Det betaler sig ikke for virksomheder at have store faste værdier som ejendomme og egne fabriksanlæg, skriver Deutsche Bank i en analyse. De aktier, der opererer efter “asset-light”-metoden, giver et betydeligt større afkast, og det gælder også i Europa, omend ikke så udpræget. Udviklingen er nået til service. Skal en virksomhed eje eller leje en service? Også her ses samme udvikling i aktieafkastet. Begrebet “Asset-as-a-Service” svarer til, at man ser en film på Netflix i stedet for at købe en dvd, og at en virksomhed bruger cloud fremfor at opbygge sin egen software.

How Assets-as-a-Service can save a

balance sheet blow out

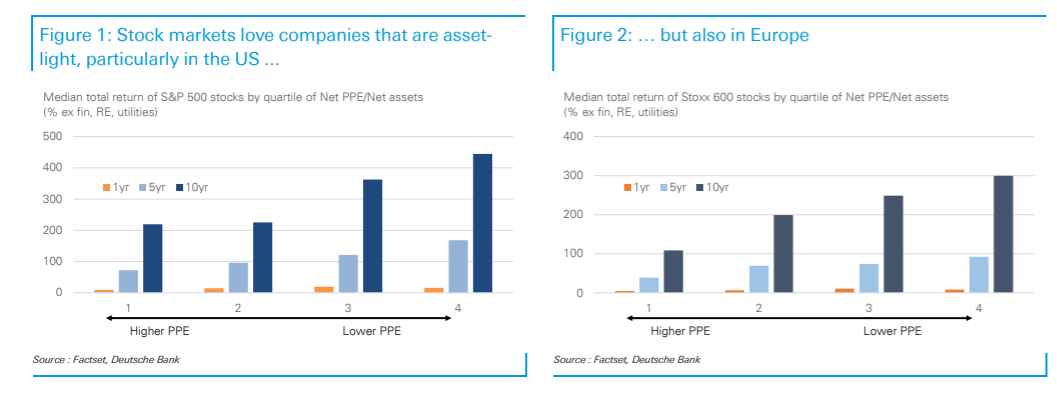

Being ‘asset-light’ has been Wall Street dogma for years. And no wonder. Over the

last decade, US stocks with low levels of Property, Plant, and Equipment (PPE) have

seen double the stock market returns of high PPE stocks. In Europe, the returns

have been triple.

But could it all come to an end? Over the last two years, the PPE on company balance

sheets has exploded. In the US, it has grown from 40 per cent to 60 per cent. In

Europe, it has gone from 36 per cent to 48 per cent. The cause has been new

accounting rules that capitalise operating leases. This has affected 80 per cent of

large European companies and 90 per cent of large US companies. And investors

are not ignoring this – rather it has shone a spotlight on the ‘true’ level of assets that

a company uses to operate.

Adopting an “Assets-as-a-service” model may help reduce the balance sheet drag.

Indeed, corporate interest in AaaS has jumped between 30 and 50 per cent since the

covid outbreak left many firms paying for idle assets.

In this piece we review the burgeoning AaaS market and analyse how stock markets

penalise companies for poor asset efficiency. We then analyse how companies can

materially increase their Return on Equity by converting even a small proportion of

their equipment into AaaS operations.