Uddrag fra Zerohedge:

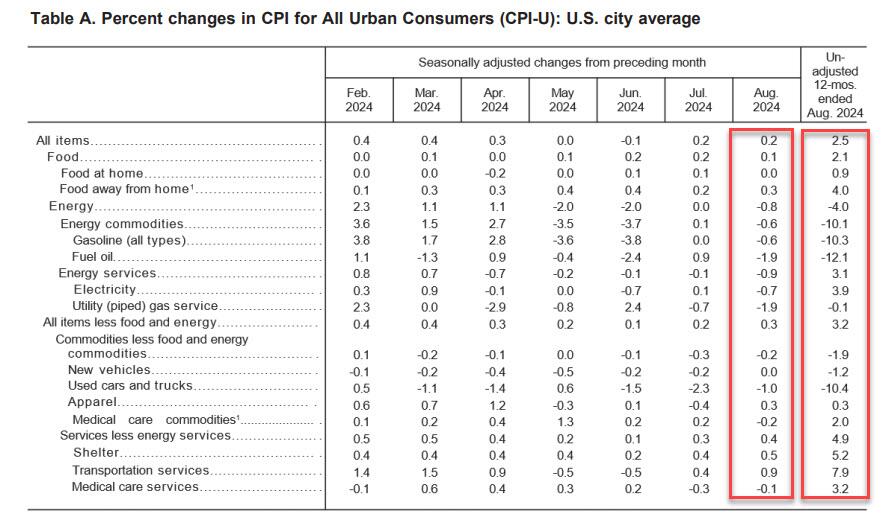

ollowing last month’s modest miss in CPI which sparked speculation about a 50bps cut, which was then boosted by the jobs report miss and the huge downward revision, moments ago the BLS reported that – as only a handful of Wall Street strategists warned – CPI actually came in hotter than expected at the core level, rising 0.3% MoM vs expectations of a 0.2% print, with all remaining metrics coming in line, to wit:

- CPI 0.2% MoM (or 0.187% unrounded), Exp. 0.2% – in line

- CPI Core 0.3% MoM (or 0.281% unrounded), Exp. 0.2% – hotter than expected

- CPI 2.5% YoY, Exp. 2.5% – in line

- CPI Core 3.2% YoY, Exp. 3.2% – in line

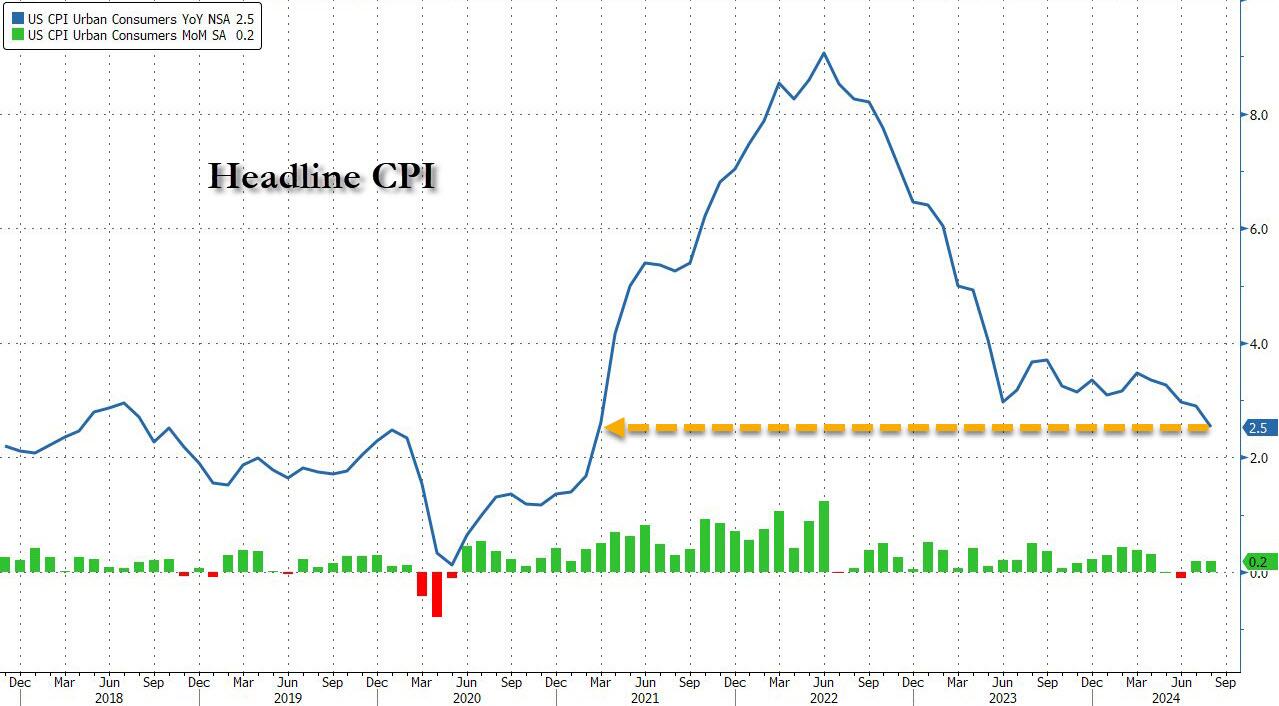

And visually, here is the headline print, where the annual CPI increase dropped to just 2.5% from 2.9%, the lowest since February 2021…

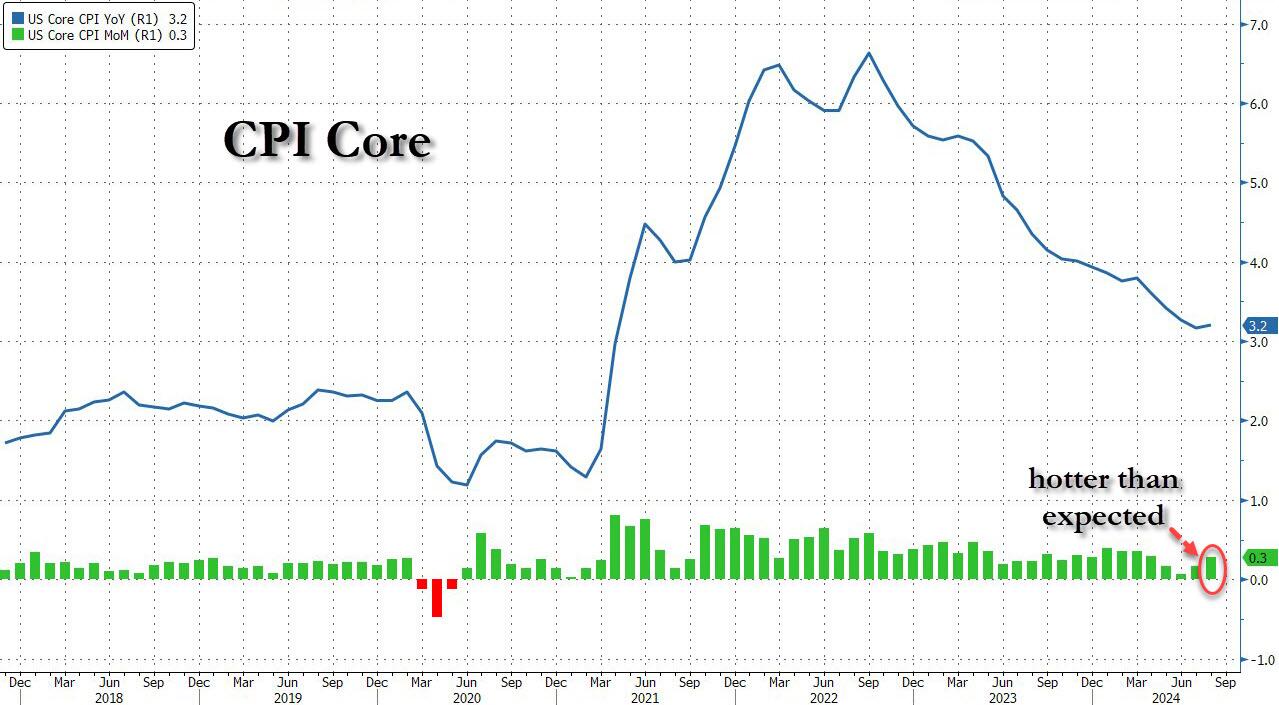

… and the core….

