Nordea analyserer den seneste rapport fra ECB-mødet i oktober og hæfter sig ved, at ECB indikerer, at dets støtteprogram kan blive forlænget til udgangen af 2021, fordi corona-krisen bliver langvarig trods nye vacciner. Men Nordea hæfter sig også ved, at ECB understreger, at pengepolitikken ikke i sig selv kan løse corona-krisen. Det er nødvndigt med flere finanspolitiske initiativer. Regeringerne må til fadet.

ECB Watch: Reinforcing fiscal and monetary policies

The ECB monetary policy account set the thresholds for further easing and those thresholds will be met. We expect new easing to concentrate on the PEPP and TLTROs, but the pace of bond buying is unlikely to be increased.

- Recent information supports the case for more easing at the ECB December meeting.

- We expect new easing to concentrate on the PEPP and TLTROs.

- Longer-lasting bond purchases more likely than an increase in the pace of purchases.

- Winter months will be challenging despite a vaccine on the horizon.

- In this environment, monetary policy is effective only together with easy fiscal policies.

The ECB monetary policy account from the meeting of 28-29 October confirmed that given the sharper slowdown in growth momentum and the weakening of underlying inflation dynamics compared with what had previously been expected, as well as the deterioration in the balance of risks, it would be warranted to recalibrate the monetary policy instruments in December.

By the time of the December meeting, the ECB would have sufficient information to enable the calibration of its instruments, more specifically more information would be available on

- major geopolitical developments such as the result of the US presidential election and Brexit

- Effectiveness of the new restrictions and their impact on the economy

- fiscal response in the Euro area, with further indications on the prospective use of NGEU funds

- updated staff projections, including a clearer picture of the dynamics of the pandemic and prospects of a vaccine.

On the first point, the larger market moves in connection with the US presidential election have calmed down, though a major fiscal stimulus package seems to be off the table for now. Brexit negotiations are proceeding but have not yielded a trade deal, so uncertainty prevails.

