Fra John Authers:

The headline number, as we know, rose to 8.6%, scotching hopes that March’s 8.5% had been “peak inflation.” As I wrote Friday, politically sensitive food and fuel prices are rising fast for reasons that have little to do with US economic policy — but unfortunately the evidence is that inflation is broadening.

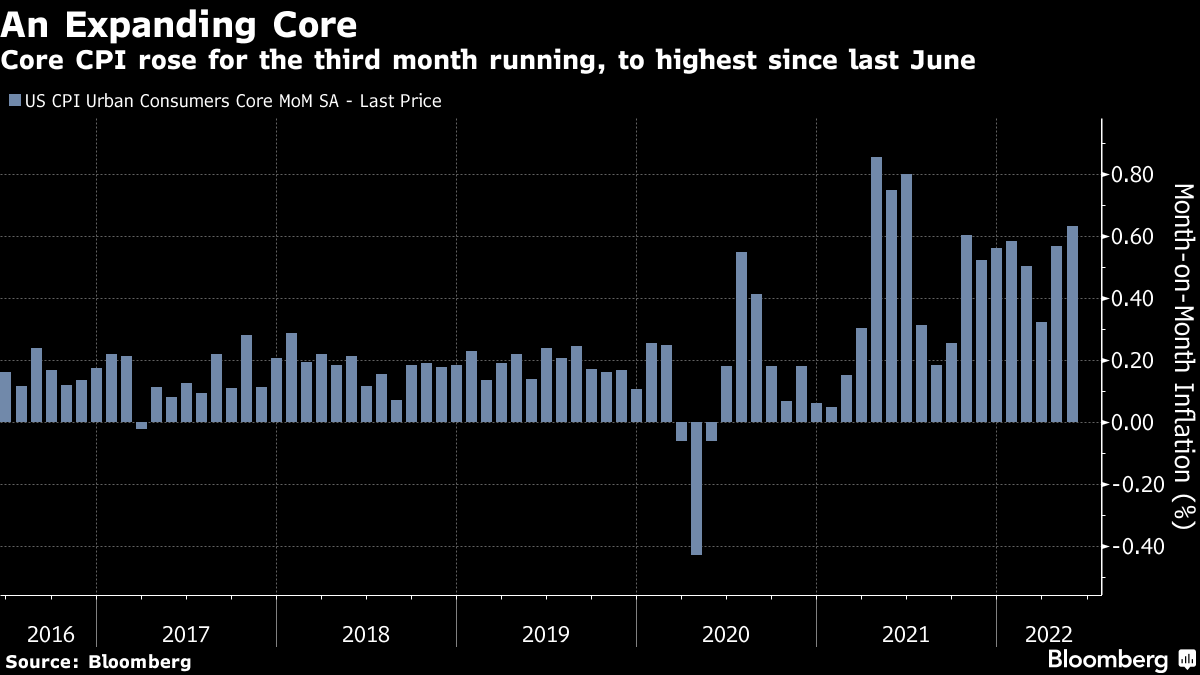

There are various ways to measure “core” inflation. If we simply exclude food and energy then May’s month-on-month increase was the highest since June last year:

