Deutsche Bank har lavet en omfattende analyse af risikoen for øget inflation. Den eksplosive vækst i gæld, der er finansieret af centralbankerne, ligger bag udviklingen. Ikke siden Den anden Verdenskrig er der pumpet så store beløb fra regeringernes og centralbankernes side ud i økonomien. Øget inflation er langt alvorligere, end de fleste forestiller sig, for det kan tvinge centralbankerne til abrupte rentestigninger, der kan skabe store spændinger i samfundet. Det interessante i analysen er, at Deutsche Bank mener, at en ny finansiel-økonomisk krise i høj grad er selvskabt.

Inflation: The defining macro story of

this decade

Conclusion

We worry that inflation will make a comeback. Few still remember how our societies and economies were threatened by high inflation 50 years ago. The most basic laws of economics, the ones that have stood the test of time over a millennium, have not been suspended.

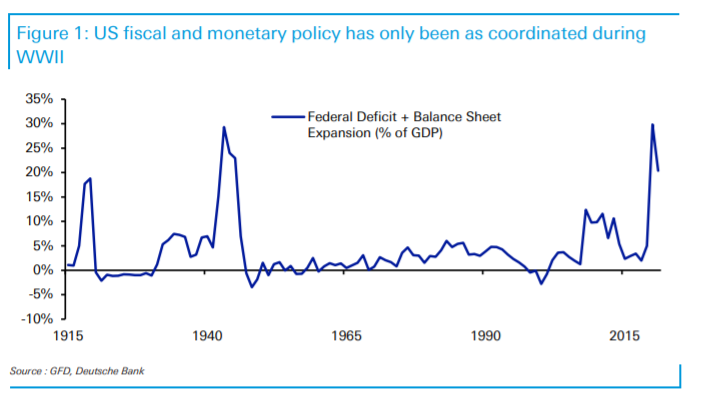

An explosive growth in debt financed largely by central banks is likely to lead to higher inflation. We worry that the painful lessons of an inflationary past are being ignored by central bankers, either because they really believe that this time is different, or they have bought into a new paradigm that

low interest rates are here to stay, or they are protecting their institutions by not trying to hold back a political steam roller.

Whatever the reason, we expect inflationary pressures to re-emerge as the Fed continues with its policy of patience and its stated belief that current pressures are largely transitory. It may take a year

longer until 2023 but inflation will re-emerge. And while it is admirable that this

patience is due to the fact that the Fed’s priorities are shifting towards social goals,

neglecting inflation leaves global economies sitting on a time bomb.

It is a scary thought that just as inflation is being deprioritised, fiscal and monetary

policy is being coordinated in ways the world has never seen. Recent stimulus has

been extraordinary and economic forecasting, which is difficult at the best of times,

is becoming harder by the day. Fractured politics amplifies the problem. Needless

to say, the range of global outcomes over the coming years is wide.

When central banks are eventually forced to act on inflation, they will find it

themselves in a difficult, if not untenable, position. They will be fighting the

increasingly-ingrained perception that high levels of debt and higher inflation are a

small price to pay for achieving progressive political, economic and social goals.

That will make it politically difficult for societies to accept higher unemployment in

the interest of fighting inflation.

Eventually, though, any social priorities that policymakers have will be set aside if

inflation returns in earnest. Rising prices will touch everyone. The effects could be

devastating, particularly for the most vulnerable in society. Sadly, when central

banks do act at this stage, they will be forced into abrupt policy change which will

only make it harder for policymakers to achieve the social goals that our societies

need.

Low, stable inflation and historically low interest rates have been the glue that have

held together macro policy for the last three decades. If, as we expect, this starts to

unravel over the next year or two, then policymakers will face the most challenging

years since the Volcker/Reagan period in the 1980s.