Deutsche Bank har analyseret de ekstreme stigninger i energipriserne den seneste tid. Der er en lang række faktorer, der spiller ind, men forbrugerne skal vænne sig til, at prisstigningerne kan blive værre, og der vil under alle omstændigheder fortsat være høje energipriser, selv om de måske bliver lidt mindre end i dag. Det er energipriserne, der er den vigtigste faktor bag inflationen og dermed de kommende rentestigninger. Benzin og diesel er steget med 20-25 pct. det seneste år. I år vil gas- og el-priserne formentlig stige med henholdsvis 20 og 15 pct. Den grønne omstilling bliver dyr, og i omstillingsperioden vil der være mangel på olie og gas, og det vil også sætte elektricitetspriserne i vejret. Investeringerne i en grøn økonomi bliver ekstreme, og det er forbrugerne, der må betale for det. Velkommen til den grønne fremtid. Nu begynder vi at se prisen for det, alle efterspørger. Forbrugerne skal vænne sig til et helt nyt begreb – greenflation – dvs. den inflation, som skyldes de prisstigninger, der vedrører den grønne omstilling.

Energy price inflation – this time is

different

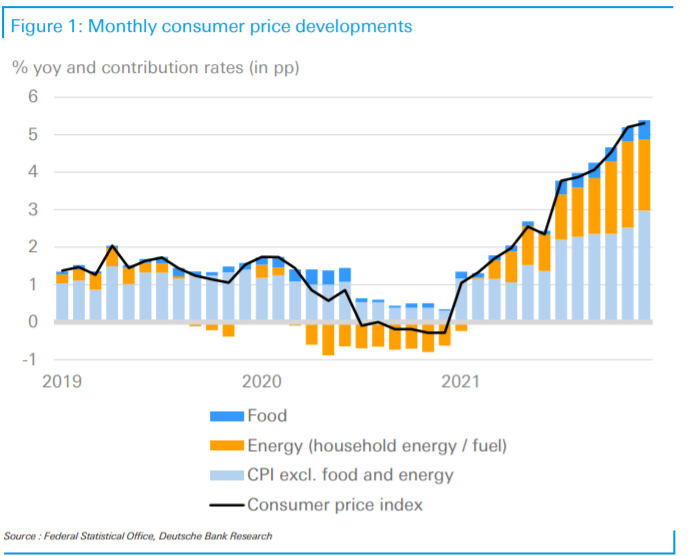

Energy prices were the main driver of consumer price inflation (CPI) in Germany in

2021. The energy price component in German CPI – comprising household energy

(electricity, gas, heating oil) as well as petrol and diesel – rose by 10.4% on average

last year, contributing more than one percentage point to the annual inflation rate

(2020: -0.5 pp).

The reasons for the sharp increase in energy prices are manifold: On

the one hand, global energy demand has increased drastically due to the

synchronised world economic recovery and higher mobility after the first corona

lockdowns in early 2020 and winter 2020/21.

On the other hand, the global energy

supply has been severely disturbed by several external shocks and market

imbalances such as extreme weather events in the US in early 2021, technical

problems at gas fields and pipelines in Europe, low filling levels for gas storage

capacity in Germany, interruptions in the global logistics sector or trade issues

between China and Australia.

What is more, climate policy measures contributed to the general price increase for

energy. In 2021, Germany introduced a new carbon levy (basically a tax) of EUR 25

per tonne of CO2 that affects heating oil, natural gas and liquid fuels. This measure

alone caused, for example, a price increase by 7.1 cent per litre of petrol and 8.0 cent

per litre diesel and heating oil, respectively, and added 0.46 cents per kWh to the

price of natural gas – a major source for heating in Germany.

The overall CO2 price effect from the country’s climate package on Germany’s 2021

inflation rate (both direct and indirect price raising effects net of any electricity price

dampening effects from the decrease in the EEG levy) were estimated to amount to

around 0.3 percentage points, according to Deutsche Bundesbank (see pages 30-

34 in the monthly report for December 2019 as well as footnote 13 on page 27 in the

monthly report for June 2020).

In 2022, the implemented increase in the carbon levy

from EUR 25 to EUR 30 per tonne of CO2 could add another 0.2 percentage points,

according to the Bundesbank. A temporary factor that has further pushed up

Germany’s inflation rate in 2021 – and hence also Germany’s CPI energy price

component – was the reintroduction of the increase in the value added tax (VAT).

The VAT effect contributed approximately more than a full percentage point to the

December 2021 inflation rate of 5.3%.

Time lag between commodity and producer prices and consumer prices

Consumer pockets are affected by higher world market prices for crude oil quite

directly at the pump. Service station operators can pass through these price

increases almost at an hourly basis. Diesel and petrol prices are currently roughly

20-25% higher than in early 2021.

Moreover, the considerable increase in Brent

crude oil prices to more than USD 85 per barrel (a seven-year high) speaks against

a fast and marked slowdown in double-digit fuel price inflation.

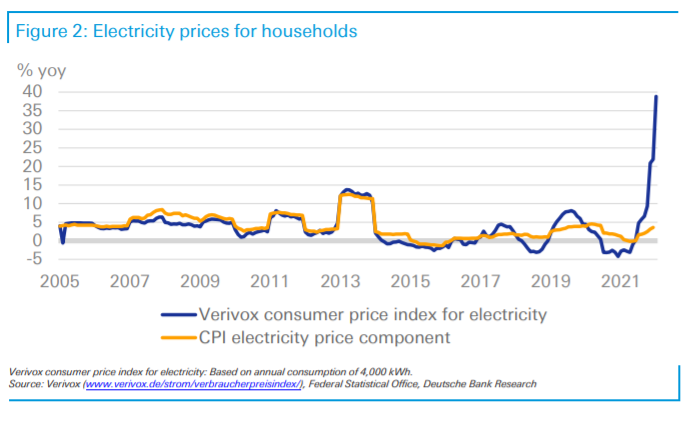

The worst is still to come

The worst is still to come for private households in terms of price increases

for natural gas and electricity. In 2022 as a whole, prices might increase by more

than 20% for gas on average and by more than 15% for electricity. In that case,

higher gas and electricity prices would substantially boost Germany’s inflation rate

in 2022.

Given their shares in the overall CPI basket (of 2.6% for electricity and 2.5%

for natural gas), such price hikes could on their own raise the headline rate by up to

1 pp (2021: 0.1 pp).

Greenflation

Structural factors are likely to keep energy price inflation high

A more ambitious climate and energy policy will very likely continue to raise

consumer price inflation over the medium term. Rising CO2 prices (via the national

carbon levy or the EU wide emissions trading system) will lead to a permanently

higher price trend for fossil fuels (oil/gas heating, fuels).

Moreover, it will affect costs

for electricity generation given that 43% of Germany’s total electricity generation

is based on coal and natural gas (data as of 2021). The share of fossil fuels in

electricity generation could even increase in 2022 since three nuclear power plants

went off the grid in late 2021. Overall, this weakens the widespread argument of

viewing energy price increases as temporary.

Thus, consumers could be confronted with climate policy-induced higher energy

price inflation (“greenflation”). This is because consumers have few alternatives

(heating, mobility, etc.) in the short run and therefore must carry rising energy costs.

In addition, the path towards a climate-friendly economy requires enormous

private and public investments in new infrastructure. These climate-related

investment goods compete for already limited production capacities (particularly

skilled labour shortages amid rapid population ageing), intensifying price pressures

in the capital goods, construction and craft sectors.

Already in 2021, construction

investment prices increased by more than 8% (as measured by the deflator for

construction investment activity in the overall German macro economy).