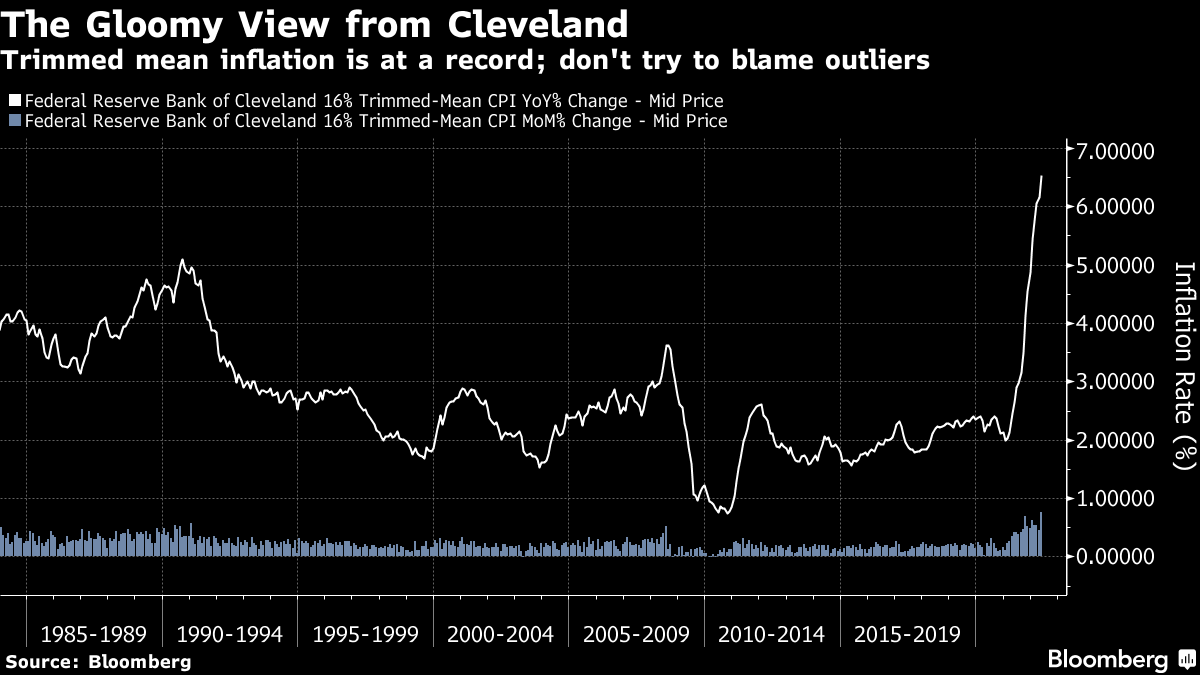

Alternatively, we could use the “trimmed mean” concept, stripping out the biggest outliers in both directions and taking the average of the components that remain. This has been calculated by the Cleveland Fed since 1984, and unfortunately both the year-on-year and month-on-month figures are the highest on record:

Another way to get at the core underlying inflation pressure is to look at “sticky” prices — for products and services where increases need to be planned well in advance and where it is difficult to make many changes in a year. The Atlanta Fed’s measure of sticky price inflation is the highest in three decades on a a year-on-year basis. Last month’s reading was nearly back to the high set earlier this year. This is exactly what we would have hoped wouldn’t happen if we wanted to avoid drawn-out inflation:

Another long-held fear coming to fruition is a pickup in shelter inflation, which accounts for about a third of the index. It was well below average entering last year, but rising rents and house prices have now brought it to the highest in three decades. This is a problem for the Fed because — unlike food or fuel inflation — house prices and rents react directly to monetary policy. It was possible to argue against rate hikes on the basis that they wouldn’t shift oil or grain prices. Plainly, tighter monetary policy should help rein in an overheating housing market:

