end, one of our key worries remains a sharper move higher in the back-end of the rates curve with a risk that the Fed may be cornered (see Report).

- Sector Analysis

- Energy. With the emphasis on US energy independence and security, maintaining an abundance of oil can be seen as a way to reduce inflation, provide relief to US households and support the economics of onshoring. Therefore, the preponderance of weight seems to lean towards abundant oil supply as opposed to tight supply. Given the narrow $70-80 range for oil so far despite geopolitical fragility along with looser climate regulation and permitting, Energy could be vulnerable to downward pressure to prices.

- Retail. The sector is likely vulnerable to tariff increases given significant import exposure and lower relative pricing power. Some of this should be offset through minor pricing pass-through, shifting production, cost cutting and strengthening USD. Autos likely benefit from stronger tariff protections from overseas competition though this will likely be partially offset by higher input costs from other tariffs (e.g., steel, aluminum, etc.). There could be some movement on the uncapped EV credits, which may affect EV adoption but State mandates are expected to remain sticky.

- Industrials. Given their multinational footprint, the sector should be vulnerable to increased tariffs and would likely be negatively impacted by tariffs on key inputs (e.g., steel, aluminum, etc.). Note, the sector does have better relative pricing power than discretionary retail (net income margins of 11.4% vs. 9.5%), which suggests a stronger ability to pass through higher costs.

- Financials. Given the damage from the regional banking crisis, the need to grow regional banks again with the largest players having exited the index (e.g., SVB, FRCB, etc.) and the potential for a softening regulatory backdrop, a modest pick-up in M&A activity could be on the horizon. Further, a focus on deregulation could see further upside though concrete measures are unclear at this stage. US regional banks (KRX Index) and US small caps (Russell 2000 Index) could benefit from deregulation and tax cuts for small/domestic oriented businesses with the potential to be amplified by short covering (see Report).

- Technology/Communication. We could see a meaningful benefit in M&A with a more supportive FTC (see Report) though this will likely benefit companies outside the Mag7. Trade will likely hit physical goods more than digital as it did during the first round of tariffs under Trump 1.0. In that scenario, we would expect Software to outperform Tech Hardware/Semis around tariff increases. We highlight that the relative dependency on China trade has declined with greater Asia and North America filling the gap. In some ways, the easiest parts of the supply chains to shift/diversify away have already been actioned as part of the initial US-China trade war and later with the pandemic and uneven reopening. Even though the amount of China imports has decreased over time, the remaining imports are likely harder to shift away without significant economic cost leaving those goods still vulnerable to a material increase in tariff rates.

- Healthcare. ACA repeal remains a risk though a low probability one, in our view. The larger concern is around ACA subsidies being extended in FY25, which the campaign has been less clear about. Drug pricing remains a focus though not expected to accelerate as it would under Blue Wave Tail scenario. Some potential pick-up in M&A activity is likely though unclear how robust. Medicare Advantage policies are on the line, with Republicans likely pushing for more favorable rates and less scrutiny, while Democrats will look to maintain current regulatory pressures, affecting margins and reimbursement rates. Regarding the Inflation Reduction Act and Drug Pricing, Democrats are expected to continue supporting the bill and push for lower drug prices (see Report).

- Utilities. Expect impact from deregulation with friendlier EPA. Alternative energy (e.g., Wind/Solar) could be negatively impacted by leasing, permitting and tariffs. Noncore portions of the IRA could come under greater scrutiny such as offshore wind (see Report).

- Clean Energy. Although additional guidance was just announced by the US Treasury and IRS on the 45X tax credits, all eyes are on the results of the elections. BNEF recently released a scenario that includes a full repeal of the IRA that resulted in a 17% decrease in US renewable deployments through 2035. A full IRA repeal is very unlikely under any election outcome and, like many sectors, the direction of clean energy will depend on the eventual winner of the election (see Report).

- Rates. A red sweep is likely to bring fiscal concerns to the forefront, steepening the Treasury curve and increasing yields (JPM Rates Strategy expects 10Y up 30-40bps with upside bias, see Report). This could trigger a sharper market reaction due to expectations of greater fiscal expansion and deficit pressure.

