Europæernes opsparing er steget kraftigt under pandemien, fordi forbrugsmulighederne var begrænsede. Der er en mer-opsparing på 2,5 pct. Derfor har økonomer og ECB ventet lidt af en forbrugseksplosion. Men de ekstremt høje energipriser som følge af Ukraine-krigen og Vestens sanktioner ændrer fuldstændig billedet. Nu må pengene bruges på den dyre energi. Forbruget vil derfor kun stige behersket, vurderer ABN Amro. Alt det, der er sparet op for at kompensere for pandemiens begrænsninger, fordufter. ABN Amro venter en inflation i andet halvår på 6,5-7 pct.

Euro savings to cover energy price hit, rather than for consumer boom

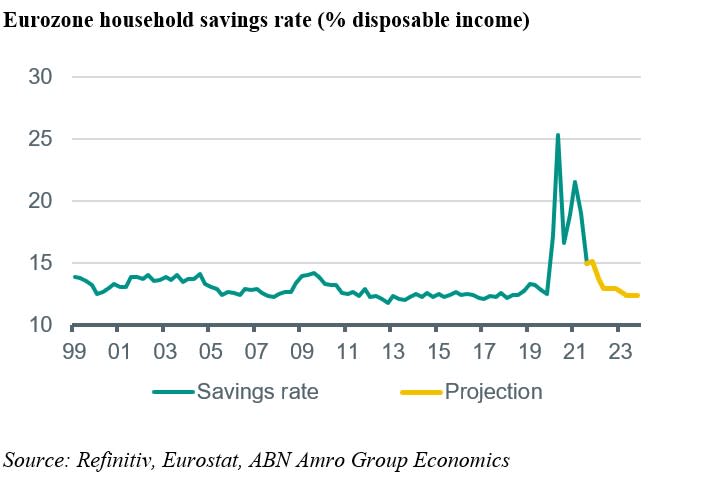

Eurozone households have accumulated a significant amount of excess savings during the pandemic, as lockdown measures have hindered consumption of many goods and services. As a result the household savings rate (savings as a percentage of disposable income) was around 2.5 percentage point above the pre-pandemic level in the final quarter of last year.

The consensus and ECB view was – and to an extent still is – that the high level of the savings ratio and accumulated savings would lay the ground for a consumer boom this year. However, the energy price shock has changed the picture.

Savings rate to drop sharply, but consumer spending to be only moderate

Eurozone households have accumulated a significant amount of excess savings during the pandemic, as lockdown measures have hindered consumption of many goods and services. As a result the household savings rate (savings as a percentage of disposable income) has jumped up and down since the start of the pandemic, rising during periods of lockdowns and falling during periods of re-opening. At the eurozone macro level, data for eurozone disposable income and household savings is available until 2021Q3.

The savings rate was 15.0% that quarter, which was more than 4 percentage points below the level of 2021Q2 and around 2.5 percentage point above the pre-pandemic level of 2019H2. Whereas household income data for 2021Q4 are not yet available, the available data for wage growth, employment and private consumption growth indicate that the savings rate probably edged slightly higher that quarter, which can be attributed to the fact that a large number of countries implemented restrictions related to Omicron.

The consensus and ECB view was – and to an extent still is – that the high level of the savings ratio and accumulated savings would lay the ground for a consumer boom this year. However, the energy price shock has changed the picture. We expect inflation to increase in the first half of this year and peak at a monthly rate of around 6.5-7% during Q2.

The quarterly change in the price index is expected to be significantly higher than quarterly growth in employment and wages (i.e. disposable income), implying that real disposable income will drop. This means that a drop in the household savings ratio in the coming months will no longer lead to a consumer boom, but rather help to cushion the energy price shock, while consumer spending growth remains moderate.

Given our estimates for real disposable income, if the savings rate were to return to its pre-pandemic level by the middle of this year, consumer spending would only expand at a quarterly rate close to its pre-pandemic average rate (around 0.4% qoq). For consumer spending to be stronger than this, households would have to spend part of their stock of excess savings that was built up during the pandemic.

Given the current uncertainties about inflation and economic growth due to the Ukraine-Russia conflict, it seems unlikely that consumers are willing to voluntarily use up large part of their excess savings. Indeed, we expect consumer confidence (to be published on 23 March) to have dropped sharply in March and we expect consumption growth to be close to the pre-pandemic trend in the first half of this year.