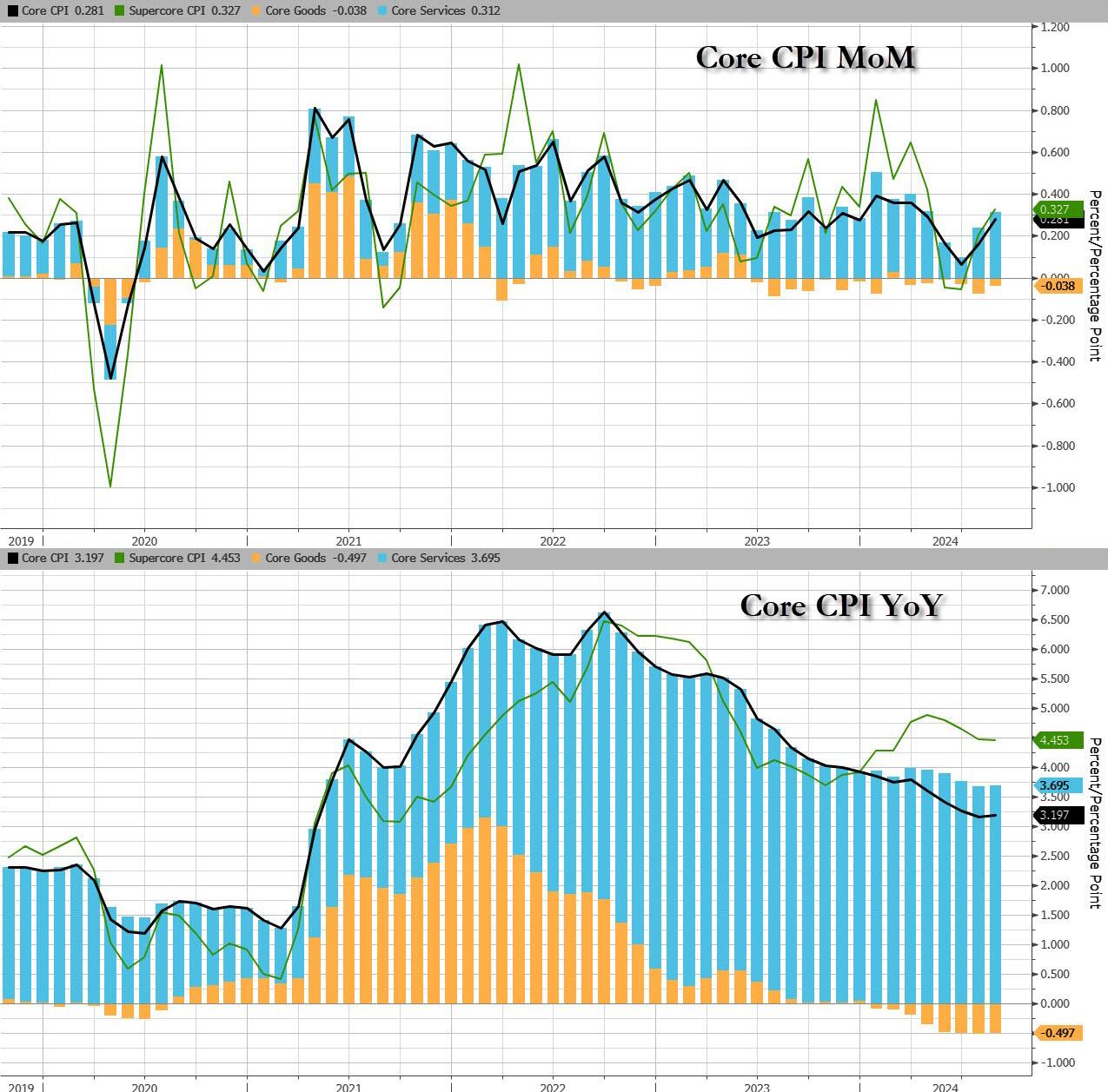

…. as goods deflation is stalling and may even print positive in the coming months, while core service inflation remains the biggest driver.

That was s the 51st straight month of MoM increases in Core CPI, and a new record high.

