Uddrag fra Authers:

“CPI Tuesday” doesn’t have the same ring as some other regular market dates, but there’s little denying that no single data release matters more these days than US consumer price inflation. Tuesday morning’s release on price rises in August will matter a lot.

Judging by the rally in equities over the last few days, plenty now believe that the August data will show a continuing decline, and ram home that the peak is in. For a cynical but fair take on the optimism, this is what Peter Tchir of Academy Securities Inc. said ahead of the numbers:

Everyone is waiting for Tuesday’s CPI data. We will get officially told what inflation was in August. It is unlikely that it will reflect what we see and feel every day. It doesn’t tell us anything about where September will be (actually, that is not true, as some of the data will be so off, that it will have to get fixed in next month’s report, and some is just stale by its nature (housing)….

The market has concluded that both the ECB and even the Fed, despite their protestations otherwise, are both being viewed as data-dependent. I cannot see any scenario where the market doesn’t decide that CPI is heading the right direction and that October will be lower than September and so on and so forth (so many commodity futures contracts that I checked out are all lower forward than spot). That combination should allow markets to continue to enjoy the strength that they saw towards the end of last week.

There is good reason for the growing optimism on inflation — but as Tchir suggests, that optimism is nowhere near as strongly rooted in facts as many have now convinced themselves. Yes, it does look ever more as though the peak for inflation is in, and that is far preferable to a situation where inflation rates were still accelerating. But the key is how quickly price rises come down. The Fed still wants to get inflation down to its target of 2%, and that is still a long way off.

