Fra Zerohedge:

Whether you’re shaking your fist like an old man with kids on his lawn, or a true believer in Non-Fungible Tokens (NFTs) looking to make millions, there’s a booming ‘virtual reality’ real-estate market where people are buying and selling parcels of ‘land’ across several online “metaverses” – where people are building virtual hotels, stores, and other properties in the hopes of increasing their value.

And if you’re an accredited investor willing to drop at least $25,000 – and you’re invited – there’s a fund for those who want to get in on the NFT real estate market.

Bloomberg unpacks:

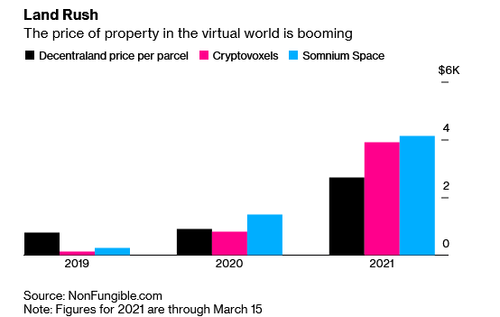

Plots sell daily in online worlds such as Decentraland, a virtual place with its own economy, currency and social events calendar, accessible to anyone with a web browser. And values for such assets are multiplying.

This year through March 15, the average price paid per parcel in Decentraland was $2,703 — more than triple what it was in 2020, according to NonFungible.com, which tracks the sales. Land prices quadrupled in the metaverse called Cryptovoxels, from $821 a parcel last year to $3,895 in the first two and half months of 2021.

Republic, meanwhile, has purchased over 30 parcels across four metaverses, and is in talks with a real-world hospitality brand to co-develop a hotel and bar on one of those sites. We assume you have to mix your own drinks. According to Yorio, the lodging firm would collaborate on the virtual hotel design – paying Republic to develop it. The goal is to become a well-regarded watering hole, which then draws other retailers and developers to snap up nearby parcels.

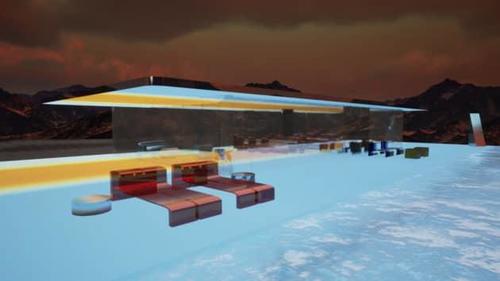

We assure you, this is real. This week, contemporary artist Krista Kim recently sold an NFT-minted digital house, called “Mars House,” for 288 ether – valued at more than $500,000 based on Friday’s trading price.

“Right now, a lot of the [NFT] art that’s currently available on platforms, it’s a very limited parameter of how you can present the art,” said Kim in a Wednesday CNBC interview. “It’s presented, basically, as a digital file, a beautiful drawing or video on your screen, but my intention was to look beyond that.”

“For me, I actually foresee that we will be living in an augmented reality lifestyle within a very short period,” Kim added, saying it could happen in “a couple years.”

The new owner of Mars House will be able to upload the property to various metaverses.

In February, meanwhile, eight lots of virtual real estate sold for a combined $1.5 million on gaming platform Axie Infinity, according to NonFungible.

“There is obviously some fear-of-missing-out phenomenon behind this,” says NonFungible COO, Gauther Zuppinger, in an email to Bloomberg. “The best, rarest places are almost all purchased. The secondary market shows that the first buyers sell their assets for way more than the initial price.”

Each land parcel is a non-fungible token, or NFT — a unique asset that can’t be forged or replicated, just like physical land in the real world.

The value of online real estate rises as more people buy digital art or other collectibles and need a place to showcase them, according to Zuppinger. Many artists and designers also are turning to the virtual world to host what they create, as consumers spend more time there, Yorio said.

And now, there’s a functional market in which prices have more than quadrupled in a matter of months for well-trafficked space.

“Buying land today in virtual worlds may end up feeling a lot like buying land in Manhattan in the 1750s,” says Yorio. “There is massive growth ahead, and now is the time to get in on the ground floor.”

Now might be a great time to read Neuromancer, Ghost in the Shell or watch Lawnmower Man if you’re uninitiated, as it seems we may be headed in that direction.