Uddrag fra Zerohedge og en stribe finanshuse;

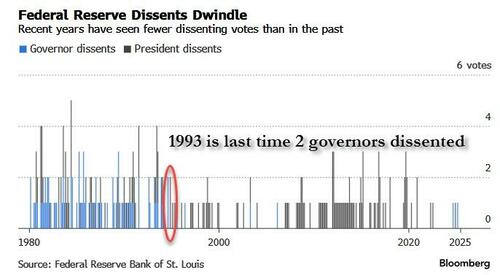

- The FOMC is widely expected to leave rates on hold, but we could see dissents from both Governor Waller and Governor Bowman given their recent commentary – something that hasn’t happened since 1993 – at a time when political pressure on Chair Powell is intensifying.

- Other Fed policymakers have largely toed a patient, wait-and-see approach due to the uncertainties of the tariff impact and delayed imposition of tariffs, with new tariff rates not set to come into force until August 1st.

- While tariffs on China were set to come into effect on August 12th, talks early this week are looking to extend that deadline by at least 3 months to avoid tariffs of 145% on the US side and 125% on the Chinese side.

- Attention at the press conference will be on Chair Powell, to see if he offers any guidance for rates ahead, or if it may soon be time to lower rates, depending on the data, although the Fed has been reluctant to commit to future moves in the past, given the ongoing uncertainties around trade policies.

- During the Press Conference, Powell will also likely be quizzed about his future given President Trumpʼs continuing criticisms of the Fed Chair. Powell tends to avoid these sorts of questions, usually stating that he is focused on the Fed’s mandate.

- The press conference may also see Powell quizzed on the accuracy of recent data, with an increasing number of economists worried about the accuracy and whether it could distort Fed policy.

EXPECTATIONS: The Federal Reserve is widely expected to keep rates on hold in July, with the latest Reuters Poll finding all 105 economists surveyed looking for this outcome. Money markets are also largely pricing in a hold, with just a 3% probability of a 25bps rate cut.

Polymarket is even more reserved, with traders in the online betting platform giving only 2% odds to a rate cut.

With a hold largely expected, and hinted at in recent commentary, attention will turn to any potential dissent(s), given that both Governors Waller and Bowman have previously argued for a rate cut as soon as the July meeting. If both dissent, as Goldman, Deutsche and Morgan Stanley expect, it will be the first time two governors have dissented since 1993.

Looking ahead, economists are more split, with 56 of 105 economists surveyed expecting a rate cut in September (at the time of writing, money markets price in approximately 17bps of easing, which implies a 68% probability of a 25bps rate cut). Goldman expects three 25bp rate cuts this year in September, October, and December, followed by two more in 2026 to a terminal rate of 3-3.25%. Our funds rate scenario analysis implies that our probability-weighted Fed forecast remains dovish relative to market pricing.

The Fed has been reluctant to commit to future moves, but it would be key if they gave some guidance for the September confab, or if Powell alluded to such a move; still, Morgan Stanley highlights that he will likely state it is a long time until September, with plenty of data due between now and September 17th.

RECENT DATA: Inflation data has recently been benign with little evidence of inflation skyrocketing higher in the face of tariffs, albeit the June data did show the start of the impact, with goods inflation rising 0.7%. There is still uncertainty ahead regarding the impact of tariffs on inflation, with some fearing it will have a permanent impact, but the doves argue that it will be a one-time increase. However, Trump’s scattered tariff approach only pushes back the time until the Fed will have a clearer understanding of the inflation impacts from trade policies – Goolsbee, for instance, has said it could delay rate cuts. The labor market has been “solid,” with no signs of a sharp deterioration, though the latest Beige Book noted that reports of layoffs were more common among manufacturers, but limited in other sectors (more below). Something to be aware of in the Q&A is that Powell may be quizzed about the accuracy of US data. A recent Reuters poll found that 89 out of 100 economists polled by Reuters were concerned about the quality of official US economic data, with 41 saying they are very concerned. Oddly enough, none of them were concerned about data accuracy during the Biden admin – go figure. Meanwhile, 71 of the 87 surveyed believe the US authorities are not treating challenges of economic data accuracy with sufficient urgency, with 66 stating that they are worried about the impact of US statistics quality on Federal Reserve policy-making.

