“Is there an AI bubble? Or are there more than one?” asks Deutsche Bank’s Research Institute’s Adrian Cox and Stefan Abrudan in an excellent note indicating red flags, green flags, why it matters, and what could go wrong in the increasing contagious AI ecosystem across markets and economies.

Is there an AI bubble? With valuations surging and an economy riding on AI capital expenditure just three years since the launch of ChatGPT, this is the top question on the mind of investors – particularly the generation scarred by the dotcom bubble of the late 1990s.

If this is a bubble, it is still in its early stages. Retreating now risks leaving significant gains on the table. It was more than three years after then-US Federal Reserve Chairman Alan Greenspan warned of “irrational exuberance” in December 1996 that the dot-com bubble burst.

In fact, the dot-com bubble was really two bubbles:

- one with lightly capitalised, neverprofitable IPOs,

- and the other with heavily indebted telecoms companies that laid down fibre optic cables that remained dark for years.

There is also more than one boom (or bubble) this time. The charge is led by well-established big tech companies with multiple revenue streams, who are paying for their investment in data centres mostly out of free cash flow and from which they are generating immediate returns from enterprise customers. The unprofitable companies at the cutting edge of model and application development are still private, with spending commitments that may or may not actually be fulfilled depending on how their business models evolve.

Part of the issue comes down to naming.

Just as the cliché goes that Inuit people have 100 words for snow, there is not just one kind of bubble.

This report aims to separate out at least three different kinds of bubble: valuations, investment and technology.

The Deutsche Bank team explains why they think that reports of a bubble are exaggerated (for now) as well as what could go wrong.

Would the real AI bubble please stand up?

Red Flags

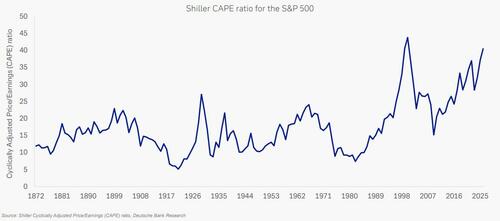

1. Valuations: Levels are nearing the historic peaks of the dot-com era.

The Shiller Cyclically Adjusted Price/Earnings ratio is has passed 40, not too far below its peak of almost 44 in 2000

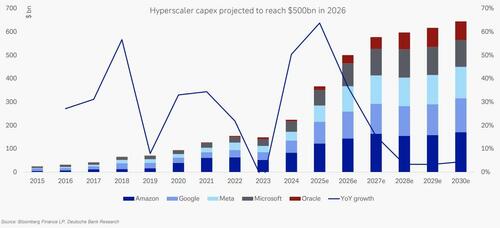

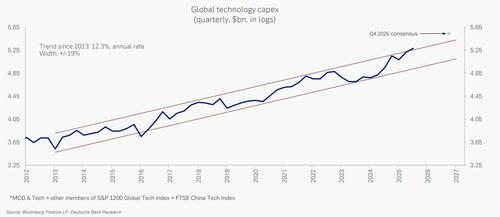

2. Investment: AI data centre capex may hit historic $4 trillion total by 2030.

Capex, led by hyperscalers, is forecast to exceed 10x inflation-adjusted cost of Apollo programme with no guaranteed return

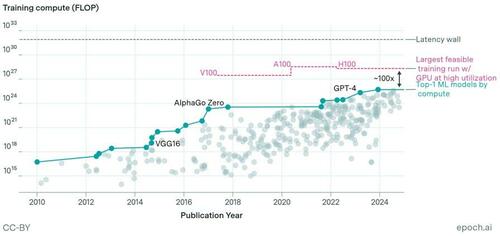

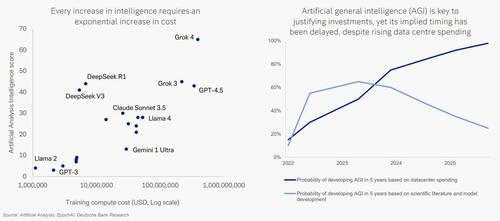

3. Technology: Generative AI is flawed and may hit a wall.

The tech is (still) prone to error and hallucinations; can be hard to apply at scale; and faces bottlenecks in further scaling

