Produktionstallene PMI viser, at den svenske genopretning er begyndt. Det overordnede PMI-indeks viste for første gang ekspansion i økonomien i juli – for første gang siden nedsmeltningen i marts. Indekset steg til 51 mod 47,3 i juni. Et indeks over 50 viser ekspansion. Underindekset for produktion steg til 55,5. Underindekset for eksport viste, at de udenlandske ordre nu vokser. Et andet underindeks viser, at der nu er ekspansion i forsyningskæden på globalt plan. Kort og godt: Genopretningen er begyndt.

Sweden Macro Review: PMI at expansionary territory

The manufacturing PMI marked its first reading in expansionary territory since March. The recovery has started.

The headline index rose to 51.0 in July from 47.3 in June. The reading above 50 implies that economic activity is expanding again, but from very low levels. It’s still a long way back to normal.

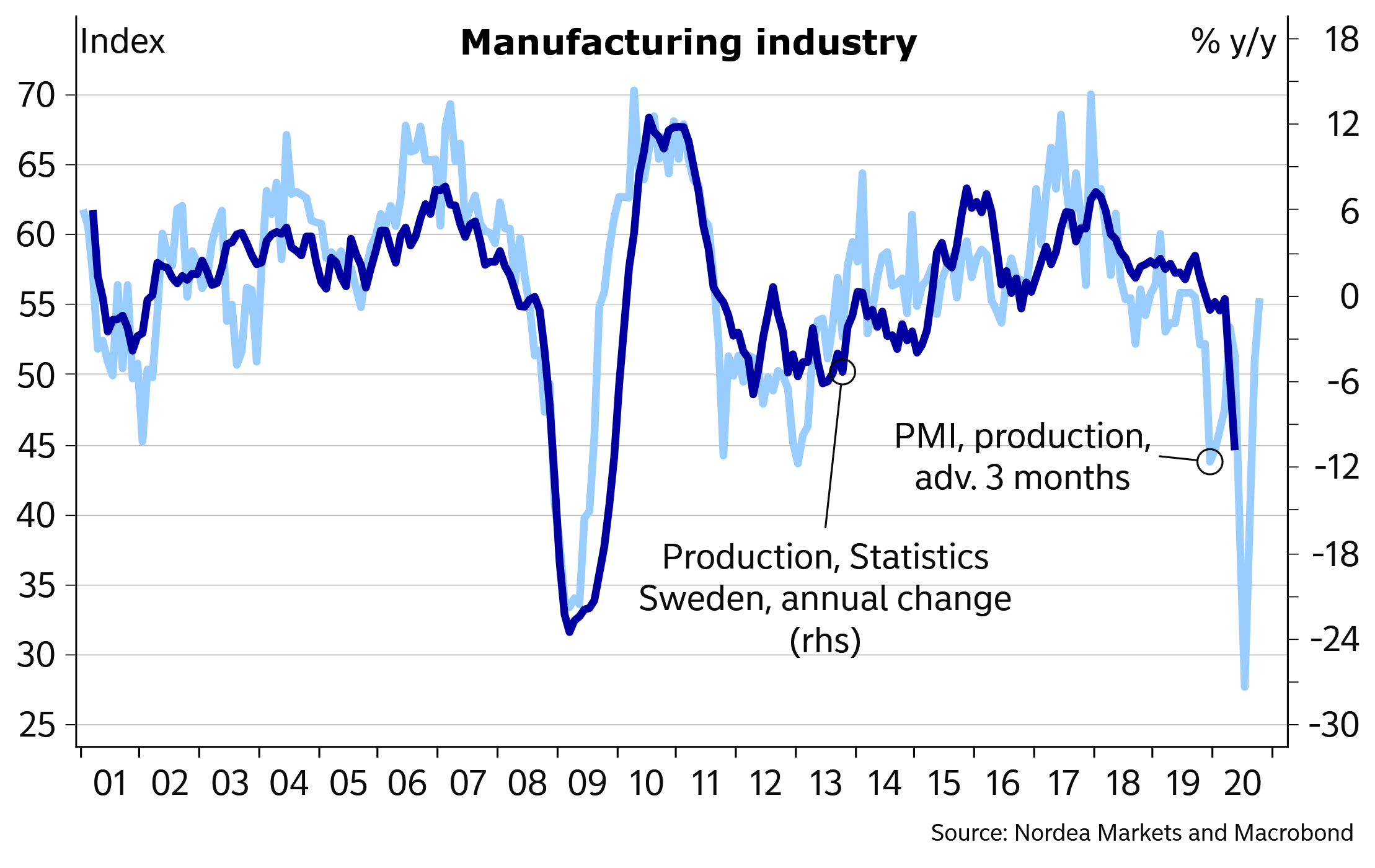

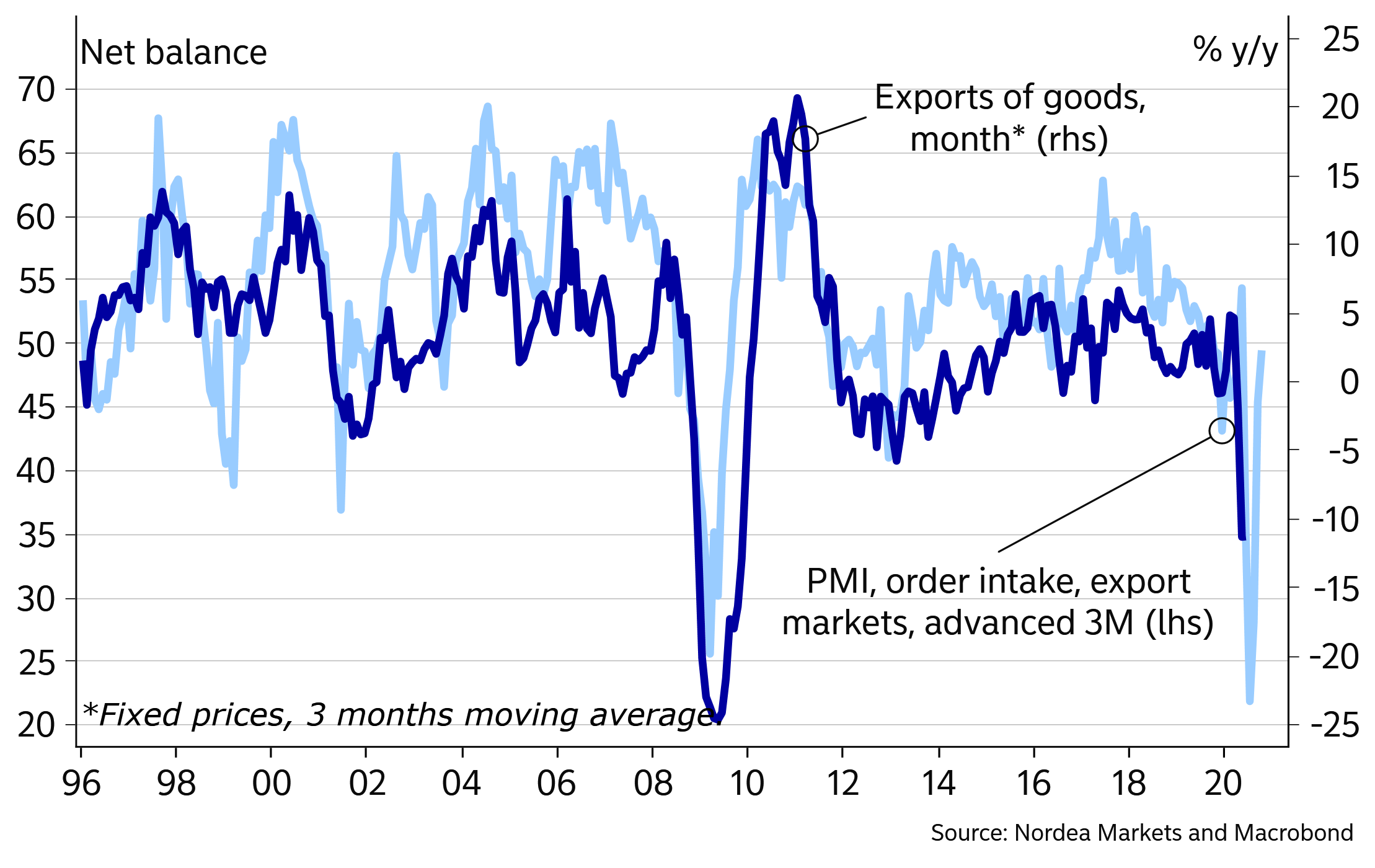

Production rose to 55.5, marking its second month of expansion. The rise in the sub-index for export orders indicates that foreign demand is picking up, and the index will most likely rise to net positive numbers next month.