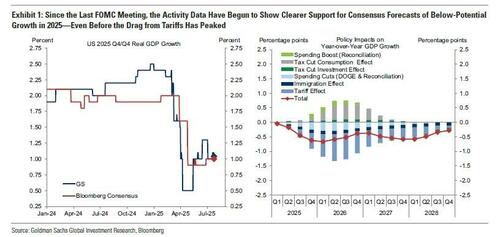

According to Goldman, the most notable change since the June FOMC meeting is that the activity data have begun to show clearer signs of the below-potential growth that most forecasters have expected since it became clear in the spring that large tariff increases were coming. Concerningly, this deceleration has occurred before the drag from the trade war has likely peaked. While this has strengthened the case for rate cuts, the inflation and employment data and the range of views among FOMC participants have left the timing of the first cut an open question for now.

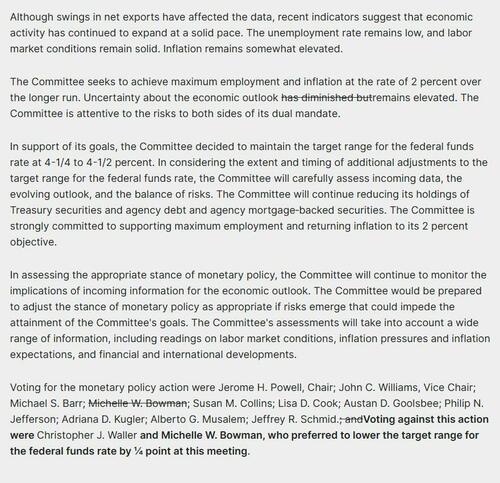

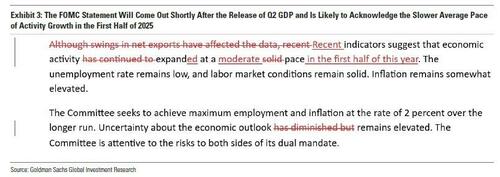

FOMC STATEMENT: Below we share Morgan Stanley’s expected changes to the FOMC statement in July. Strikethrough text represents deletions from the June statement and bolded text represents new language we expect to be added in the July statement. The bank expects no material changes in the statement. In addition to the description of the incoming data, the committee will retain its assessment about uncertainty – “remains elevated” – though the reference to “diminished” uncertainty can be removed given the amount of time that has elapsed since “Liberation Day” in early April. In addition, with additional tariffs forthcoming on August 1, some committee members may be worried about a re-escalation in trade tensions. Beyond this, the language that “the committee is attentive to the risks to both sides of its dual mandate” is generic enough to not warrant any changes. As it becomes clearer which way the economy is evolving versus the dual mandate, the Fed may alter its assessment of the balance of risks, but that will take time.

It’s also worth noting that Q2 GDP will be released on Wednesday morning, and FOMC statements after GDP releases often summarize the results in the first paragraph. The FOMC will likely follow what has become a widespread practice among economists this year of averaging Q1 and Q2 growth and according to Goldman, the Fed is likely to acknowledge the softer growth pace in the first half of the year, downgrading its assessment of growth from a “solid” to a “moderate” pace. It is also likely to remove the comment that uncertainty “has diminished” because the renewed threats to raise country-specific tariff rates have if anything increased it. Here is what the statement redline will look like according to Goldman:

POWELL PRESS CONFERENCE: In the press conference, Chair Powell will probably be asked whether the two cuts in 2025 implied by the median June dot is still the baseline. He will likely acknowledge the June median but note that there are still two rounds of inflation and employment data ahead of the September meeting and reiterate that decisions will be made on a meeting-by-meeting basis. A plausible more dovish alternative would be for him to endorse two cuts as still the median view on the FOMC while acknowledging the range of views. According to Goldman, do not expect Powell’s press conference to provide any firm hints about September

RECENT COMMENTARY: The majority of the Fed continues to favor a wait-and-see approach, but a minority (Waller and Bowman) have suggested they are open to a rate cut in July. Looking ahead, some have indicated they would be more prepared to cut in September, providing inflation remains benign. Some have also indicated that it can cut and then hold to see how the impacts of tariffs play out. Goolsbee has made the argument that Trump’s latest tariff threats could delay the Fed’s resumption of rate reductions as the Fed still will not have a clear picture until August, and then tariffs would need to work their way through the economy. A July rate cut seems unlikely based on recent commentary, and although Waller has not committed to such a move, as he will debate views with others at the meeting, he said he does not think he could be clearer on his rate position, and exclaimed that when dissenting, it is best not to be a serial dissenter. There has been a range of views on the expected tariff impact; the doves like Waller expect a one-time price increase, but others suggest there could be a more permanent impact. Note, the majority of the Fed continues to echo that they will wait for the data and if inflation pressures pick up, they can hold for longer as long as the labor market remains robust. They also note they can cut quicker if needed if inflation falls faster than expected, or if there is an unexpected weakening in the labor market.

“There is no doubt that the FOMC will leave interest rates unchanged,” Bill Nelson, chief economist for the Bank Policy Institute, said Tuesday in a note. “The question is whether they will convey a greater openness to cutting rates at their September meeting,” Nelson, formerly a top economist at the central bank, said.

BEIGE BOOK: The Fed Beige Book, based on information collected on or before July 7, 2025, saw economic activity increase slightly from late May through early July. Five Districts reported slight or modest gains, five had flat activity, and the remaining two Districts noted modest declines in activity, an improvement from the prior report. Employment increased very slightly overall, with one District noting modest increases, six reporting slight increases, three no change, and two noting slight declines. Although reports of layoffs were limited in all industries, they were somewhat more common among manufacturers. Looking ahead, many contacts expected to postpone major hiring and layoff decisions until the uncertainty diminished. Prices increased across Districts, with seven characterizing price growth as moderate and five characterizing it as modest, mostly similar to the previous report. In all twelve Districts, businesses reported experiencing modest to pronounced input cost pressures related to tariffs, especially for raw materials used in manufacturing and construction. It also reported that many firms passed on at least a portion of cost increases to consumers through price hikes or surcharges, although some held off raising prices because of customers’ growing price sensitivity, resulting in compressed profit margins. Contacts in a wide range of industries expect cost pressures to remain elevated in the coming months, increasing the likelihood that consumer prices will start to rise more rapidly by late summer.

POWELL V TRUMP: Some of the Q&A will likely focus on US President Trump’s criticism of Powell, and his lack of willingness to lower rates, although after a meeting last week, Trump said he had the impression that Powell may be ready to lower rates. Given many on the Fed, including Powell, have signaled a wait-and-see approach, and a dedication to central bank independence, a July cut remains unlikely. Powell’s term as Chair is set to expire at the end of May 2026, but his term as a Fed Governor does not expire until February 2028, opening up the possibility of him remaining on. Some have argued it would be good for Fed independence if Powell were to remain on as a Governor, despite Fed Chairs traditionally stepping down once their term as Chair is up. Note, whenever Powell is questioned about the future of his role, he avoids the question and states he is focusing on the current job at hand. Leading candidates to replace Powell are said to include former Fed Governor Kevin Warsh (who recently heavily criticised the Fed, and argued that rates should be lower), Governor Waller, as well as White House Advisor Hasset and Treasury Secretary Bessent.

MARKET REACTION: Below we excerpt some ideas from around the Goldman trading desk

Rates

- Mitchell Cornell – Volex Trading: Like Belly Payer Distributional Trades: Ahead of this week’s Fed, activity has been relatively low with the majority of market participants holding risk steady ahead of the events, and implied vols across the surface are near cycle lows. In addition to the outright level of vol, left side vols have normalized a lot vs right side vols, with 1y1y only being about 1 normal vol higher than 1y10y. Looking back a couple weeks, notable flows have included large lifts of the USU 108 puts and TYU 112 calls. These are now 3 week options and would create some amount of convexity deficit into a large delivered move across the Fed and the data cycle. While we don’t expect the Fed to be a notable event, we are looking for updated guidance on how the committee is feeling about the health of the labor market and the likelihood of cutting this fall. Belly payer spreads and payer ladders are good ways to gain leverage to a reversal in belly yields across strong data.

- Cemre Ertas – STIR Macro Trading: Two Dissents, Otherwise Little Change: The market is currently putting in just under 1 bp of cuts for the meeting tomorrow. While we expect the fed to stay on pause at next week’s meeting, we are expecting at least two dissents in favor of a 25 bp cut from Bowman and Waller. Believe that the dissents will cite the continued target level inflation prints and the argument to cut while labor market data is strong. Aside from the dissents, there should be very little changes to the statement; with Powell continuing to reiterate his wait and see policy. September meeting at just over 15bps feels well priced and we do not think it can rally much more before the Fed and NFP next week. We like receiving further out meetings here such as oct dec flatteners.

FX:

- Kamakshya Trivedi and Michael Cahill – GS Research: Continued Dollar Depreciation: The US announced a slate of preliminary trade agreements that look likely to weigh on the Dollar over time. The deals have been generally consistent with our economists’ expectations for a reset higher in the baseline tariff rate offset by some key reductions in sectoral tariffs. We think this direction of travel should keep the Dollar under pressure both by avoiding more disruptive outcomes that could have activated Dollar safe-haven flows and codifying higher tariff rates that will likely weigh on US terms of trade, especially as the baseline tariff turns from a “pause” placeholder to the new reality.

