ECB har lempet lånemulighederne for de europæiske banker, men ellers lagde ECB i går ikke op til ny kapitaludpumpning. ECB understregede krisens alvor og den betydelige usikkerhed, der er over krisens effekt. ECB venter, at minusvæksten for i år bliver på mellem 5 og 12 pct. Den værste periode bliver 2. kvartal.

Uddrag fra Nordea:

ECB Watch: Money machine with European characteristics

ECB emphasised its readiness to act and concentrated on supporting banks’ role in corona crisis. The decisions add downward pressure on especially short money market rates, but do not solve Italy’s problems.

The ECB meeting in a nutshell:

- The ECB decided about the new PELTRO liquidity operations to banks and also made the TLTRO III operations even more favourable to the banks.

- The important role of liquidity operations can be justified by the large role banks play in the Euro area but their positive impact on the Euro-area recovery also stems from the fact that they will also boost banks’ profitability and facilitate financing to the governments.

- The size or scope of the PEPP was not increased which may have been due to the forthcoming decision by the German constitutional court.

- The ECB foresees the GDP to decline 5-12% in 2020, scenarios will be published tomorrow.

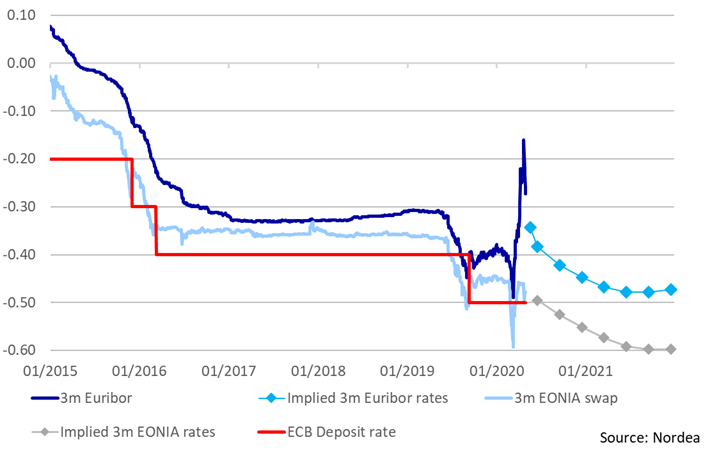

- The ECB’s decisions add downward pressure on market interest rates, even if the benchmark rates were not cut.

As the most likely next step, the ECB could extend or expand the PEPP

The ECB announced new tools to guarantee a sufficient capacity in the banking system to boost lending in the Euro area. The Governing Council decided about a new liquidity tool (PELTROs) and improved also conditions for the existing TLTRO III as the main response at this stage to the corona crisis (read more about the decisions here).

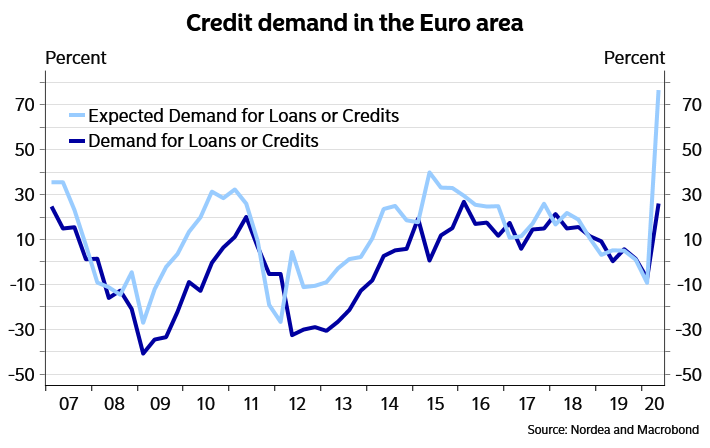

As a result of these measures, banks’ funding will be extremely affordable in the coming months, at least until summer 2021. In the press conference, Lagarde emphasised that the purpose of the liquidity programmes is to provide enough capacity to the banks to lend money to companies and households. The recent bank lending survey showed a clear increase in demand for credit among companies and that has probably been one argument for the measures.

Obviously, the central role of the banks in financing the real sector compared to e.g. the US also speaks in favour of putting the emphasis on banks. However, it is also evident that with cheap financing, it becomes very profitable for banks to buy for example short-term government papers. Thus, on top of providing financing to the real sector, the liquidity operations – together with the ECB’s asset purchase programmes – can also play a role when it comes to financing the widening government deficits and bank profitability. Thus, given the risk stemming from the German court next week (read analysis here), the liquidity operations may also be a way to circumvent some of the criticism that the purchase programmes tend to raise in Europe.

Talking about the asset purchase programmes, there were expectations prior to the meeting that the ECB could expand the PEPP to cover also junk bonds in line with last week’s decision on the collateral rules. However, the ECB did not widen the scope or the size of the PEPP at this meeting.

Lagarde’s comments were rather vague also when she was asked about the possibility of using the OMT tool in the corona crisis. The same applied to her replies on the possibility of introducing yield curve control or the decision to provide cheap financing via liquidity operations rather than taking the MRO lower.

Lagarde emphasised the size of the shock and the important role that the ECB will play in the crisis. She wanted to convince the audience that the central bank is there to help in alleviating the negative effects of the corona crisis.

According to new ECB growth scenarios, the Euro-area GDP could contract 5-12% in 2020. The impact on e.g. the labour market has already been dramatic in many Euro-area countries and hard data released this morning showed the extent to which the lockdowns have knocked out the Euro-area economy already in the first quarter (read our comment here).

In the ECB’s worst case scenario, a fall by 15% on a quarterly basis is expected in Q2. As for the speed and extent of the recovery beyond the second quarter, Lagarde commented that we “do not have clarity”.

Credit demand has risen

Not enough for Italy

The initial market reaction to the ECB decision was rather muted, but the Italian bond market clearly welcomed the news with yields falling initially. Unfortunately for Italy, the more positive mood did not last, as Lagarde’s performance at the press conference did not impress. Italian yields shot higher again amidst the press conference, while German bond yields, the euro and equity prices all fell.