ECB sendte i går stærke signaler om en ny hjælpepakke i december – som en konsekvens af, at den økonomiske genopretning er blevet stærkt svækket. ECB-præsidenten Lagarde sagde i går, at ECB er parat til at bruge flere instrumenter. Nordea forventer, at ECB fortsætter med opkøbsprogrammet PEPP – med yderligere 500 milliarder euro. Det er også muligt, at renten vil falde yderligere, og ECB vil måske gøre en indsats for at bremse euroens stigning.

ECB Watch: The devil is in the December details

The ECB sent strong signals that another easing package would be in store in December, as the economic outlook had darkened notably. The ECB’s stance leaves some more room for bond yields and EUR/USD to fall further.

- Strong easing signals already in the statement

- December easing will be in the form another package

- We expect a bigger and longer-lasting PEPP, more TLTROs and easier TLTRO terms, but not a deposit rate cut

- A faster pace of purchases looks likely already before December

- The ECB’s message leaves some more room for bond yields and EUR/USD to fall and spreads to narrow

The ECB left no room for guessing and signalled exceptionally already in the statement that more easing will be in store. With such an approach, the central bank minimized the risks of Lagarde’s press conference giving a mixed picture of the ECB’s intentions, which has sometimes been the case in past ECB meetings, though not today.

In the current environment of risks clearly tilted to the downside, the Governing Council will carefully assess the incoming information, including the dynamics of the pandemic, prospects for a rollout of vaccines and developments in the exchange rate.

The new round of Eurosystem staff macroeconomic projections in December will allow a thorough reassessment of the economic outlook and the balance of risks. On the basis of this updated assessment, the Governing Council will recalibrate its instruments, as appropriate.

In the press conference, Lagarde said that the economic recovery had lost momentum, and clarified the various ECB committees were already at work to investigate the easing potential the ECB’s different instruments. She added that it will be a mix of instruments that are considered, in other words another easing package should be expected.

We continue to expect another easing package at the December meeting, consisting of a EUR 500bn expansion in the Pandemic Emergency Purchase Programme (PEPP), further prolonging the horizon of that programme, the announcement of more Targeted Longer-Term Refinancing Operations (TLTROs) and easier terms on the TLTROs.

In addition, the ECB will probably come up with a few surprising details, as has often been the case in the past. Given the recent developments in terms of weak inflation and more economic restrictions due to Covid-19, risks are tilted towards an even bigger easing package.

In the meantime, Lagarde emphasized that all the flexibility of the PEPP would be used, in terms of the pace of purchases, deviations from the capital key and the distribution among asset classes.

The recent pace of weekly PEPP purchases has been only around half of what was seen at best in the spring, while more than half of the EUR 1350bn PEPP envelope remains available, so no new Governing Council decisions are needed to increase the pace of purchases.

FX rate mentioned, but recent developments not hugely concerning

Enough to keep financing conditions in check

While not hugely surprising, the ECB’s signals of further easing in December were probably strong enough to prevent a tightening in financing conditions. In fact, the market reaction was slightly dovish, even if no huge market moves were seen in response to the ECB.

Given the current negative momentum of the Euro-area economy and the ECB’s signals that the more the outlook deteriorates, the more it will do in December, Euro-area bonds could rally somewhat further despite the already low yield levels.

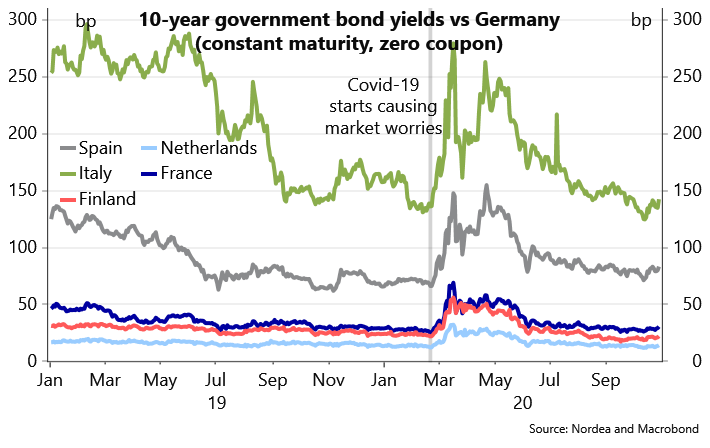

This would turn into lower core yields, somewhat flatter curves and narrower spreads. The fact that intra-Euro-area bond spreads have resisted widening pressure rather well despite bad economic news and more bond issuance suggests the ECB remains in control.