AI’s rapid scaling may soon hit physical barriers such as limits on how fast data can be moved between chips, some researchers say

Source:Ege Erdil, and David Schneider-Joseph. ‘Data movement limits to frontier model training’. ArXiv [cs.DC], 2024. arXiv. https://arxiv.org/abs/2411.01137

Green Flags

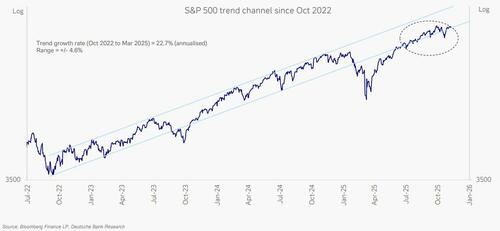

1.1 Valuations: Equities are still at the low end of the post-2022 trend

Historically elevated valuations are due to structural and cyclical factors and supported by a robust demand-supply balance

1.2 Valuations: Tech stock rally has been driven by earnings growth

The 60% valuation premium for tech has been justified by 20%+ earnings growth differential; now earnings are broadening

Big tech valuations are not nearly as stretched as in the tech bubble

Mega-cap growth* and tech stocks next-12-months (NTM) P/E relative to rest of S&P 500

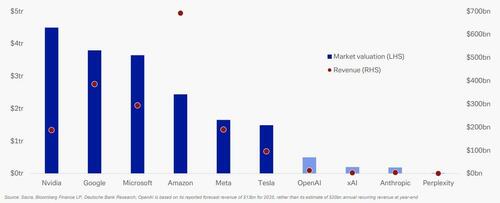

1.3 Valuations: highest valuations are non-profitable private companies

The price to sales ratio of OpenAI is 38 and Anthropic is 44, vs Nvidia at 22, Microsoft at 12, Google at 9.9 and Amazon at 3.5

Valuations of notable big tech companies in the public and private markets

2.1 Investment: capex growth is still in line with strong trend from 2013

At less than 40% of EBITDA, tech capex is still well below levels of late 1990s and is now just at levels of rest of S&P 500

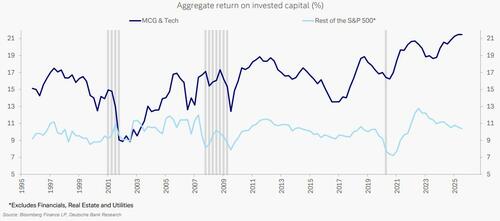

2.2 Investment: big tech returns have grown since start of AI cycle

Hyperscalers are generating new returns from AI via customer cloud demand, AI-powered tools and cost savings on coding

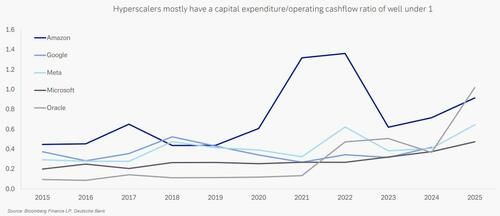

2.3 Investment: hyperscalers are funding capex mainly via free cash flow

With, eg Google generating $48bn in operating cashflow in Q3, hyperscalers can afford to invest without external capital

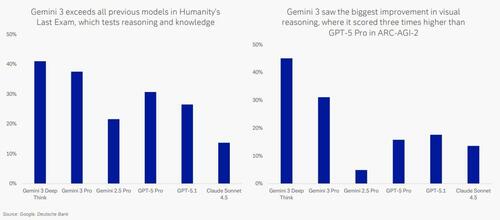

3.1 Technology: scaling is still delivering improvements in capabilities

Launch of Google’s Gemini 3 in November showed that AI has not yet hit a wall, with significant multimodal advances

