Deutsche Bank er sikker på én tendens: Sustainability-revolutionen er begyndt. Miljøet og klimaet vil definere vores tid, og det er især de yngre forbrugere, som står bag. De vil omsætte deres holdninger i deres indkøb, og de vil vælge brands, der svarer til deres holdninger, også selv om det bliver dyrere for dem. Det vil gavne selskaber med en stærk ESG-profil, men især inden for luksusbranchen, og det vil gavne selskaber med en stærk social virksomhedsprofil (CSG). De bliver fremtidens vindere. Det får en række virkninger for virksomhederne: De bliver nødt til at have fuld kontrol over forsyningskæden for at sikre eksklusiviteten. Men det gør det muligt for virksomhederne at tage en højere priser.

Sustainability as the ultimate luxury: how realistic?

ESG matters, and luxury brands need to walk

the talk

The sustainable revolution has begun: the environment

is the defining issue of our time, and younger

consumers are seriously concerned about it. A new

generation of consumers increasingly back their

beliefs with their shopping habits, favoring brands

that are aligned with their values and avoiding those

that aren’t.

Luxury goods companies are rushing to

shine in ESG terms by ticking all the possible boxes

from a reporting standards and an objective setting

viewpoint. While there is some true action behind

it, and tangible results to come, we sense this is

still mostly high level image building. We believe

environmental, social and governance issues (ESG)

are here to stay, and the ability to extend the efforts

further and blend newness, quality and Corporate

Social Responsibility (CSR) themes will shape the

winners of the future.

World 2.0 vs just a formal change

World 2.0 means implementing radical changes to

products, durability, production processes, distribution

and ultimately the business model with potentially

profound changes to sourcing and manufacturing,

including building circularity and deciding the level of

involvement in resale or rental.

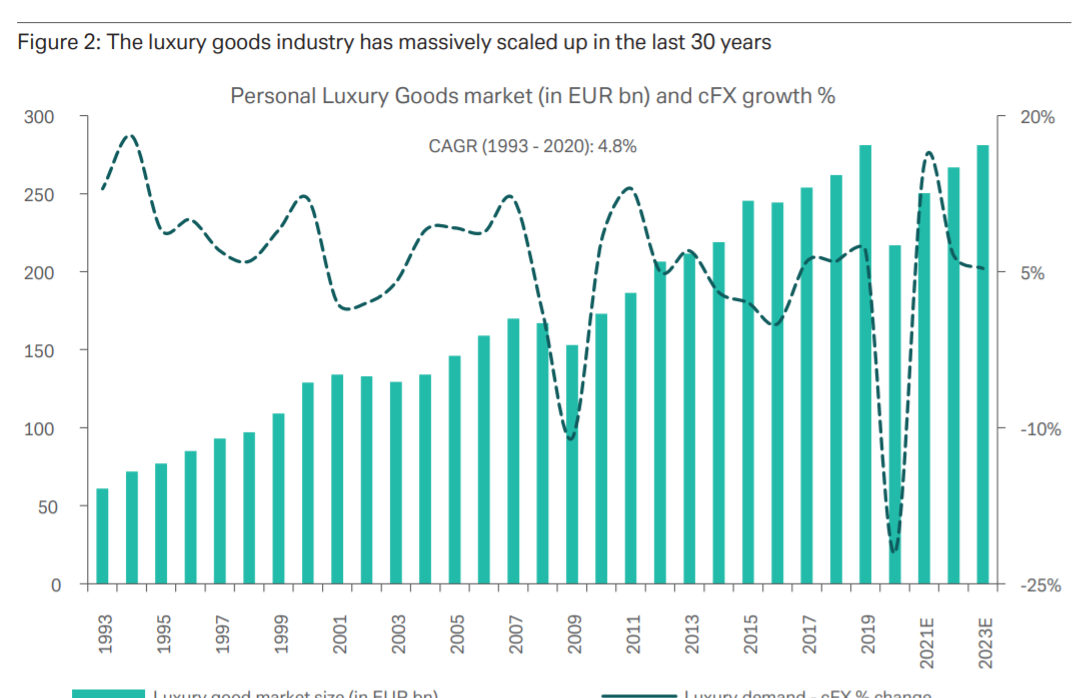

Based on two high profile brands with different business

models used as case studies, we estimate that units produced

and sold between 2000 and 2019 tripled. We believe

companies will have to produce less, avoid waste, and

make products that last forever; arguably, embracing a

tighter, supply driven distribution model.

Is a return to exclusivity the answer?

In our view, exclusivity is a good base from which to

reset the manufacturing towards a more controlled,

more qualitative supply chain with greater proximity

to the brands. Over time luxury brands have

demonstrated a willingness to increase more and

more control over the value chain. Higher control on

distribution and production would promote higher

exclusivity.

This is not only an economic advantage,

but it allows brands to have full product visibility

and traceability and to use it to promote sustainable

practices as well as differentiate the brand with

consumers. Exclusivity could also provide a lever

to further extend pricing power: we estimate

prices increased at a CAGR of ~4% from 2000 to

2020.