In the short end of the curve, the market prices in more than 10bp lower rates until next autumn, implying another 10bp deposit rate cut is in prices.

We do not expect the ECB to cut the deposit rate further, as the Governing Council has not shown appetite for further rate cuts lately and has focused on other forms of easing. A further cut in the TLTRO rate looks more likely.

Nevertheless, another deposit rate cut cannot be fully excluded, if the investigations ongoing in the ECB committees resulted in a recommendation of another rate cut and the EUR strengthened ahead of the ECB meeting. The tiering multiplier could also be increased in December.

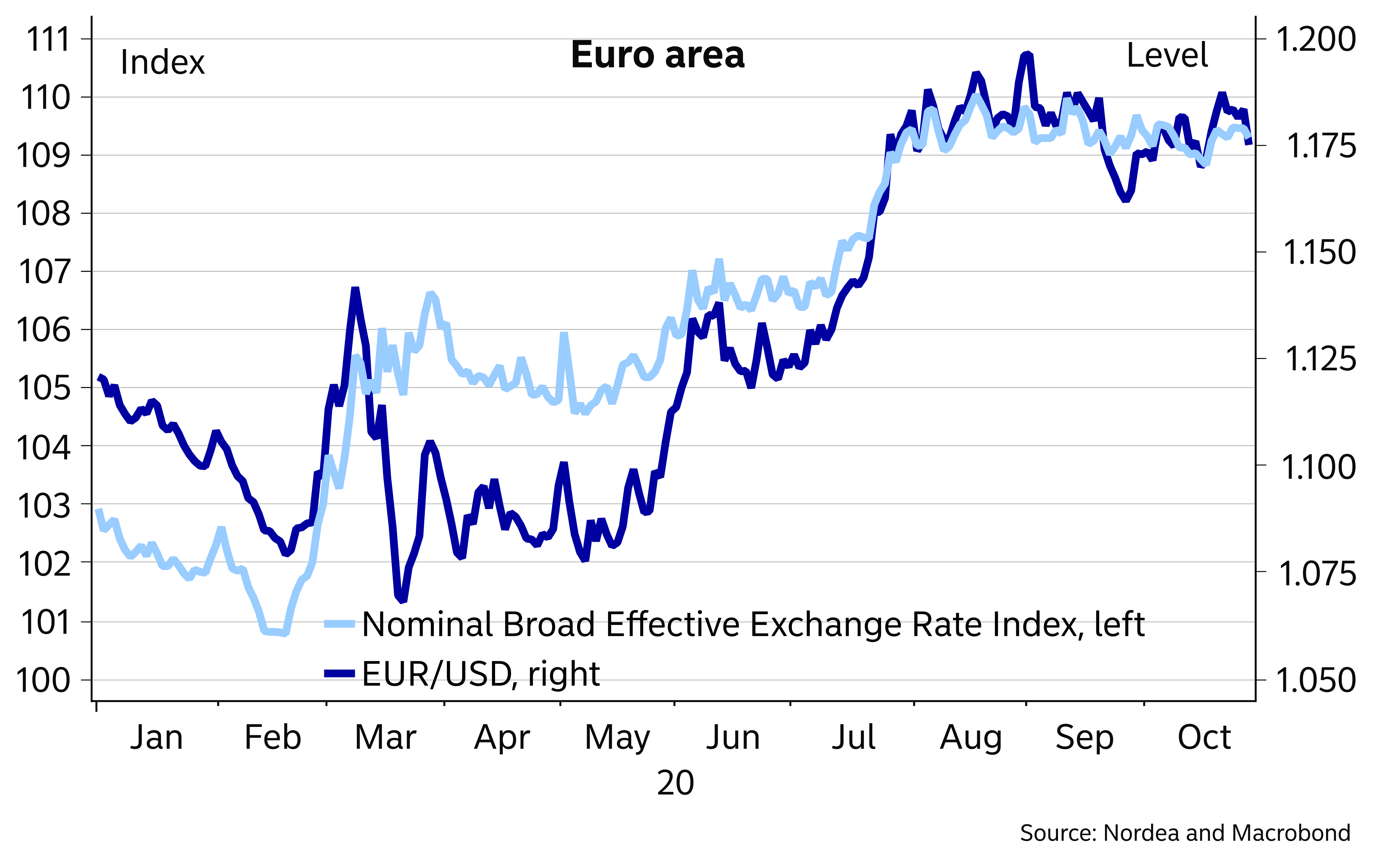

On the FX front, the ECB has now confirmed it would fight a rapid strengthening of the EUR and together with the negative Euro-area economic momentum such a message should help to keep EUR/USD heading lower in the near term.