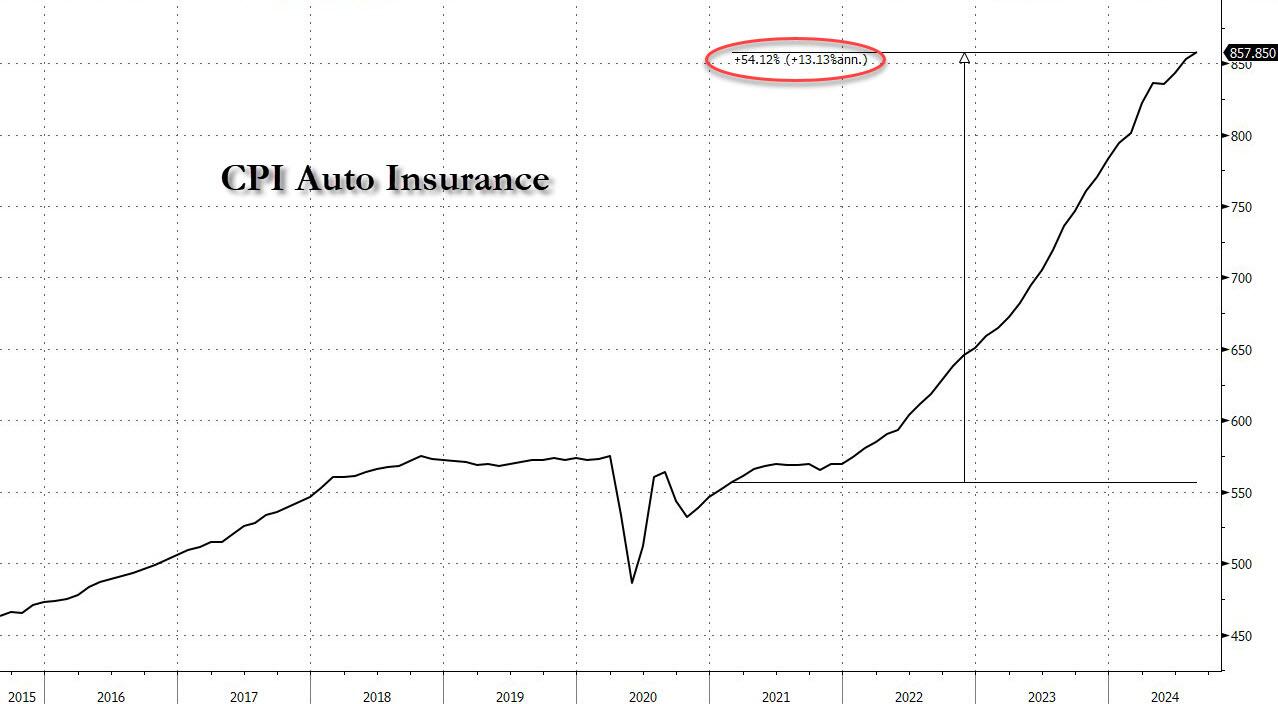

Under the hood, used car prices fell 1.0%, moderating from last month’s 2.3% drop, while airline fares jumped 3.9%, a big reversal to last month’s bizarre -1.2% drop and a reversal to drops in each of the past 5 months. Car insurance costs jumped another 0.6%, after rising 1.2%; furniture prices dropped 0.3% reversing last month’s 0.3% rise.

Here is a more detailed breakdown:

Food:

The food index increased 0.1 percent in August, after rising 0.2 percent in each of the previous 2 months. The index for food at home was unchanged in August. Two of the six major grocery store food group indexes increased over the month while the other four indexes declined in August.

- The index for meats, poultry, fish, and eggs rose 0.8 percent in August as the index for eggs increased 4.8 percent.

- The dairy and related products index increased 0.5 percent over the month.

- The nonalcoholic beverages index fell 0.7 percent in August, after rising 0.5 percent in July.

- The index for other food at home decreased 0.3 percent over the month, the index for fruits and vegetables declined 0.2 percent, and the index for cereals and bakery products fell 0.1 percent in August

- The food away from home index rose 0.3 percent in August, after rising 0.2 percent in July.

- The index for limited service meals rose 0.3 percent and the index for full service meals increased 0.2 percent over the month

Energy

The energy index decreased 0.8 percent in August, after being unchanged in July.

- The gasoline index fell 0.6 percent over the month.

- The electricity index decreased 0.7 percent over the month and the natural gas index fell 1.9 percent in August.

All items ex good and energy

- The shelter index increased 0.5 percent in August:

- The index for owners’ equivalent rent rose 0.5 percent over the month and the index for rent increased 0.4 percent.

- The lodging away from home index rose 1.8 percent in August, after rising 0.2 percent in July.

- The airline fares index rose 3.9 percent in August, after declining in each of the previous 5 months.

- The index for motor vehicle insurance increased 0.6 percent over the month.

- The indexes for education and apparel also increased in August.

- The index for used cars and trucks fell 1.0 percent in August, following a 2.3-percent decrease in July.

- The index for new vehicles was unchanged over the month.

- Over the month, the household furnishings and operations index fell 0.3 percent.

- The medical care index fell 0.1 percent in August, after falling 0.2 percent in July.

- The communication index decreased 0.1 percent in August, as did the recreation index and the personal care index.

Visually: