uddrag fra Zerohedge:

l;dr: The Fed hiked 75bps as expected but signaled a much more hawkish than expected future trajectory of rates (higher for longer).

The Fed also slashed its economic growth expectations and increased its unemployment rate expectations.

* * *

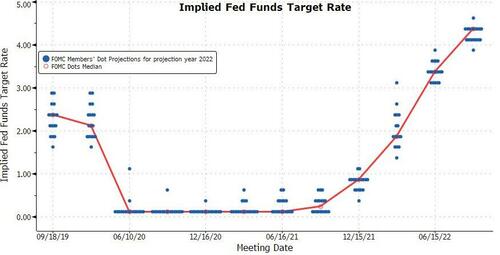

A lot has happened since the last FOMC meeting on July 27th. Fed Pivot narratives have imploded along with risk-asset prices as ‘peak inflation’ guesses failed to appear and at the same time growth fears were resurrected prompting growing fears of stagflation and a post-Jackson-Hole uber-hawkish Fed.

The dollar has been on a one-way trip higher since the last Fed meeting while pretty much everything else has tumbled – stocks and gold are almost exactly down the same while bonds have been a bloodbath… (red dashed line is Jackson Hole)

Source: Bloomberg

Focusing on bonds, 2Y yields are up over 100bps since the last Fed meeting (notably underperforming the long-end and flattening the yield curve dramatically). The two inflection points are Powell’s Jackson Hole speech and last week’s CPI print…

Source: Bloomberg

And thus, Financial Conditions have dramatically tightened since the last FOMC (helped by J-Hole of course) to new cycle tights…

Source: Bloomberg

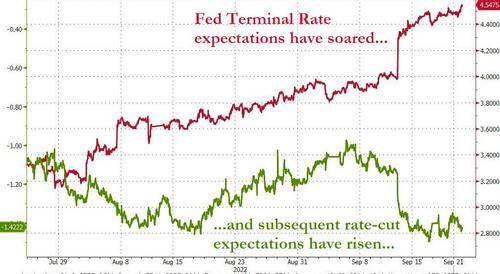

The market’s expectation for The Fed’s Terminal Rate has soared a stunning 125bps from 3.25% to over 4.50% (and at the same time, subsequent, recession-inspired, rate-cuts expectations have risen too)…

Source: Bloomberg

Most (94/96) economists expected a 75bps hike today, but the market left the option open for 100bps, pricing in a 20% chance of that mega hike…

Source: Bloomberg

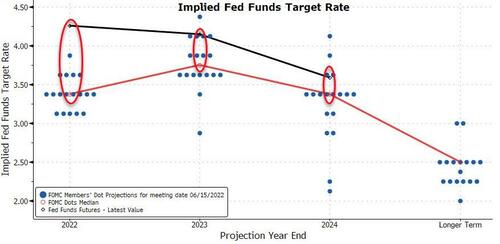

Today we also get new DotPlots and inflation/growth estimates… and as Goldman noted, “the dot plot probably matters more” than the rate-hike size. Ahead of today’s shift, the market is dramatically more hawkish than The Fed’s “dots”…

Source: Bloomberg

So which will it be today: 75bps & Hawkish presser? or 100bps & Dovish presser? (or a blend of both)?

Here’s what happened…

- *FED HIKES 75 BPS, REPEATS IT ANTICIPATES ONGOING RATE HIKES ARE APPROPRIATE

The Committee reiterates its previous language that it is “highly attentive to inflation risks.”

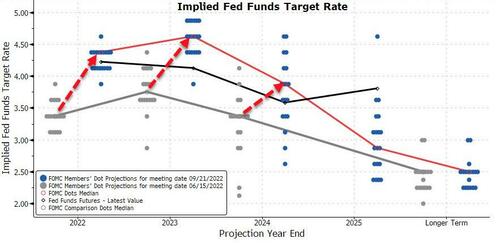

The new DotPlot is very hawkish:

- MEDIAN FORECAST SHOWS RATES 4.4% AT END-2022, AT 4.6% IN 2023, 3.9% IN 2024

The most hawkish dots (and there are six of them) now see the fed funds rate reaching nearly 5% in 2023.

While Wednesday’s decision was unanimous, the dot plot shows 10-9 majority in favor of hiking above 4.25% this year, suggesting a fourth straight 75 basis-point increase in November is possible, which comes about a week before the midterm elections.

Remember, until Powell’s Jackson Hole speech, the Fed had been talking about a soft landing (and the economic projections at the June meeting reflected that thinking).

Today’s updated projections suggest the “pain” that Powell hinted at is coming…

- The Fed substantially revised down GDP forecasts, with the median estimate for growth this year at just 0.2%, down from 1.7% forecast in June.

- Unemployment rate forecasts are up, with the median now at 4.4% for both 2023 and 2024. The long-run rate is unchanged at 4%.

- Both headline and core PCE forecasts are up for this year and next. The Fed doesn’t see inflation returning to its 2% target until 2025.

After today’s hike, The Fed Funds rate will have increased by the most amount since the six months ending March 1981.

* * *

Read the full redline below – Almost zero change in the policy statement. Really no indication there that we are heading towards any sort of pivot.