Amerikanske virksomheders opkøb af egne aktier er faldet en smule i år, fordi den amerikanske økonomi er blevet svækket. Diskussion om, hvorvidt share buyback pumper aktieniveauet op.

Amerikanske virksomheders opkøb af egne aktier er faldet en smule i år, fordi den amerikanske økonomi er blevet svækket. Diskussion om, hvorvidt share buyback pumper aktieniveauet op.

Uddrag fra Merrill Lynch:

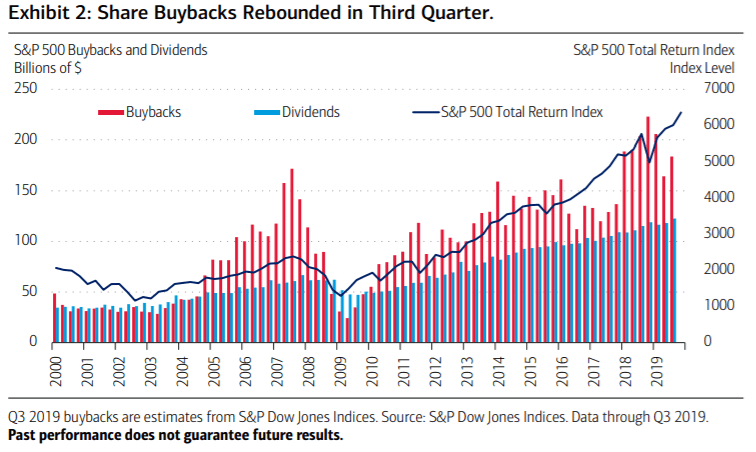

A key source of support for U.S. equities has been aggressive corporate share

buyback programs, with companies repurchasing their own stock at record levels in 2018

and 2019. During the past year, over 75% of S&P 500 companies bought back their stock, up from 35% at the end of the financial crisis. Aggregate S&P 500 share buybacks totaled an estimated $184 billion in 3Q 2019, down roughly 10% from a year ago.

The slower pace of buybacks comes as business confidence in the U.S. economy has

dropped. The latest survey data indicates that more than two-thirds of U.S. CFOs believe

the U.S. will be in recession by the end of 2020.1

In the 10 years since the end of the financial crisis, cumulative share buybacks from

corporations were $5.1 trillion, according to data from S&P Global. This compares with

less than $150 billion in net purchases from foreigners and about $450 billion in net

sales from households and nonprofits.

Looking ahead, we expect share buybacks in 2020 to remain strong but are more

cautious about companies’ ability to pay out at the same levels of 2018/19.

One reason for caution is that cash balances have declined and have become increasingly

concentrated among top holders. Meanwhile, corporate debt has risen to a record high of 47% of GDP, calling into question the strategy of some companies to issue debt to repurchase shares.

The debate on share repurchases is likely to ramp up as the 2020 election nears. Some

critics assert that outsized buybacks diminish long-term economic growth, as companies

forego investments in more productive uses of cash such as capital investment or

research & development. The other side of the argument claims that buybacks don’t

detract from capital investments, but rather they efficiently redistribute capital in the

economy—away from mature companies to newer companies with better investment

opportunities.