Tyske investorer har hidtil været tilbageholdende med passive investeringer, men nu kommer der en mangedobling af de robot-drevne investeringer fra 4 til 25-35 mia. euro om bare fem år, og det er mere mænd end kvinder, der driver udviklingen.

Uddrag fra Deutsche Bank:

German robo-advisors

March of the machines driving passive

investments

Germans are not famous for their direct investment in capital markets. They

keep a large share of their savings in deposit accounts and invest in capital markets mostly indirectly via retail fund holdings.

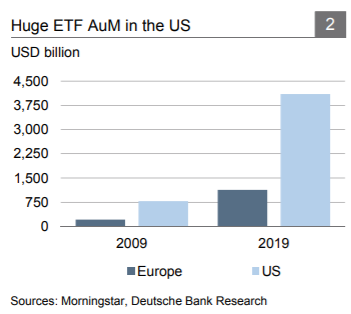

To date, Germans have also shown relatively little interest in passive investment

alternatives. Retail clients hold EUR 633 bn in mutual funds, but only a small

EUR 30-35 bn in ETFs. Due to traditional financial advisory services and payas-you-go public pension plans in Germany, ETFs were not able to replace

more of the costlier and less liquid open-ended funds.

Robo-advisors, which primarily invest in ETFs, have seen the number of their

clients and AuM grow in Germany. If the current market dynamics broadly continue, robos could manage about EUR 25-35 bn in 2025, up from EUR 4 bn today. This may drive up retail clients’ ETF holdings.

The pioneer robo-clients are largely male and middle-aged. On average, their

income is three times that of an average bank client. They value full control and

autonomy in their financial decisions and deal with financial matters mostly

online. Still, they visit bank branches quite frequently.

In the 1990s, index funds took on a new dimension with the introduction of exchangetraded funds (ETFs). ETFs trade on public exchanges rather than via a middle man (i.e., a fund management company). They are therefore much more liquid and also cheaper than

traditional index funds.