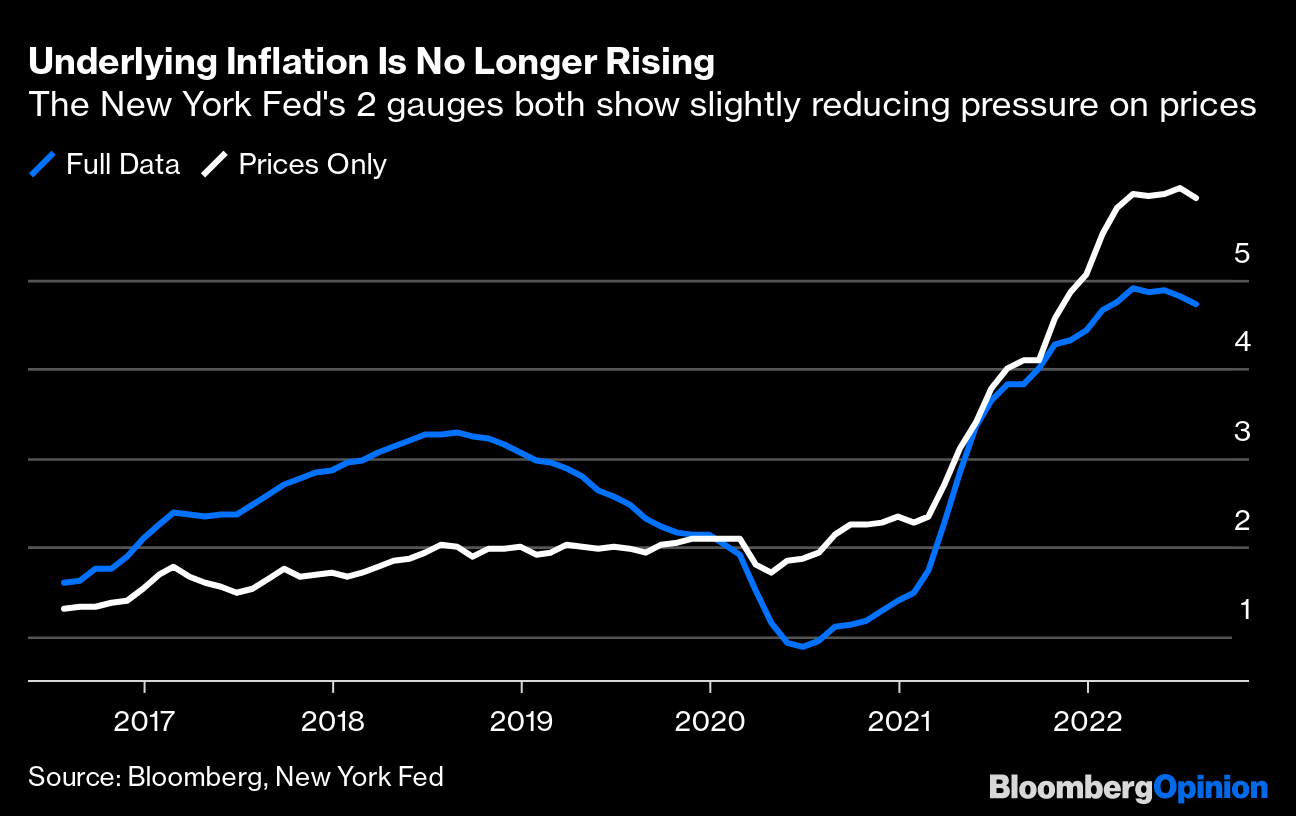

Data produced by the New York Fed on underlying inflation, looking at correlations between different CPI components, and also with some macroeconomic variables, show what looks like a plateau after reaching a historic high:

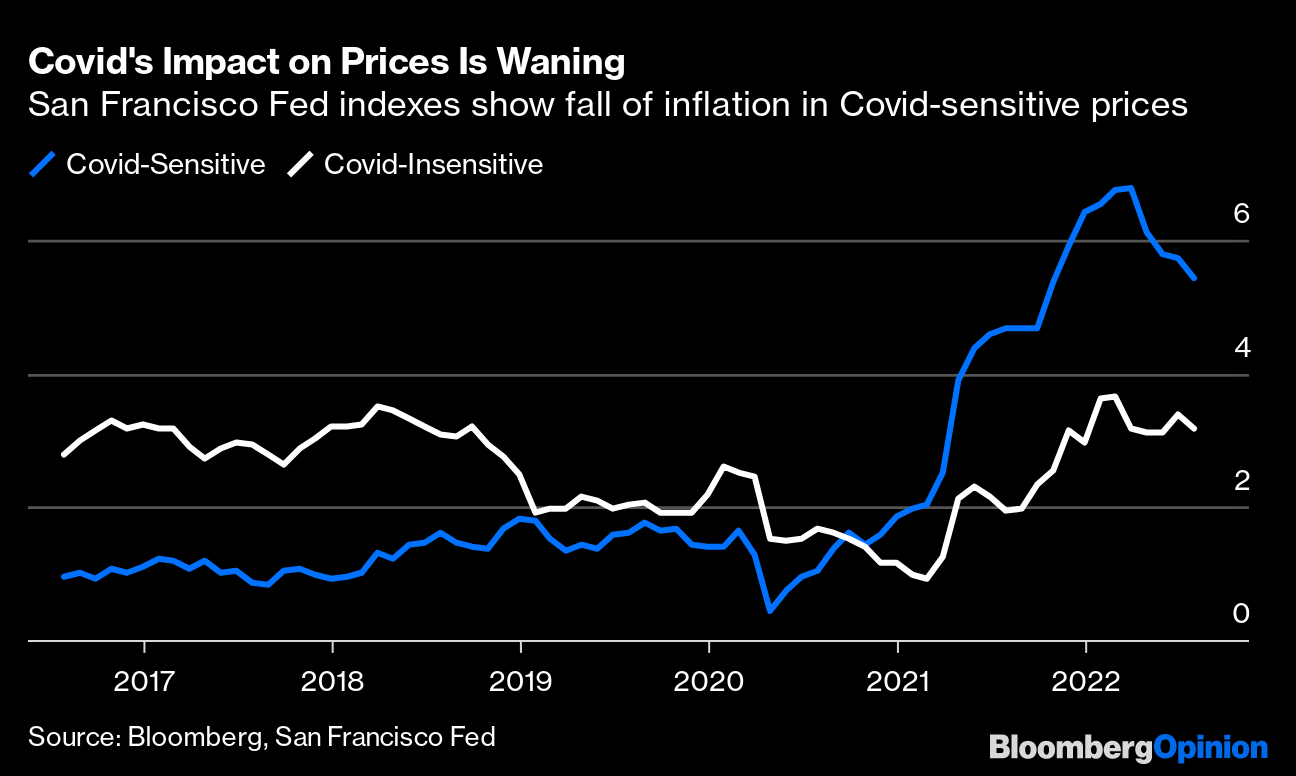

Another Fed, from San Francisco, created two baskets for products that were most affected by the Covid-19 pandemic, and those that were least sensitive to it. The Covid-sensitive measure has been declining for several months, and peaked before it was able to pull Covid-insensitive prices with it. That can only be good news for those hoping inflation will soon come down:

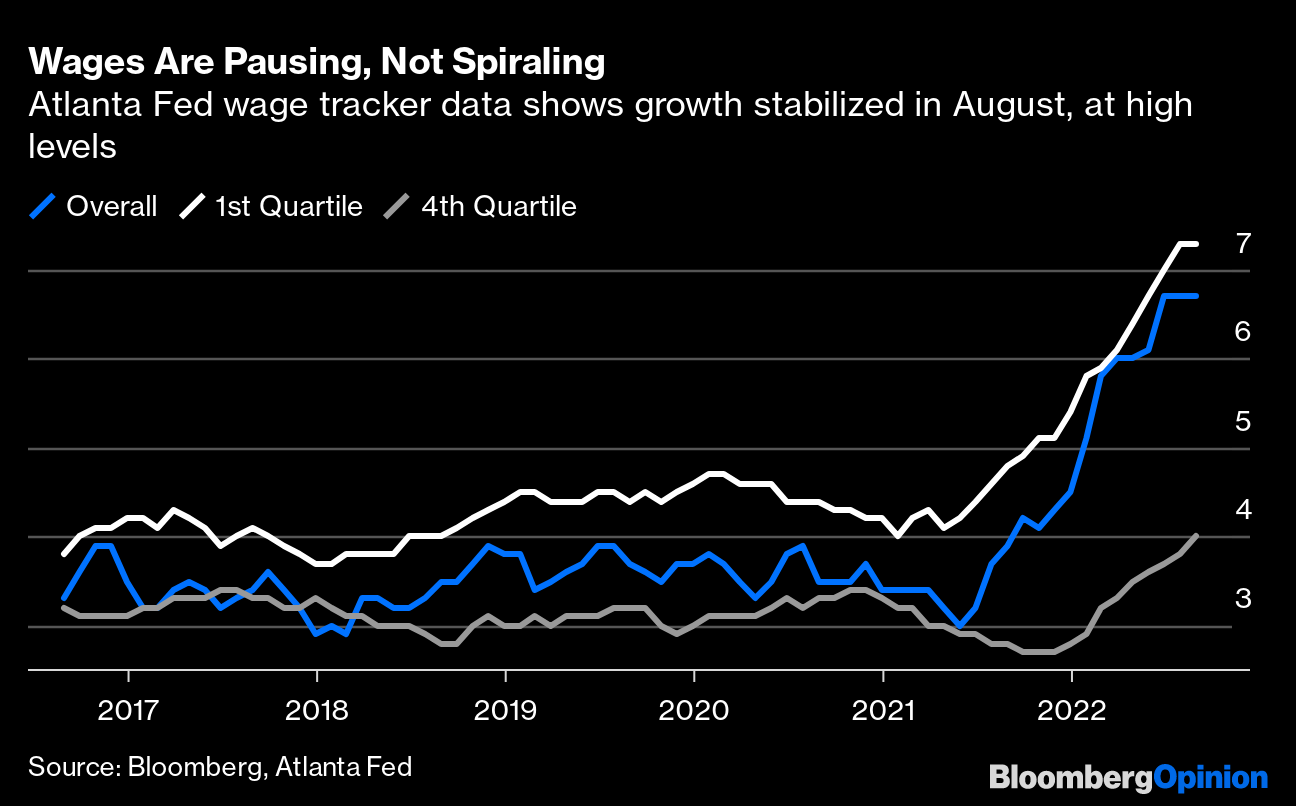

Moving on, the Atlanta Fed published its latest wage-tracker data last week, using census numbers to show how wages rose during August. This series is also at historic highs, but the overall level of wage growth appears to have stabilized just below 7%. Wage rises in the lowest-paid quartile, which have run ahead of the average, also remained unchanged after an impressive surge.

