Første halvår har været tumultagtigt, og det smitter også af på virksomhedsovertagelser og fusioner. Deutsche Bank har analyseret markedet og forudser, at selv om der bliver et fald i M&A-aktiviteten, så ventes der et pænt antal overtagelser. Det er der flere grunde til, og en af de vigtigste er, at europæiske virksomheder har et efterslæb på det teknologiske område, og derfor vil mange selskaber styrke sig ved overtagelser eller fusioner. Også på andre områder er der en slags efterslæb, f.eks. i forsyningssikkerheden. Der er masser af kapital til rådighed. Det skaber mulighed for at udnytte de meget specielle vilkår i dette halvår til at styrke de enkelte virksomheder.

With a tumultuous first half of 2022 almost over, we are making a contrarian call for the second half.

Specifically, we believe that although M&A will slow compared with last year, it will be more resilient than the drop so far in 2022 would suggest. To support this, we have identified several post-covid themes that are motivating corporates and private capital to make acquisitions.

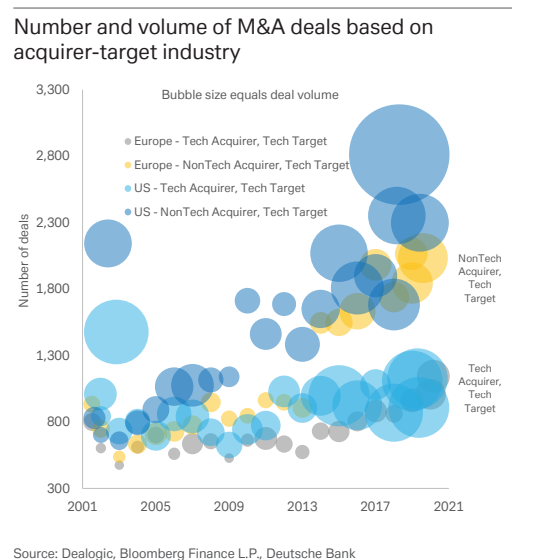

One of the biggest themes is the “tech catch-up”. This is where non-tech companies are acquiring tech firms, and it comes as many companies found during covid that their digital infrastructure lagged their peers.

Buying it now can be easier and more reliable thanbuilding it in-house. Similarly, acquisitions are being closely linked to supply chains. With onshoring and near-shoring becoming more necessary for operational and political reasons, vertical integration is more attractive.

Even as economic conditions worsen, divestments have held up relatively well. We expect this trend to continue as it can streamline businesses, improve earnings, and provide funds for share buybacks.

Following on from this, companies have been given new impetus to show they can thrive in a high inflation, lower growth world. M&A is one way to supplement stuttering organic growth.

Motivation for M&A is one thing. Available capital is another. The good news is that there is plenty of

capital ready to do deals. Corporates currently have strong balance sheets and robust margins. Financial sponsors are in good shape, too, and have record levels of dry powder seeking deals. Where finance is needed, the cost is clearly increasing but is still historically cheap whilst real yields are very attractive.

Finally, a slowing economy in the US, Europe, and China will certainly dent aggregate M&A. Yet, at the same time many opportunities have opened up during the market sell-off this year.