The Fed this week is another potential near-term catalysts for further Dolar depreciation If FOMC members share our economists’ concerns on underlying momentum in the labor market, they could use this week’s meeting to more explicitly keep a September cut on the table. More broadly, upcoming trade negotiations with China will likely keep the strengthening bias in the CNY fix in place a while longer, and after some likely seasonal distortions in last month’s payrolls report, risks seem skewed towards a softer read on the labor market in Friday’s NFP report. Taken together, we maintain a negative outlook on the Dollar.

- Alan Stewart – Head of the EMEA EM Trading and Head of EMEA G10 Spot Trading): Permanent Damage to the Dollar; Near Term Neutral, Longer-Term Weakness: We are near term neutral on the USD, although with asymmetry skewed towards a weaker Dollar. If we see a dovish Fed reacting to the pressure from Trump and a miss in Friday’s payrolls then I think the modest front-end pricing will move to at least two cuts in to YE. This will be supportive of US carry.

On the broader USD view, the resilience and even outperformance of US assets is introducing some doubts around the end of exceptionalism narrative that had been prevalent one quarter ago and one of the primary pillars supporting the weaker USD thesis. Immediate near term may see US stocks continue to outperform their European counterparts, but we believe some of the permanent damage has been done to the dollar and that some of this will be done on a more hedged basis that has been the case historically. We would also flag that the stock of unhedged US assets remains very elevated, and whilst the immediate hedging requirements may have been satiated, there will be slower moving requirements that will generate USD supply for several quarters ahead. On this we believe it is near term neutral, medium term bearish dollar.

Whilst the 2025 FED repricing that we have seen this month has been one of the factors driving the 2.5% rebound in DXY in the first half of this month…. With less than 2 cuts of 25bp now priced in for this year we feel that the asymmetry is to greater cuts being priced in in the event of any notable data weakness or any ratcheting up of political pressure to cut. Thus we view this as currently neutral but with an asymmetry skewed towards a weaker dollar. Separately, this week’s ECB meeting delivered a level of hawkishness and subsequent repricing that took us and the market by surprise. Whilst not obviously merited, and despite some of the ECB doves pushing back subsequently, this repricing should prove to be supportive for EUR/USD in the near term.

Equities:

- Dom Wilson & Vickie Chang – GS Research: Hedge Against Near Term Growth Worries: We expect the FOMC to keep the funds rate unchanged at this meeting, although we expect two dissents in favor of cutting. The underlying inflation news ex tariffs has been benign, and so the question going forward for the path of policy is whether and when more FOMC participants become comfortable that tariffs will only have a one-off effect on prices, and the evolution of the labor market data alongside that. Our macro tools suggest that the market is pricing 1y-ahead growth above our near-term forecasts, and while growth pricing doesn’t look wildly optimistic vs. our medium-term view, continued resilience in risk assets rests on the market being able to continue to look through any near-term weakness in growth. In our base case, the market can probably still hold onto that faith, but current pricing does mean that the market is more vulnerable now to a slowdown narrative and the path forward might be bumpier. Powell is unlikely to provide strong forward guidance at this meeting, but if he were to reaffirm the 2-cut median in last meeting’s dot plot or if he were to characterize the labor market as in more need of support, the market could take that as dovish relief and could perceive the latter as a Fed that will be more responsive to growth weakness than currently expected. A dovish shift from the Fed (not necessarily at this meeting) is the most likely potential macro tailwind that we see for risk assets now that growth is already more generously priced, though that may not necessarily take place at this meeting. It’s a packed data week even outside of the FOMC, and so we think it makes sense to hedge the risk of growth worry with some mix of front-end rate receivers or equity puts/VIX calls. The FOMC isn’t the most likely event to trigger those worries though.

Credit:

- Thank You Usman Omer – Index Trading: Slow Grind Tighter: Since June FOMC, credit has grinded tighter in sympathy with other risk assets as technicals (all-in yield demand, RM accounts underrisked) remain supportive. Bullish expressions like CDX compression have played out as accounts search for spread and carry in thin liquidity, and Implied Vol in 1-2m space has reracked lower with realized. However, dissecting the flows tells a more nuanced story — we have seen large hedge setting go through by RM accounts and more tactical Macro players in both Index and Vol format . While some of these hedges have been sold back in recent days, longer dated downside screens particularly rich and calendar steep as no natural sellers (FM/ systematics) step in to digest the flow (IG IVol in 32% vs Credit spreads near all time tights). In a similar vein, LQD borrow has moved left last week as there is greater demand to set term shorts in the asset. Given this set-up, the desk likes funding delta shorts by selling 3m+ Vol. We also like decompression (shorting risk in CDX HY vs IG) as HY single name stories becomes increasingly relevant, while playing for the IG roll technical.