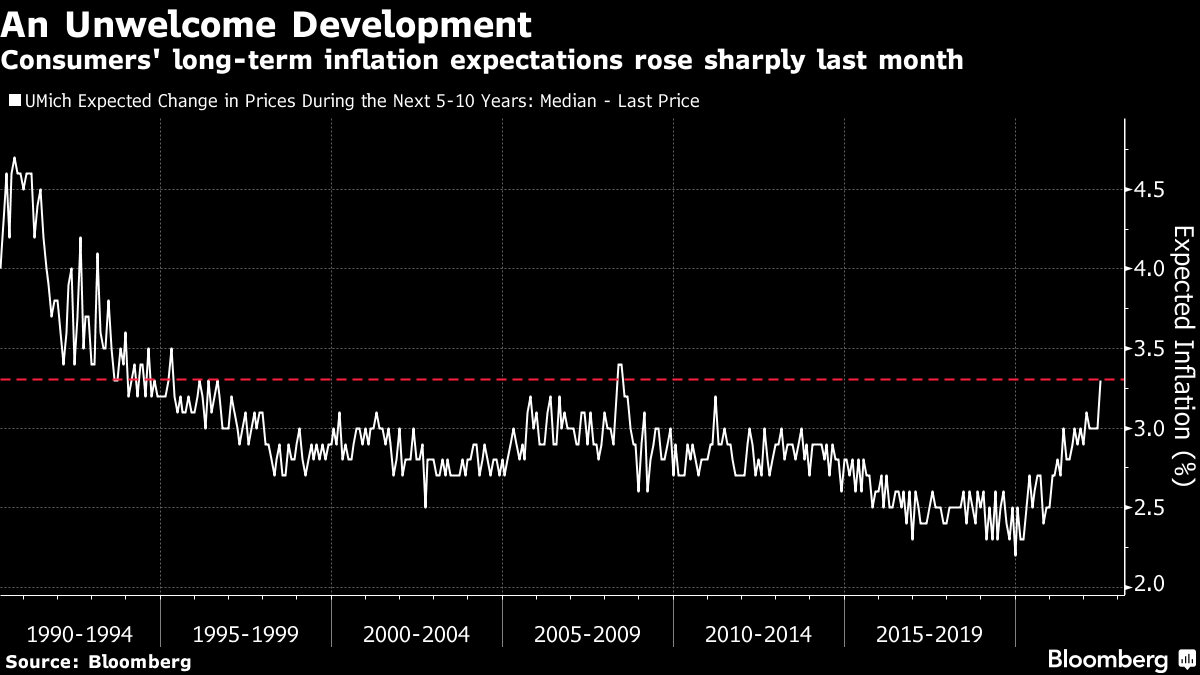

Yet another unwelcome development came with publication of the University of Michigan’s long-running survey of consumer expectations. That found that consumer confidence for the future was at record lows. It also showed that expectations for inflation 5-10 years from now had jumped to 3.3% from 3.0%. Until now, one of the greatest reasons for optimism on inflation has been that consumers don’t seem to expect it to last. Evidence that this may be starting to change is concerning:

In sum, this report wasn’t just a worse-than-expected headline shock: The details were if anything even more alarming. There’s no way around it; this was a bad report.

