Uddrag fra Authers:

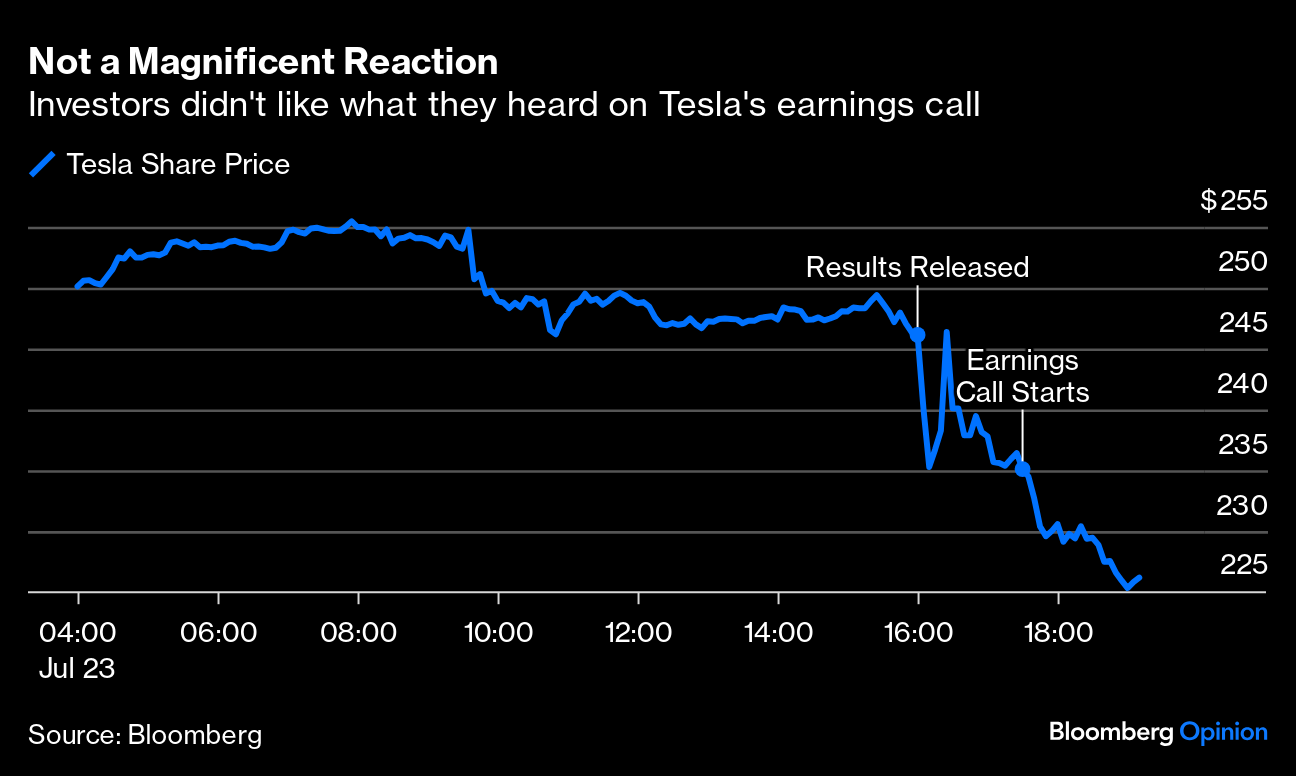

Some are dropping Tesla from the Magnificent Seven as investor skepticism drives a fall in its share price. Earnings below expectations didn’t help, and doubts appeared to intensify during the earnings call, presided over by omnipresent CEO Elon Musk. How investors felt about the earnings and Musk’s comments is clear enough from this chart for the day, through to after-market trading:

An 8% fall after market tells its own story. What was the problem? In part, the Musk schtick is beginning to wear thin. To cite two almost comical examples, he at one point said that “everyone on Earth” would want an Optimus robot, so the total addressable market for it was about 8 billion, and then answered a question about regulatory approvals for the robotaxi by saying: “Our solution would work anywhere, even a new Earth.” That inspires Musk’s legions of admirers but it falls flat with shareholders, particularly after a poor quarter.

Then there was a lack of catalysts to prompt new investments. The day to introduce the robotaxi, on which Tesla is betting big, has been put back to October, and there was no other specific news. Most puzzling was the revelation that work on a new gigafactory in Monterrey, Mexico, is being suspended until after the US election because of the risk that a Trump administration would levy extra tariffs.

Trump has also heavily criticized subsidies for electric vehicles. That makes it all the more mystifying that Musk last week decided to endorse him and send donations of $45 million each month — although he now seems to be backtracking on the financial commitment. Shareholders are being asked to pay Musk a huge executive package, and he plans to donate it to a politician whose agenda would directly damage their company. You can understand why they’re miffed