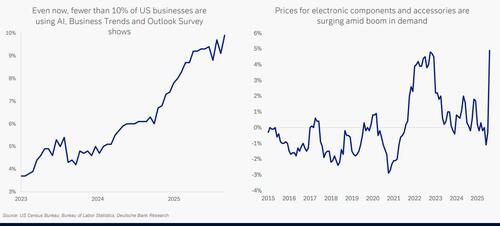

3.2 Technology: AI rollout is just getting started and demand is surging

Google said in October it is processing 1.3 quadrillion tokens a month, up from 9.7 trillion in April 2024, as AI workloads rise

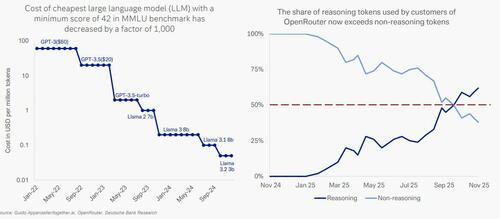

3.3 Technology: demand is also fuelled by tumbling costs and new uses

AI follows Jevon’s Paradox, where greater efficiency and lower costs boost consumption, meaning no chips are lying idle

Why It Matters

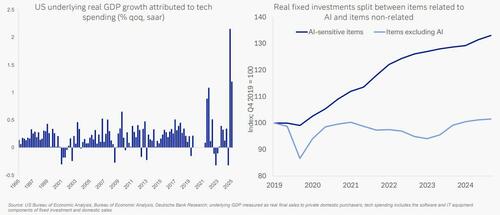

Investment in AI-related sectors is critical to GDP growth

US would be close to recession this year if it weren’t for tech-related spending, as other spending has flatlined post-Covid

What Could Go Wrong?

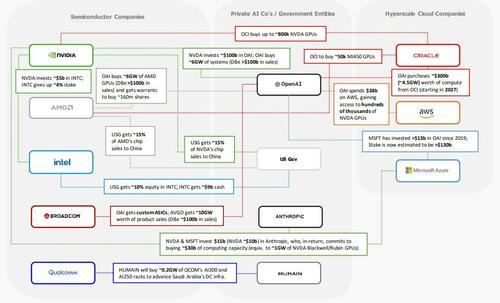

1. Valuations: Circular financing may lead to opaque valuations

Recent complex agreements, such as OpenAI’s $1.4trn in compute commitments over eight years, may carry systemic risks

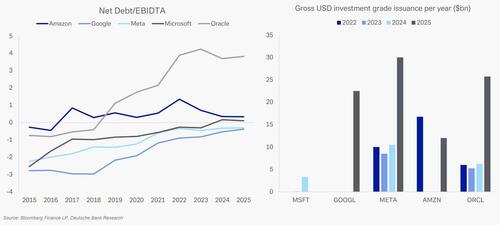

2. Investment: costs could spiral, forcing companies into debt

Even the cash-rich hyperscalers have begun to issue far more debt, with downstream companies also set to increase issuance

3. Technology: practical hurdles, prohibitive costs or slow gains

As scaling shows diminishing returns, developers may not keep finding other ways to deliver value that works “in the field”

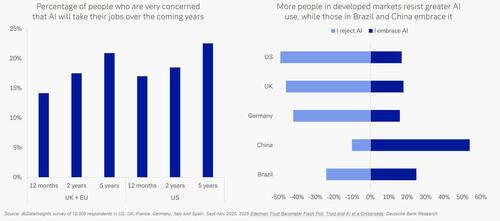

4. Social, political backlash on fears of control, privacy, jobs

Rising scepticism about AI could lead to customer boycotts, employee resistance and restrictive regulation

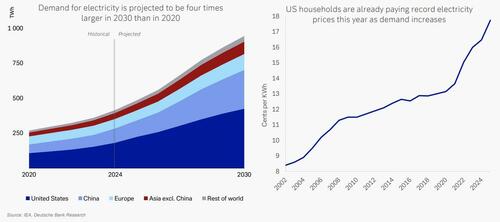

5. Practical or geopolitical supply bottlenecks, eg energy, chips

The biggest hurdle to adoption and monetisation is supply, particularly electricity, where capacity will take years to build

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her