- FX. USD is expected to strengthen 7% given the amplification of US exceptionalism by tariffs and fiscal spending with EUR, CNH, MXN, AUS, NZD and high-beta Euro bloc FX likely to underperform (see Report). Historically, we have observed that for every 2% increase in trade weighted dollar, there is a 1% earnings growth headwind for the S&P 500 given its multinational tilt. This likely favors Domestics over Multinationals.

- Commodities. Gold is expected to be the biggest beneficiary due to growing complacency over the rise in fiscal debt and trade tensions (see Report). While energy policies are aimed to boost domestic production, market constraints could limit the impact. Natural gas could have an even more bearish price impact on US and global natural gas balances by raising the likelihood of a faster increase in US natural gas production from oil plays, while even more certainty can be placed in a swift end to the Russia/Ukraine war, leading to an increased potential for curtailed Russian natural gas supply making it back to market. Base metals could see mixed outcomes, depending on tariff policies and growth initiatives. If both parties attempt to boost energy supply to tackle inflation, this could negatively impact the current supply and demand dynamic for the US Energy sector.

- Equity Derivatives. As the more likely outcome, election risk premium has eased as uncertainty is being priced out since September. There is greater concern of tariff implications and a future inflationary environment under a Red Sweep; we recommend a 1Y palladiums and equity down/rates up hybrids to navigate market uncertainty (see Report).

ING Election Scenarios:

- 1) Republican Clean Sweep

- 2) President Trump, but not a sweep. Donald Trump wins the Presidency, but Congress split (Democrats win Senate, Republicans win House).

- 3) President Harris.

