Østeuropa havde problemer i 2019, men det ser lidt bedre ud i 2020, fremgår det af en analyse hos ABN Amro. Det sker trods den svage tyske økonomi.

Uddrag fra ABN Amro:

Emerging Europe Outlook 2020 – Diverging paths

- Emerging Europe faced substantial headwinds in 2019, but CEE3 was relatively resilient

- Further modest slowdown expected for 2020 in CEE3…

- … with little policy room to react to negative surprises

- Russia’s macro fundamentals improved, but structural issues

- Turkey saw some recovery from downturn, helped by accommodative policies…

- …but remaining challenges make stability tenuous

Emerging-Europe-Outlook-2020-1.pdf (228 KB)

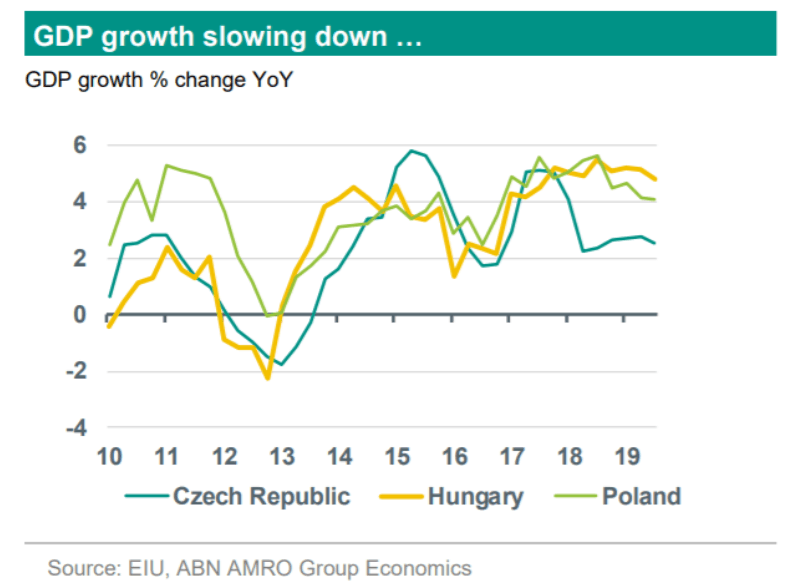

Emerging Europe faced substantial headwinds in 2019, but CEE3 was relatively resilient

Emerging Europe faced substantial headwinds in 2019 with a sharp slowdown in major economies and global trade growth amid escalating US-China trade/tech tensions. As a result of these headwinds, the Emerging Europe region slowed down in 2019, from 3.1% in 2018 to 1.8% last year. Part of this slowdown was caused by CEE3 countries (Poland, Hungary, and Czech Republic). However, their performance was in fact, surprisingly good, given all three countries export mainly to Germany, a country which more than halved its growth rate in 2019 and where GDP only showed an uptick of 0.6% last year. CEE3 is tightly connected to the euro area via value chains, and through these value chains and via hard-hit Germany, a second order hit to CEE3 exports took place as a result of the trade conflict. But despite these headwinds, and thanks to strong domestic consumption and investment, Hungary still grew 4.8% last year, down only 0.3%p from 2018. Poland also saw robust growth of 4.2% in 2019, and Czech Republic’s GDP increased a respectable 2.6%.

Further modest slowdown expected for 2020 in CEE3…

By the end of 2019, however, investment and economic growth started to slow down in CEE3. A continuation of this deterioration, at a modest pace, is expected in 2020. This is in line with our global outlook for “slower for longer” growth, in which growth is lacklustre in the first half, before picking up modestly in 2H. In this global outlook, the coronavirus depresses growth in Q1, while lifting Q2-Q3, with the net impact being modestly negative. We expect Polish real GDP growth in 2020 to stand at around 3.5%, from 4.2% in 2019. Hungary is also combining a slowdown in industrial production and trade with the mitigating effects of previous investments into a modest slowdown.