Deutsche Bank har lavet en kritisk analyse af EU’s bugetforhandlinger, hvor nogle få strammer-nationer modsætter sig en større satsning på investeringer i fremtidens erhverv. Det er en bekymrende udvikling, mener banken.

Uddrag fra Deutsche Bank:

Last week’s special Council meeting on the next EU budget 2021-2027 ended without an agreement. When EU leaders left Brussels on Friday after close to 30 hours of negotiations, there was no timeline set for further talks. In our view, it would have been a surprise if the meeting had led to a big breakthrough, given the traditionally contested nature of negotiations between net contributors and recipients of the seven-year budget. This time, the situation is much more complicated, as Brexit leaves a sizeable gap of around EUR 60-75bn in the ~EUR 1tr budget.

Compared to national budgets, the ~1% spent on the EU budget is minor. Yet, totalling EUR 1tr over seven years, it is still a very large investment pot to be distributed. For some of the net recipients, there is much at stake, given that EU funding for them accounts for a major share of public spending and national investment. In addition, for all EU leaders, the budget is a sensitive political issue at home, one which goes beyond the symbolism of “succeeding” in the negotiations on behalf of their countries.

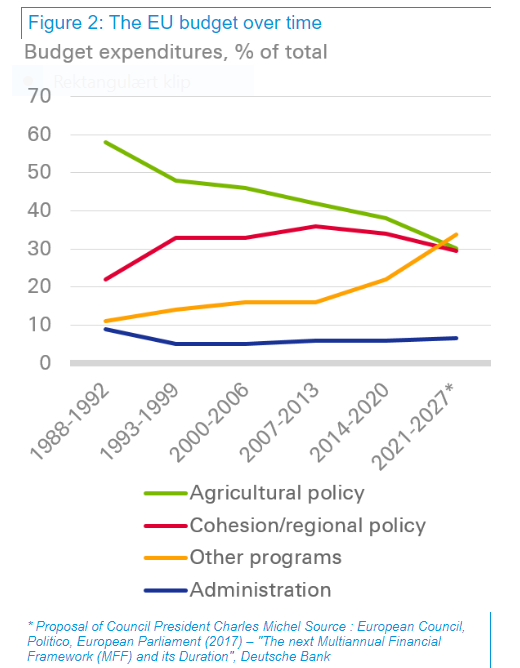

This basically left only one possible solution: (already modest) proposals for new priorities, such as digital, defense, and migration/borders, which were overproportionally affected (see Figure 1). This is exactly what we had been concerned about all along. Yet, as we learned last week, even this scaled-down solution could not bring the opposing camps closer together.