Macro Impact

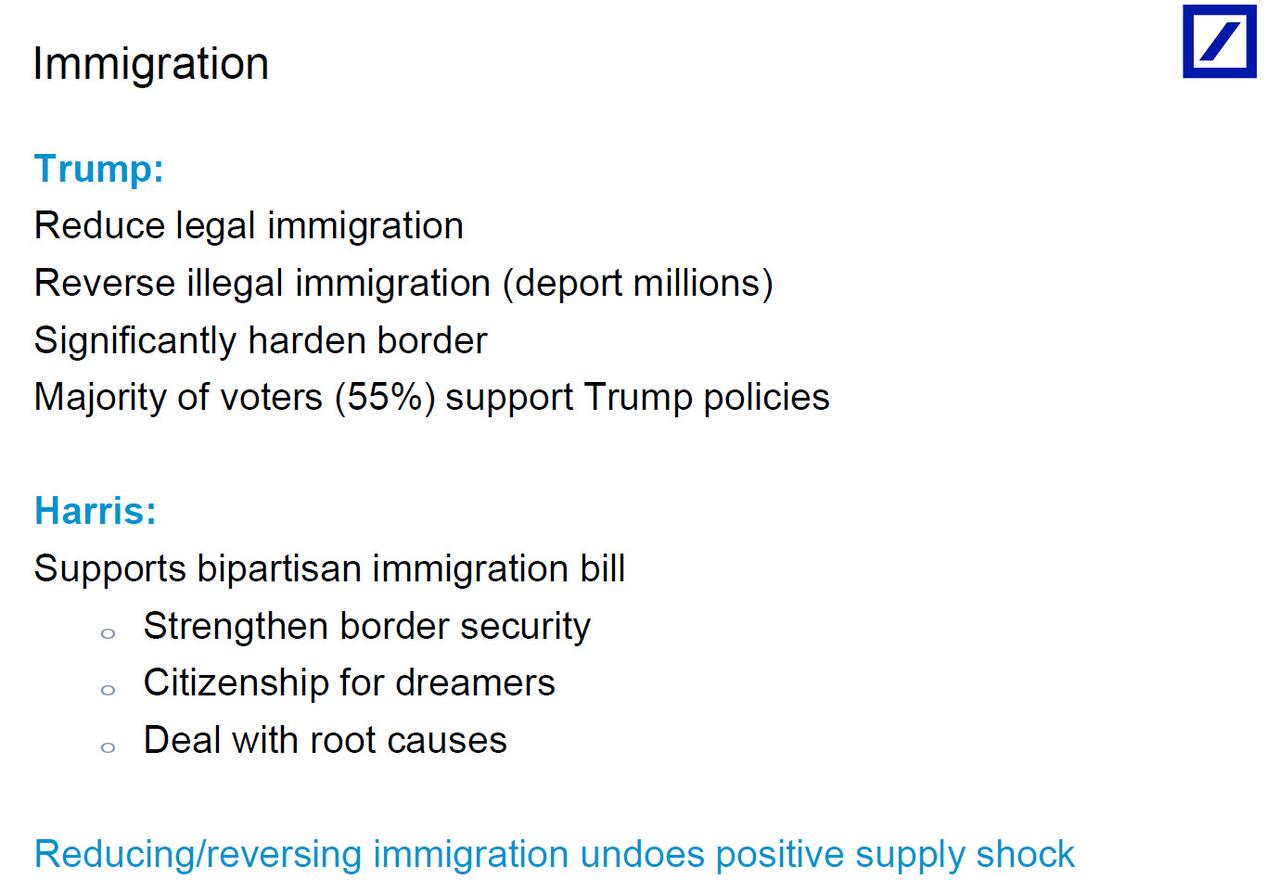

- Overall, Trump’s campaign proposals to raise tariffs, maintain loose fiscal policy and tighten immigration are all viewed as inflationary for the US economy which would curtail the Fed’s room to keep lowering rates in the coming years, if implemented. Meanwhile, with a Harris win, the Fed would likely feel more onus to bolster the US economy given less fiscal support. If Trump won, but without a sweep, the lingering fears from tariffs and tax cuts extensions may make the Fed conscious of not cutting too much in 2025.

- Credit Agricole says that FX investors have been focusing on two equally likely outcomes: 1) President Harris with a divided Congress that could result in a dysfunctional government but leave the US fiscal policy stance and economic outlook little changed, or 2) President Trump and a ‘red wave’ in Congress that could lead to extra fiscal spending and trade tariffs. As such, the firm notes that the risk-reward ahead of the vote could be for muted downside but aggressive upside for the USD.

- Looking at the wider macro impact, with a Republican sweep the confirmation of tax cuts may give growth an earlier lift while ING notes encouragement of reshoring keeps the momentum strong, while inflation would likely be lifted given tax cuts and support for domestic demand. In the event of a Harris victory, somewhat tighter fiscal policy will be a headwind to growth, but a more certain trade and economic backdrop could unwind some of the risk, also extended by if the Fed feels more content with a lower inflation profile. On the inflation footing, likely to see less pressure in the medium term.

- Goldman Sachs sees a Harris win as being the bigger boost for the US economy in the coming two years, arguing that economic output will take a hit next year under the Trump banner, and that is mostly from increased tariffs on imports and tighter immigration policies. GS adds that jobs growth will also be stronger under a Democrat government as opposed to a Republican one. On inflation, GS said that a Trump win will likely lead to a rise in core inflation amid increased tariffs on auto imports from China and the EU.

Current Polling

In terms of recent changes and current polling in the swing states (Polls as of November 4th vs prev. W/W Oct. 28th, and M/M October 1st):

- Arizona (AZ): Trump +2.6 (prev. Trump +1.9 W/W; Trump +1.5 M/M); Trump +2.6 (Trump extends his lead 0.5 W/W & +1.4 M/M). (11 electoral college votes)

- Nevada (NV): Trump +0.5 (prev. Harris +0.1; Harris +1.0); Trump +0.4 (Trump gained 0.5 W/W & +2.3 M/M). (6 electoral college votes)

- Wisconsin (WI): Harris +0.8 (prev. Even; Harris +1.6); Harris +0.8 (Harris extends her lead by 0.3 W/W & Trump trims her lead 1.2 M/M). (10 electoral college votes)

- Michigan (MI): Harris +0.8 (prev. Harris +0.5; Harris +1.9); Harris +1.1 (Harris extends her lead 0.3 W/W; Trump trims her lead 0.9 M/M). (15 electoral college votes)

- Pennsylvania (PA): Trump +0.2 (prev. Trump +0.3; Harris +0.6); Trump +0.4 (Trump extends his lead by +0.1 W/W & 1.7 M/M). (19 electoral college votes)

- North Carolina (NC): Trump +1.2 (prev. Trump +1.3; Trump +0.6); Trump +1.1 (Harris trims his lead by 0.1 W/W & Trump extends his lead by +0.6 M/M). (16 electoral college votes)

- Georgia (GA): Trump +1.5 (prev. +1.6; Trump +1.2); Trump +1.3 (Harris trims his lead by 0.1 W/W & Trump extends his lead 0.3 M/M). (16 electoral college votes)

- W/W & M/M via 538 averages; W/W and M/M via Nate Silver

- As can be seen by the polls, and highlighted by the W/W and M/M change how the momentum is with Trump as he has extended his lead, or trimmed Harris’ leads in every single swing-state (M/M), continuing to highlight how the odds of him winning the election have improved and how the momentum is with the former President. However, and given the weekend polling, Trump remains ahead in 5 of the swing states, but W/W Harris has improved in 4, further alluding to how close this election is.

Meanwhile, nationally (Polls as of November 4th vs prev. Nov. 1st D/D, Oct. 27th W/W, and Oct. 1st M/M):

- RCP Average: Trump +0.1 (prev. Trump +0.3, Trump +0.1, Harris +2.0).

- 538: Harris +0.9 (prev. Harris +1.3, Harris +1.4, & Harris +2.6).

- Nate Silver: Harris +0.7 (prev. Harris +1.4, Harris +1.6, & Harris +3.4).

- PredictIt: Harris USD 0.55 vs. Trump USD 0.51 (prev. 0.53 vs. 0.52, 0.42 vs. 0.61, & 0.55 vs. 0.48).

- Polymarket: Harris 42% vs. Trump 58% (prev. 37% vs. 63%, 35% vs. 65%, & 50% vs. 49%).

Weekend Updates (Key updates since Oct. 31st, when the Newsquawk US Election Guide first went out)

- Over the weekend (Nov 2nd-3rd) a couple of notable polls were released, showing support for Harris, which shifted the dial in betting markets and also general market sentiment.

- Firstly, a new Des Moines Register/Mediacom Iowa Poll showed very surprisingly that Kamala Harris has overtaken Donald Trump in the state 47%-44%. The poll showed that women, particularly those who are older or are politically independent, are driving the late shift toward Harris although the former President continues to lead with his core base of support: men, evangelicals, rural residents and those without a college degree. While a success for the VP in this state would be a shocking development after Iowa has swung aggressively to the right in recent elections, delivering Trump solid victories in 2016 and 2020, it could show a broader shift in votes towards Harris with undecided voters leaning towards the Dems.

- Secondly, the final NYT/Siena Polls (released Nov. 3rd) indicate how close this election is and how vital the swing states will be. Harris leads in 4, Trump in 1 and 2 tied, albeit all extremely marginal. Overall, the polls showed the race was deadlocked in six out of the seven battleground states and that all seven of them were within the margin of error. Recapping the results, Harris leads Trump in Nevada at 49% vs. 46%, North Carolina at 48% vs 46%, Wisconsin at 49% vs 47% and Georgia at 48% vs 47%, while Trump leads in Arizona at 49% vs 45% and the candidates were tied in Pennsylvania at 48% vs 48% and in Michigan at 47% vs 47%. As such, if the election was decided on the NYT/Siena poll, Harris would be President 47. Despite being exceedingly close, the polls adds that there are signs that late deciders are breaking for Harris as, among the 8% of voters who said they had only recently decided on their vote, she wins the group by 55%-44%.

- Amid the latest weekend updates, a notable shift was seen in betting markets, with Trump odds of winning the election trimmed on Polymarket and Kalshi, while on PredictIt odds actually shifted in favor of a Harris election victory.

Recent Changes

- The screenshot below, as of November 4th, shows Polymarket’s betting odds have shifted massively in Trump’s favor in recent weeks and months, while RCP average has also notably shifted with Trump ahead for the first time since August. However, and further illustrating the theme of the last weekend before the election that provided Harris with some momentum, shows the odds have trimmed back again, and are literally tied as of Monday evening.

Key policies

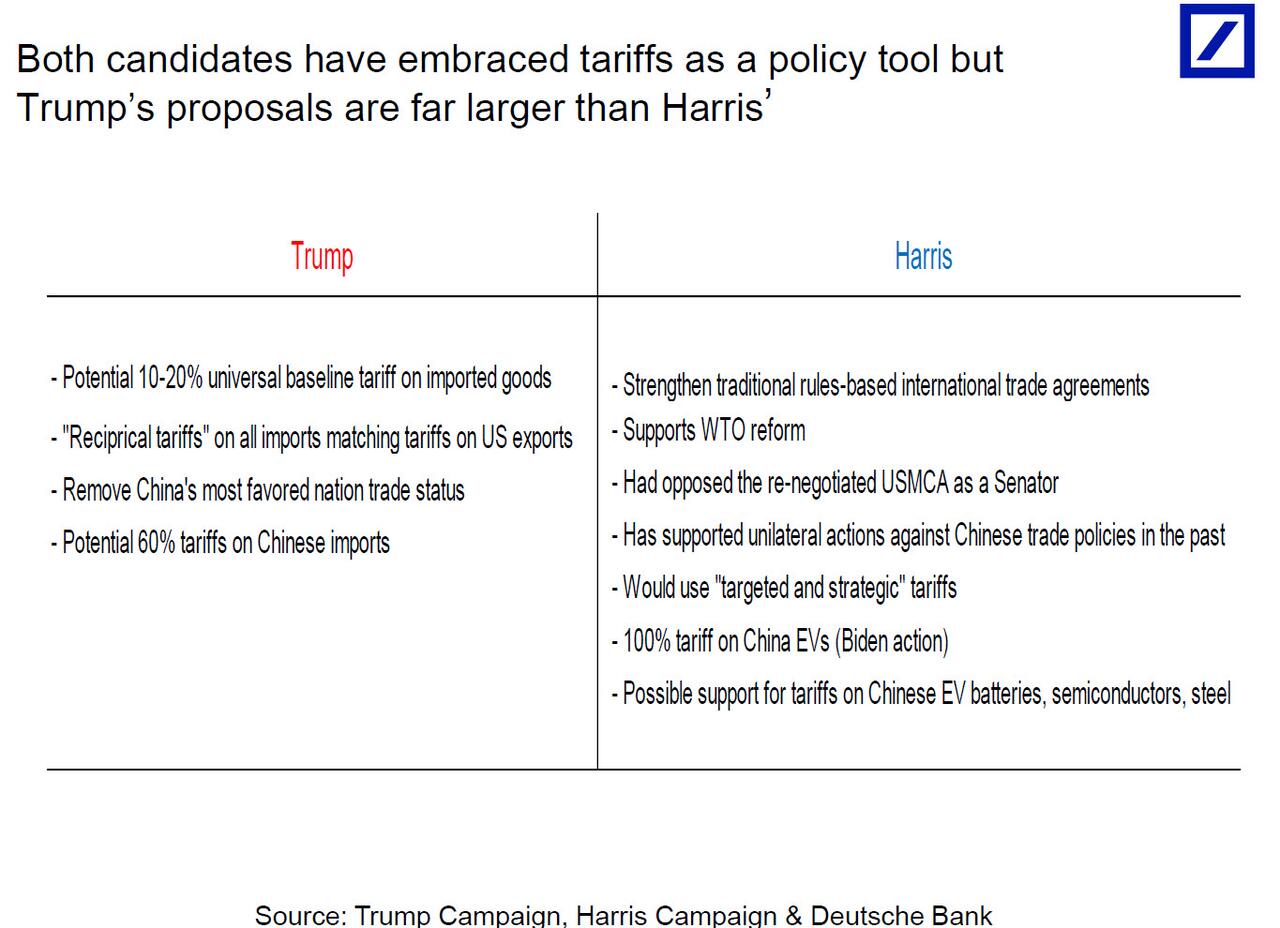

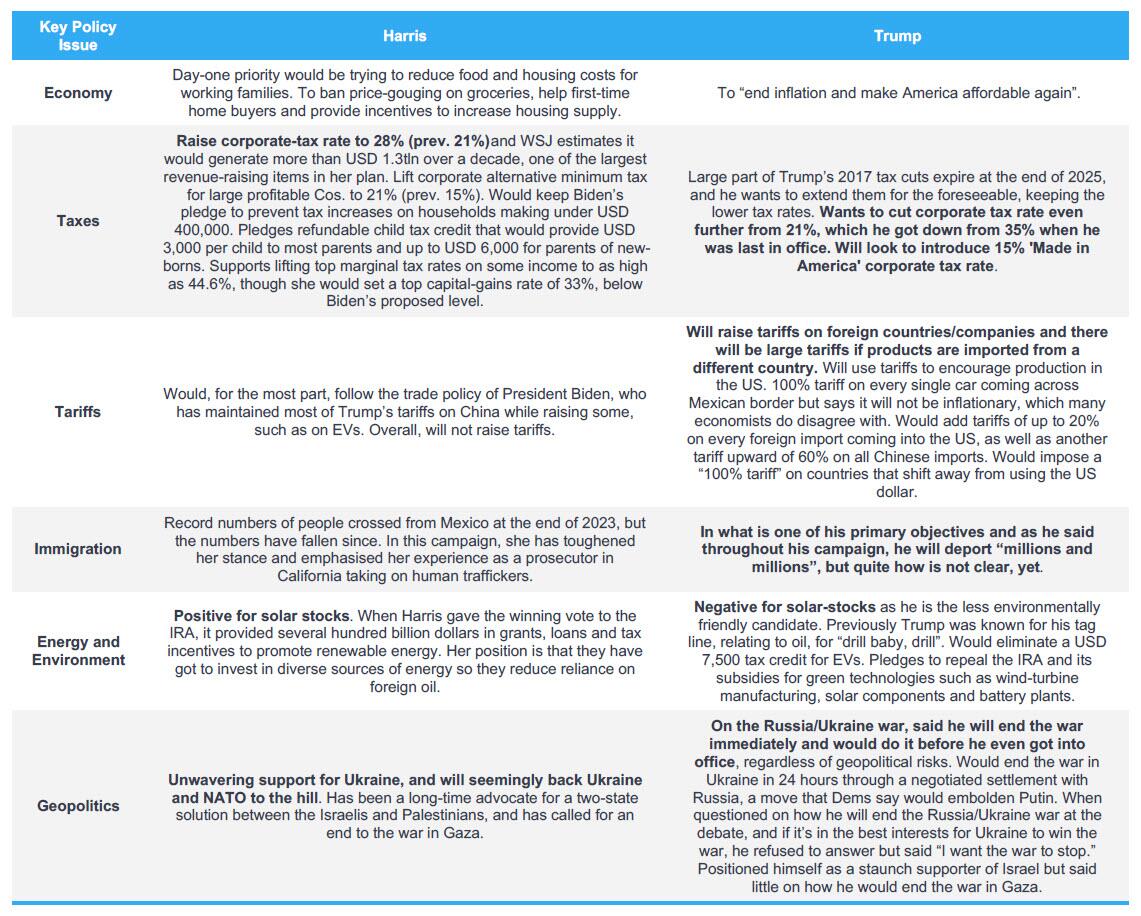

- Harris’s offcial campaign website is here. Trump’s official campaign website is here. The following chart was created by JPM Wealth Management’s Key Investment Themes publication

House Races

- The House often goes the way of the President but not always (e.g. 2012)

- Democrats (and independents who caucus with Dems) have had a slim majority in the Senate that they will lose with W.Va

- 2024 House Race Ratings: PA-07 could be a bell-weather for the outcome of the Presidential election

Senate Races

- 2024 Senate Race Ratings: GOP could flip several seats in addition to W.Va

Electoral College