Uddrag fra marketear, Bloomberg, Data Trek, UBS og JPM

Certainly uncertain

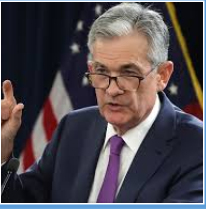

Here is a collection of the best comments on Powell and the put.

“Federal Reserve Chair Jerome Powell used the word “uncertainty” 16 times in his press conference today. We sympathize. At the outset, it’s impossible to know what tariffs will be imposed by the US on April 2., on which countries, and for how long. When the specifics are revealed, it will still be difficult to forecast their impact on economic growth and inflation in the US and around the world. Another known unknown is the response of America’s trading partners to reciprocal tariffs. Will they lead to negotiated reciprocal reductions in tariffs or to escalating retaliatory tariffs?” (Yardeni)

Highly uncertain

“We have left unchanged our forecast of two cuts this year in June and December and one more in 2026. But the timing of potential cuts is highly uncertain, and we would characterize our forecast at the moment as more of an expected value of a range of possible outcomes (as opposed to a modal outcome that we feel strongly about) than it normally is.” (GS)

The first signs of a “Fed put”

“Markets took today’s SEP and Powell’s comments as signaling a greater chance of several Fed rate cuts later this year, perhaps even one more than the Fed itself expects. Some are calling this the first signs of a “Fed put”, where the central bank steps in to stabilize financial asset prices. We would disagree with that assessment and continue to believe the “put” comes into play when the VIX hits 36, as it did in December 2018.” (Data Trek)

Source: Data Trek

Dare anyone say Fed put?

UBS summarized the message:

“A Glimpse Of The Fed Put In The Messaging Perhaps” adding “Dare anyone say “Fed put”. Perhaps not quite, but the Fed’s message is consistent with its work from September 2018 – that reacting to the inflationary consequences of tariffs only makes the growth hit worse than it needs be. Not quite the “Fed put” the markets have been hoping for, but in the scheme of things, the outcome of the Fed is a little more dovish than the market had expected. The Fed shrugging off the inflationary signals from its models and instead preferring to line the dot plot up with the growth deterioration.” (UBS)

The Trump bump thump put

Trump channeling his inner Corleone and is ‘leaning on’ saying the Fed “would be much better off” to start cutting rates.

Source: X

Talk the talk

The mention of Fed put in news-stories had spiked in March going into Wednesday.

Source: Bloomberg

The Trump put and Fed put is not what we thought

“The Federal Reserve’s first set of projections since Donald Trump’s inauguration underscored—in the central bank’s understated and technocratic fashion—just how much the president’s plans to press ahead with widespread tariffs have turned the economic outlook on its head. Months ago, policymakers presumed they would spend 2025 gradually cutting rates to keep inflation heading down without a big rise in joblessness to achieve the so-called soft landing. The latest projections point to the prospect that tariffs covering a swath of goods and materials will send up prices while sapping investment, sentiment and growth, at least in the short run.” (Nick Timiraos, WSJ)

Somewhat dovish

Somewhat dovish means somewhat small inklings of indications of a Fed put…maybe

“We saw Chair Powell’s comments as somewhat dovish in two respects. First, he appeared quite comfortable with the median projection of two rate cuts in the dot plot, even though it arguably fits a bit awkwardly with the new economic projections. Second, he downplayed the sharp increase in Michigan inflation expectations, noted that other measures have been more stable, and said that the baseline is that tariffs will only delay further progress on inflation until 2026.” (GS)

Can afford to do nothing

“My takeaway from today is that the Fed can afford to do nothing so they will. They’ll kick the can and continue with ‘patience’. Powell seems to be strong-minded that the economy is healthy (its just sentiment that is negative) and he can stand on that for now given the robustness of data and our strong starting point, so despite the GDP adjustment in SEPs, things are ‘good’, and the Fed will cut when things are ‘not good’ & that’s why we’re rallying / steepening, because things are good enough to do nothing and hard data strong, but the Fed won’t be behind when they have to cut.” (Rates strategist, JPM)

Expected inflation has only modestly ticked higher

“The upshot here is that expected inflation has only modestly ticked higher since last November’s US general election (+0.13 points, to 2.5 percent). Moreover, inflation expectations are nowhere near their 3.6 percent high in March 2022, just as the Fed embarked on its much-needed rate hiking cycle to show that they were taking the problem of higher prices seriously. ”

Source: Data Trek

Searching for a signal

“On balance, we interpreted Powell’s comments as leaning somewhat dovish, in contrast to the shift in the dots. Our long-standing view for the Fed expects the policy rate to remain on hold this year. However, a realization of downside risks to the economy, in the absence of a material increase in inflation expectations, could require the Fed to reduce rates in 2025. Like the Fed, we hope to get a better sense of the details around policies before deciding whether an adjustment is needed. The data and financial markets might not allow us (or the Fed) to be so patient.” (Deutsche Bank)