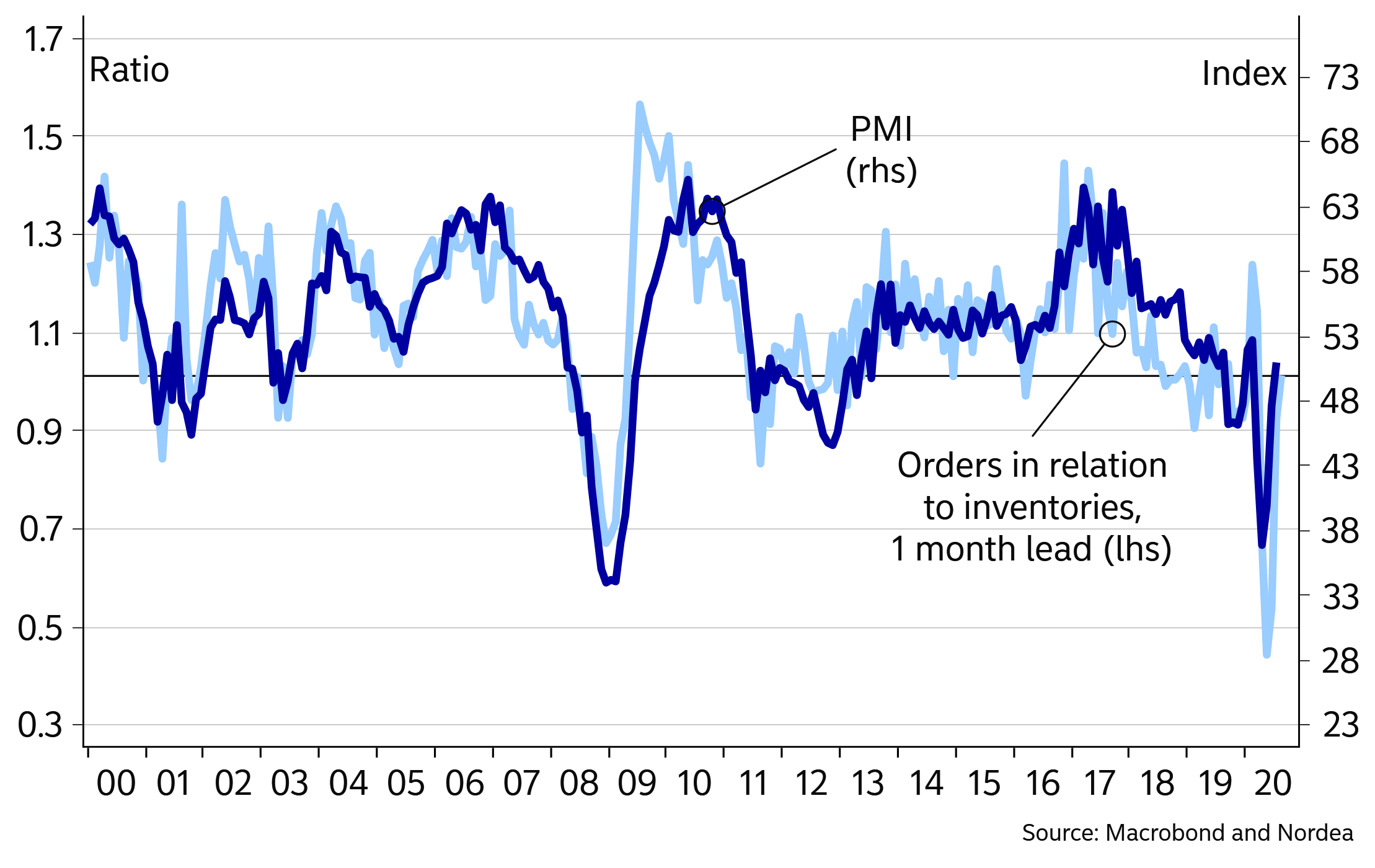

The sub-index for delivery times bounced back to 51.5. While the figure has decreased dramatically since its peak in April, it is clear that supply-chain distortions still are present even though they are normalizing since most trade partners reopened in June. Moreover, inventories decreased further in July, pointing towards an uptick in demand.

However, employment plans remains submerged, in line with our view that unemployment has not peaked quite yet.

All in all, today’s report is decent. The recovery has begun, though strains on the labor market remain.

Details, July:

PMI: 51.0 (prior 47.6)

Order intake: 51.6 (prior 47.6)

Export orders: 49.5 (prior 45.4)

Production: 55.5 (prior 51.0)

Employment: 44.9 (prior 41.1)

Inventories: 50.9 (prior 51.5)

Delivery times: 51.7 (prior 50.2)

Production plans 6 months ahead: 49.8 (prior 49.8)