Silver Linings |

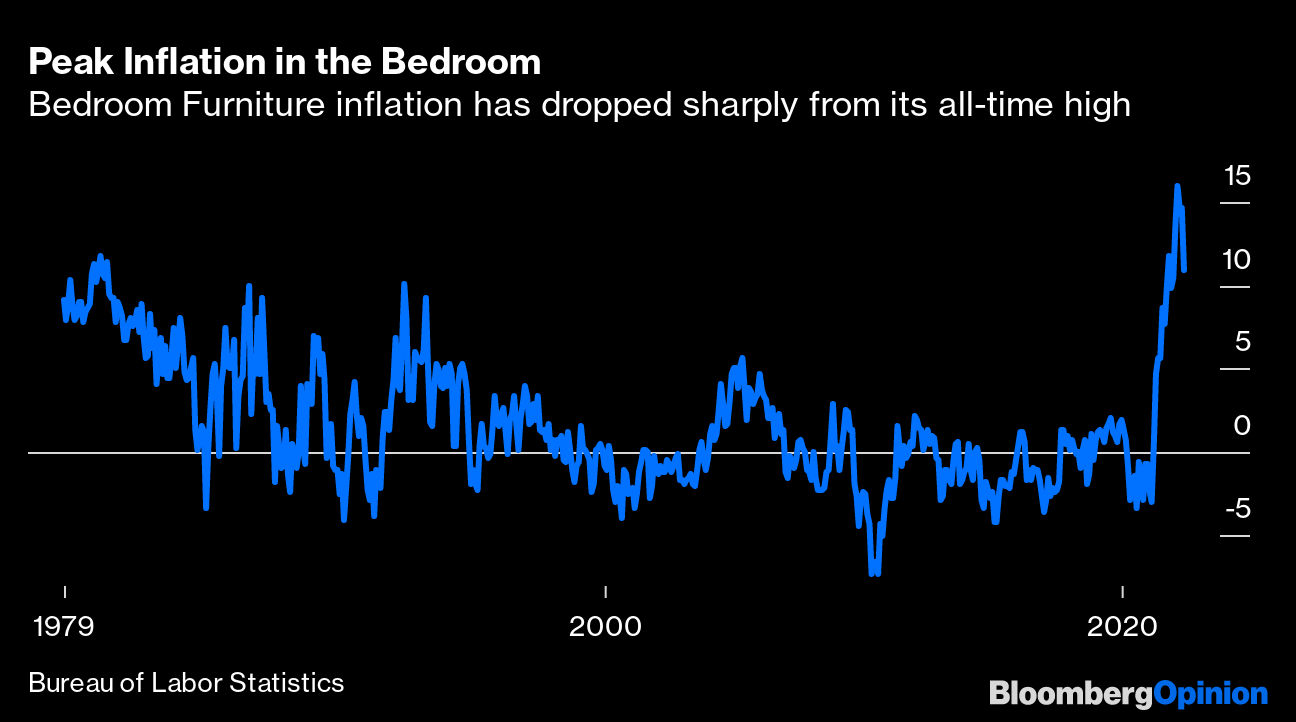

Now for a little positivity. Supply chain snarl-ups propelled the inflation in bedroom furniture prices to an all-time high earlier this year. Now it looks as though we’ve seen peak inflation, at least in the bedroom. The rate of increase is still above 10%, but down sharply:

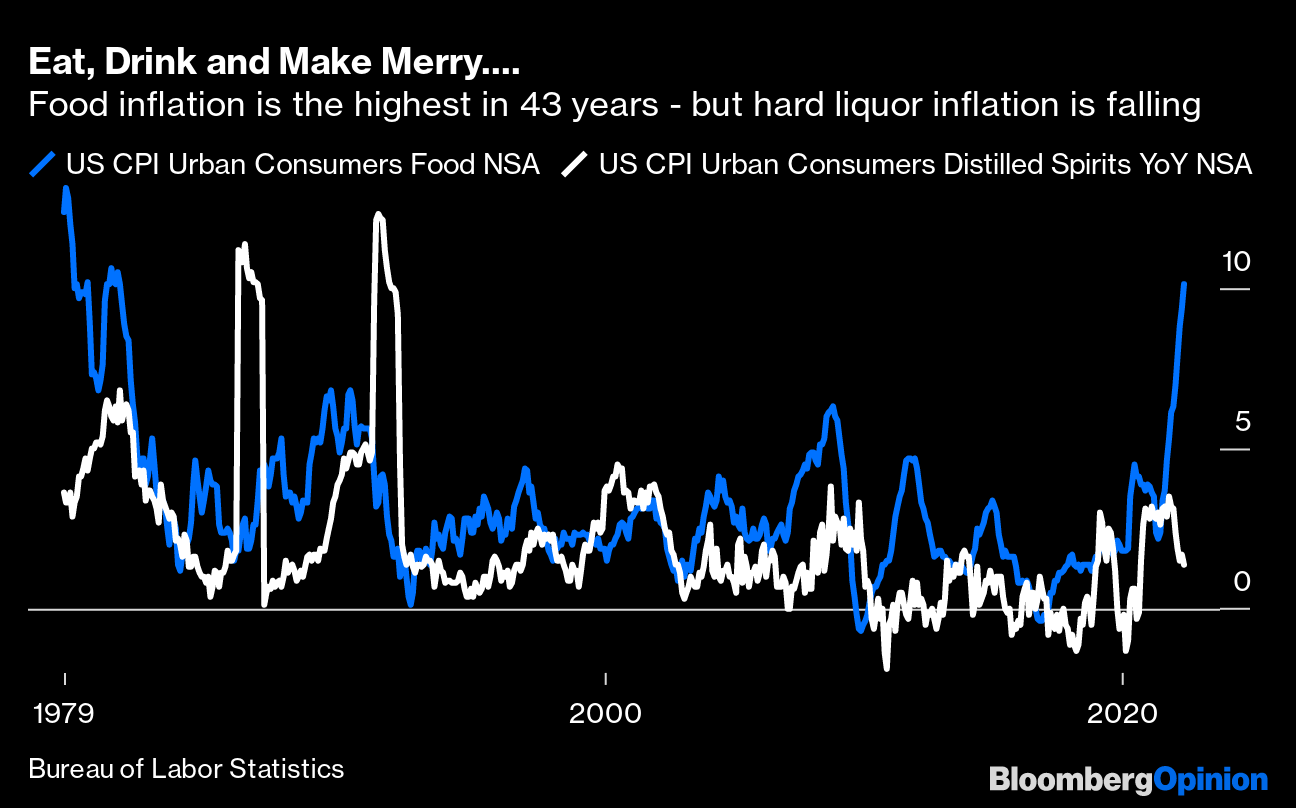

There’s also some good news for anyone who wants to drown their sorrows. Prices of food to eat in the home are inflating at more than 10% per year for the first time since 1979 — but distilled spirits inflation has dropped to 1.4%. When I shared the following chart on Twitter it prompted one reply that tequila still wouldn’t work as fuel for a motorbike, so it’s not the greatest of consolations. But still, falling hard liquor inflation is good news for some:

Markets Impact |

If I struggled to find anything good in the inflation report, so did traders. Friday appears to have been a pivot day for markets. After more than a month when bond yields had fallen and equities recovered from their lows as investors questioned whether the Fed would really have to push on with too many rate hikes, the respite is emphatically over.

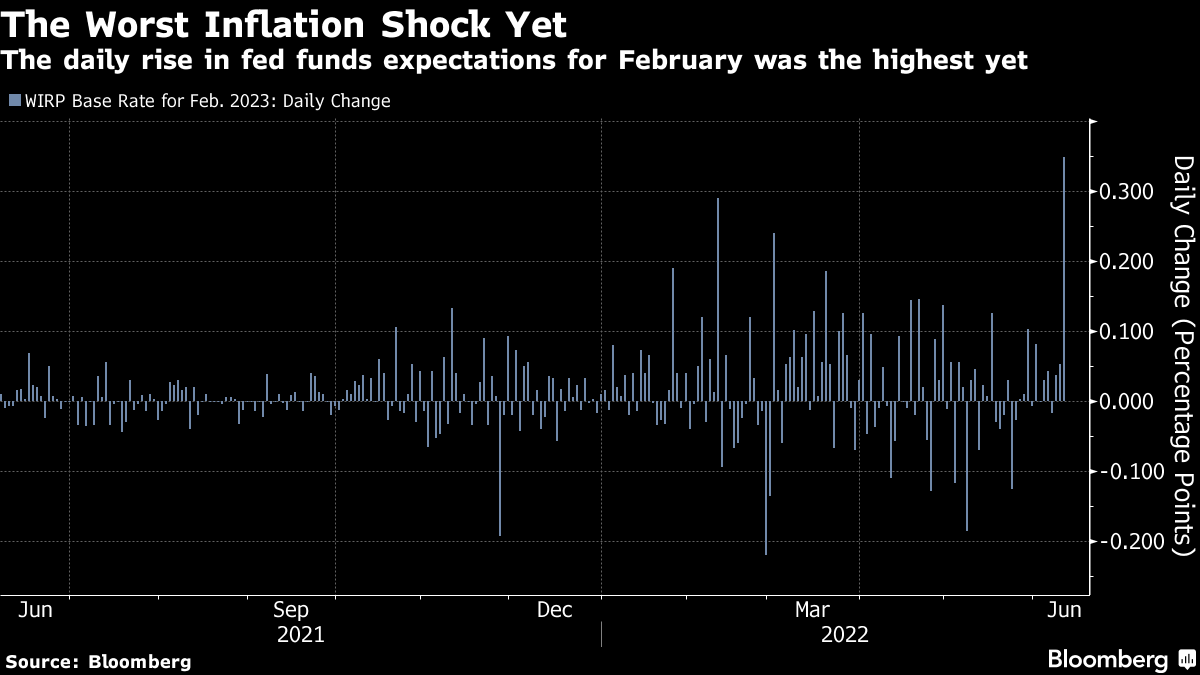

Fed funds futures now project a rate of 3.45% after the Federal Open Market Committee’s meeting next February. At the beginning of the week, that figure stood at less than 3%. Friday’s move was by far the biggest jump yet in expectations for that meeting:

Meanwhile, two-year Treasury yields also burst out in epic fashion, passing the round number of 3%, and reaching their highest since December 2007. The rise has continued in Monday trading in Asia; at the time of writing the two-year yield stands at 3.12%. The market seems convinced that the persistent negligible yields in the years following the crisis of 2008 are finally over:

As for 10-year yields, they also rose sharply, without quite topping their high from last month. The pause for second thoughts is over:

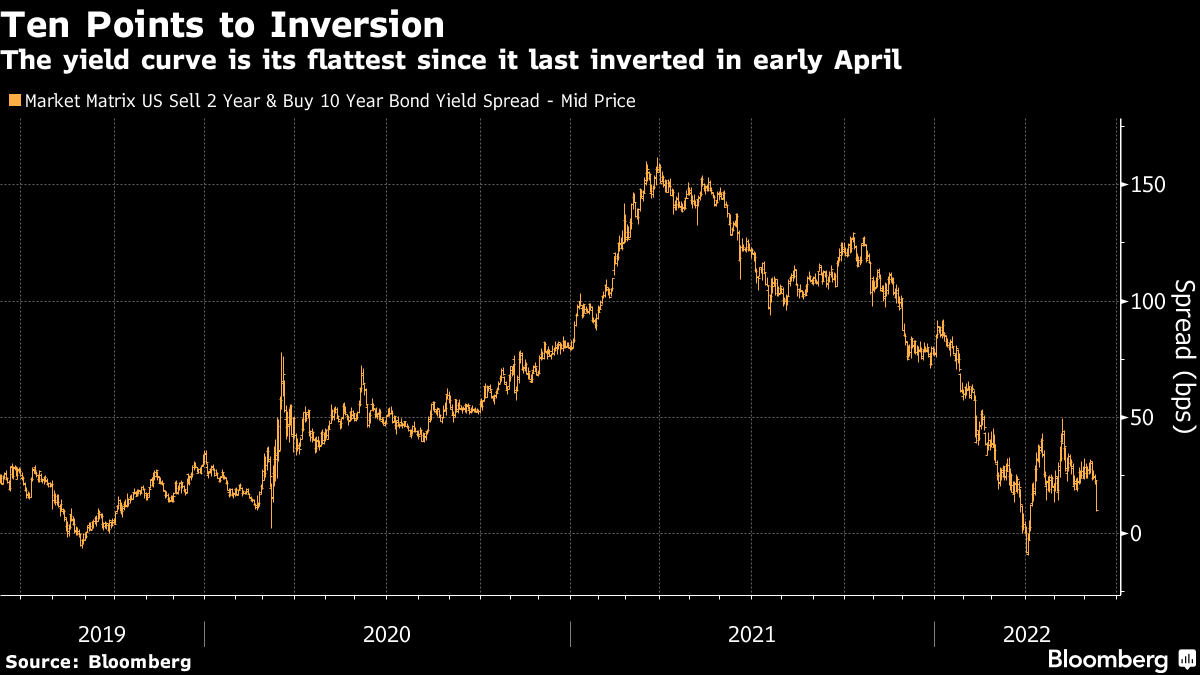

That allowed the spread between two- and 10-year yields to tighten to less than 10 basis points, as of when I drew the chart. In Monday morning Asian trading, the spread had tightened to only 4 basis points. The so-called yield curve is regarded as a critical recession indicator; any enduring inversion, in which two-year yields rise above longer yields, is seen as a harbinger of a recession. This curve has had momentary inversions in 2019, and again in April of this year. Now traders must again confront whether they are prepared to move the curve into inversion. If they do this — and they seem minded to do so — this would imply that while yields must rise in the near term, they would subsequently fall. That’s consistent with the notion that the Fed will have no alternative but to tighten until it “breaks something”:

Reverberations |

The inflation data had repercussions far beyond the US. Europe’s rates markets had already been churned by Thursday’s press conference from European Central Bank President Christine Lagarde, which raised expectations for rate hikes along with reawakening fears that the euro zone risked fragmentation. Friday saw forecasts rise even more than they had on the day of Lagarde’s comments. Over the last two weeks, the overnight index swaps market has doubled its projections for the ECB’s base rate at next February’s meeting, to 1.4% from 0.7%. This is a huge shift in perception:

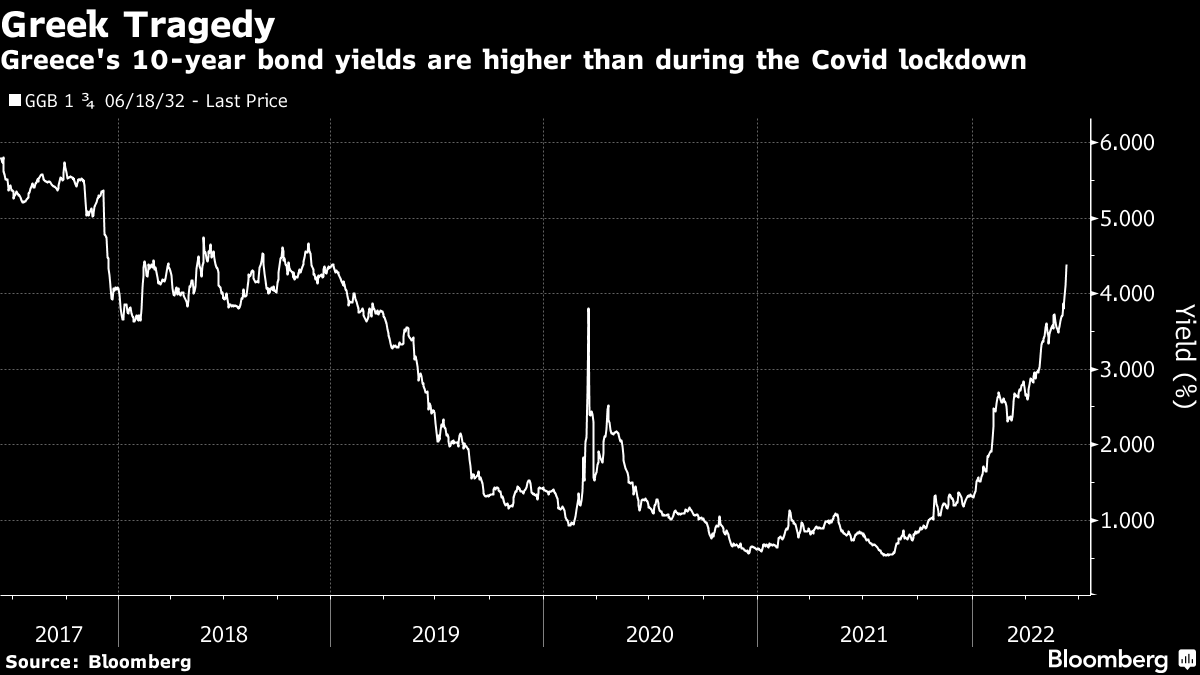

Sadly but predictably, the ramifications have been most serious for the countries whose credit came under most pressure during the euro zone’s sovereign debt crisis a decade ago. Italian yields rose by more than Treasury yields. And Greek 10-year bonds are back at a four-year high, and yielding more than they did during the worst of the Covid shutdown in 2020. For a country whose economy was gradually regaining its footing, this is cruel news:

In stock markets, one genuine positive is that sentiment held up well enough to keep the main benchmark indexes from setting new lows for the cycle. Even so, selling was widespread, with both the mega-cap Russell Top 50 index and the smaller companies in the Russell 2000 more than 20% below their peak (and therefore satisfying a popular definition of a bear market):