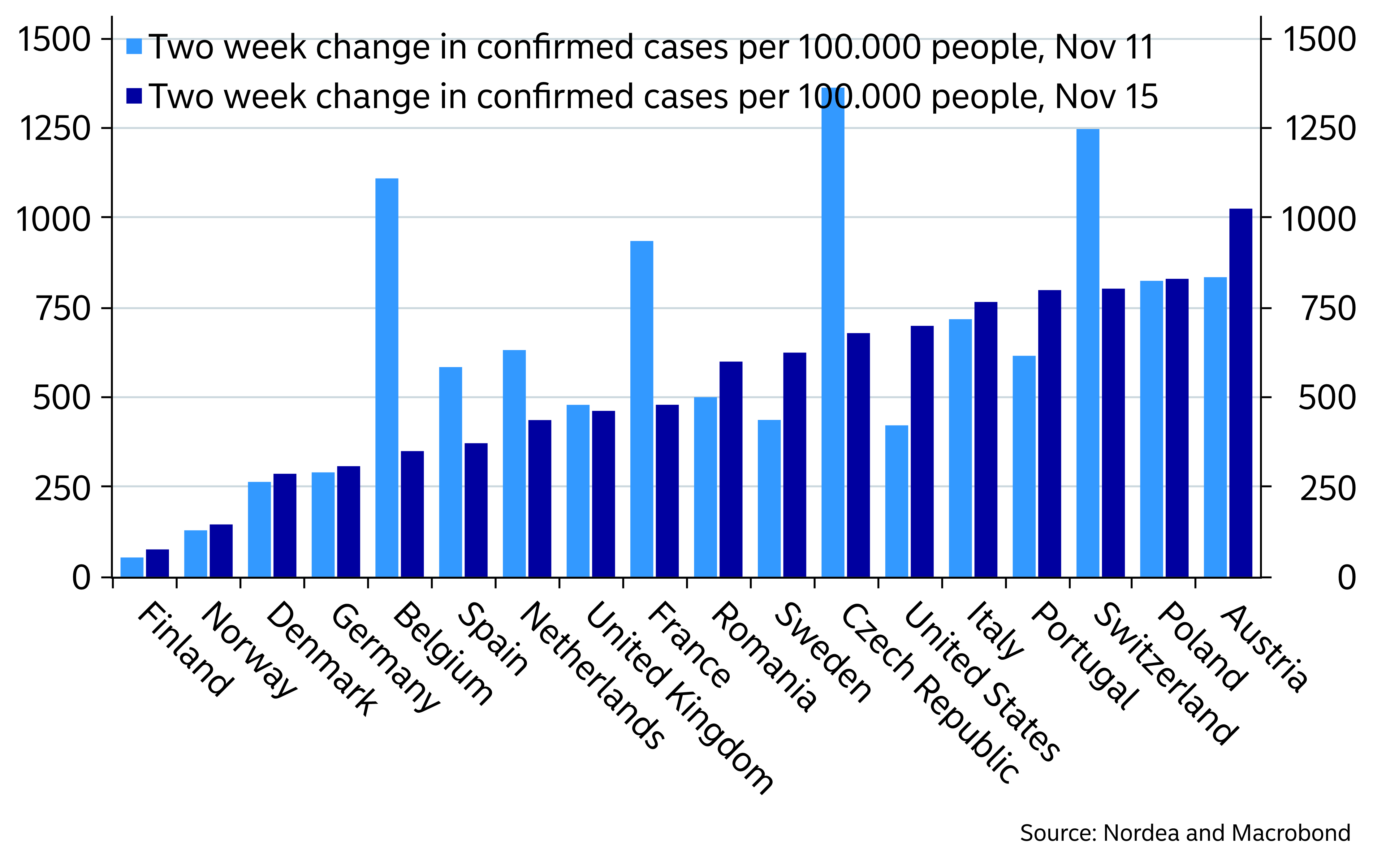

New economic restrictions have proved effective in stemming the number of new Covid-19 cases, but have hit the Euro-area economy significantly, as illustrated by the recent plunge in the services PMI.

On the third point, with Poland and Hungary blocking the NGEU for now, at the very least the common EU funds will be delayed, but more measures look likely on the national level. On the last point, news on the vaccine have been better than expected, even if many uncertainties remain.

Overall, the incoming information should support further easing measures at the December meeting. The uncertainty remains high, however, and the Euro-area economic outlook was seen to depend crucially on the effectiveness of administrative measures and the infection dynamics of the pandemic, with the magnitude and duration of a further downturn being very uncertain.

Looking ahead, the winter months would be challenging in terms of limiting the spread of the virus and a sequence of temporary “circuit breaker” lockdowns might prove to be necessary. As a result, the growth trajectory could be bumpier than previously projected.

At the same time, it was recalled that the economy had rebounded very strongly after the lockdowns in the first wave of the pandemic and that a similar dynamic recovery might be expected in the future. Further, it would be important to consider the possibility that the pandemic might have longer-lasting effects both on the demand side and on the supply side, reducing potential growth.

Recent signals from Governing Council members strongly suggest that the December easing measures will concentrate on the Pandemic Emergency Purchase Programme (PEPP) and the Targeted Longer-Term Refinancing Operations (TLTRO).

Lagarde has further emphasized the importance of the duration of the easing measures, implying the intensity of the easing (pace of bond purchases) may not increase but the easing measures will remain in place for even longer (PEPP horizon extended until the end of 2021 and more TLTROs are in store).

We expect at least a EUR 500bn expansion of the PEPP envelope and new TLTROs with easier terms to be unveiled at the December meeting.

Such an approach was also supported by the account to some extent. It pointed out that the relatively muted reaction of markets to the second wave of the pandemic was seen as evidence of the effectiveness of the ECB’s monetary policy measures in containing tail risks. In other words, the ECB thought that the current approach was working so could easily be used for a longer time.

However, while the existing monetary policy instruments were viewed as effective, questions were raised about possible non-linearities, side effects and “diminishing returns” in an environment of high uncertainty and very favourable financial conditions. The ECB may thus be reluctant to increase the pace of its asset purchases, unless financing conditions start to tighten.

ECB aiming to keep financing conditions easy

Strict economic restrictions helped to turn the tide in new Covid-19 infections in many European countries

Monetary and fiscal policy working together

The ECB emphasized many times the importance of fiscal policies, implicitly admitting that in the current circumstances, monetary policy alone would not prove hugely effective.

The account stated that in the present environment, monetary policy in part operated by facilitating fiscal expansion through keeping financing costs affordable, and both policy domains were working “hand in hand”. There was also a warning that an accommodative monetary policy stance could create the temptation for governments to enter into commitments that were difficult to undo and thereby increase expenditure beyond what was necessary to deal with the pandemic, exacerbating structural deficits and damaging the long-term sustainability of public finances.

However, for now fiscal easing was needed and there was broad agreement among members to emphasise that an ambitious and coordinated fiscal stance remained critical and was the most effective policy in the current situation to deal with the effects of the pandemic and the associated containment measures. In this way fiscal and monetary policy reinforced each other in the current circumstances, with monetary policy increasing its own effectiveness by empowering fiscal policy and fostering confidence.