Deutsche Bank mener, at cryptocurrencies bliver normen, og det handler ikke om den spekulative Bitcoin. Facebook og PayPal er gået foran, og de vil konkurrere mod de kendte betalingsformer online. Facebook ventes at lancere Libra i år, og det samme vil PayPal med Venmo. Men også centralbankerne er godt på vej, og Kina går foran. Centralbankers brug af cryptocurrencies kan på langt sigt blive normen.

The Future of Payments. When digital currencies become mainstream

A year ago, we stated that:

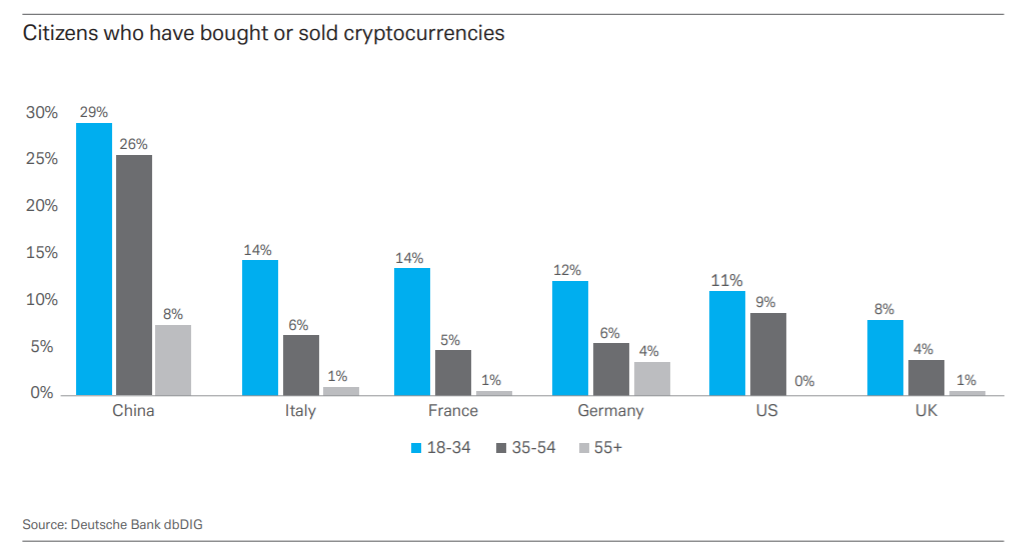

− Cryptocurrencies would become more mainstream. Both Facebook and PayPal will be adding

cryptocurrency capability to their wallets early 2021. Facebook plans to launch Libra 2.0 in early 2021.

With over 2.7 billion users (one-third of the world’s population), Facebook now has the potential to

compete with traditional online payment platforms and advance digital currencies into the mainstream.

PayPal plans to further expand the roll out internationally and to the rest of its platform including

Venmo in 1H21. This is a big development for crypto adoption, because PayPal is one of the biggest

payment providers in the world. PayPal services are being used by over three hundred million customers worldwide. Twenty-eight million stores now accept PayPal as a payment method.

Central bank digital currencies (CBDCs) will be widely discussed. The Bahamas launched the first

nationwide CBDC last October, and both Sweden and China launched pilots in early 2020.

This year, we see that:

− The pandemic has hastened the decline of cash by four or five years. The world has shifted from

asking whether digital currencies will succeed, to how and when they will become mainstream.

− Using cryptocurrencies for payments will accelerate. Energy consumption could hinder widespread use of cryptocurrencies and create negative press. Transaction speed remains low for most cryptocurrencies compared to card providers. The only exception is Libra, which is expected to run on FastPay. Libra’s transaction speeds could surpass Visa by fourfold.

− Central bankers and policymakers will react by speeding up their existing research and launching

pilots. China is likely to continue to dominate the race. In the long run, CBDCs will displace

private cryptocurrencies and become the norm.