A few more months like this would make central bankers more comfortable that a “wage-price spiral” had been averted. But wage settlements remain far too high for the Fed’s comfort, and persisting high levels of headline inflation will continue the pressure on them. The point is that these numbers have to come down significantly before the central bank can declare victory:

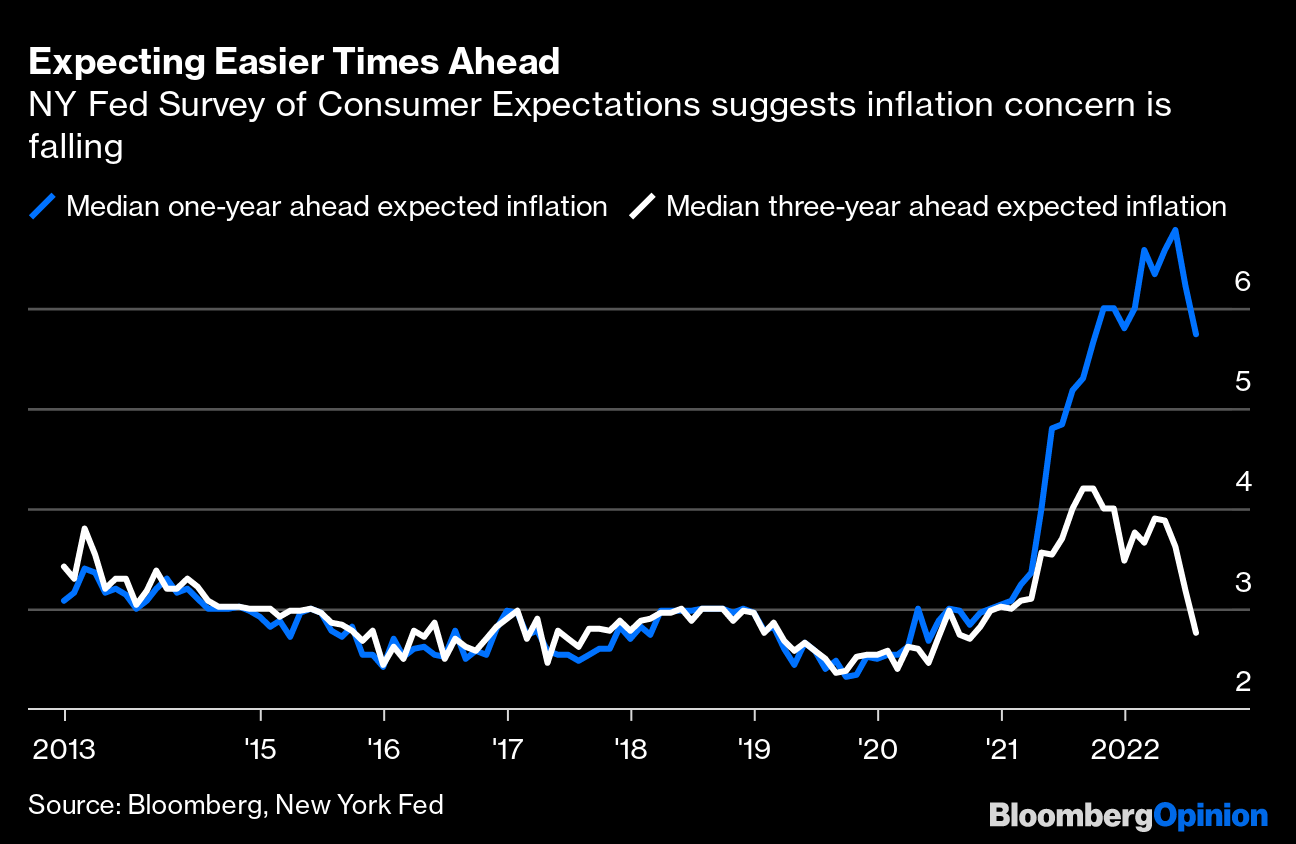

Stronger evidence that a wage-price spiral can indeed be avoided came from Monday’s publication of the New York Fed’s latest Survey of Consumer Expectations. This found expectations for inflation three years hence had dropped below levels that were typical before the pandemic, while expectations for the next year have dipped sharply from a very high level. This data should unambiguously encourage the Fed that it is succeeding in reining in angst over inflation:

So some degree of optimism over inflation is justified. But the question the equity market may be ignoring is what it would take to convince the Fed to stop hiking and even start cutting rates again. It’s hard to see how it can cut unless inflation is plainly on its way back to 2% (and nothing can prove that as yet), or economic growth starts to decline noticeably (the reverse has happened in the US as the oil shock has eased during the summer), or there is a clear-cut financial accident. There may be arguments that hiking much further would be dangerous, but the current buoyancy of the stock market ironically argues against them.