Uddrag fra John Authers kommentar

Anything other than a hike of 25 basis points in the fed funds rate would count as a major surprise. The greatest interest will focus on what, if anything, Jerome Powell says about quantitative tightening, how he chooses to present the Fed’s decisions at his press conference, and the “dots” — the graphic in which each member of the committee indicates where they expect the fed funds rate to be at different points in the future. It would be a very big surprise if the dots fail to move sharply upward.

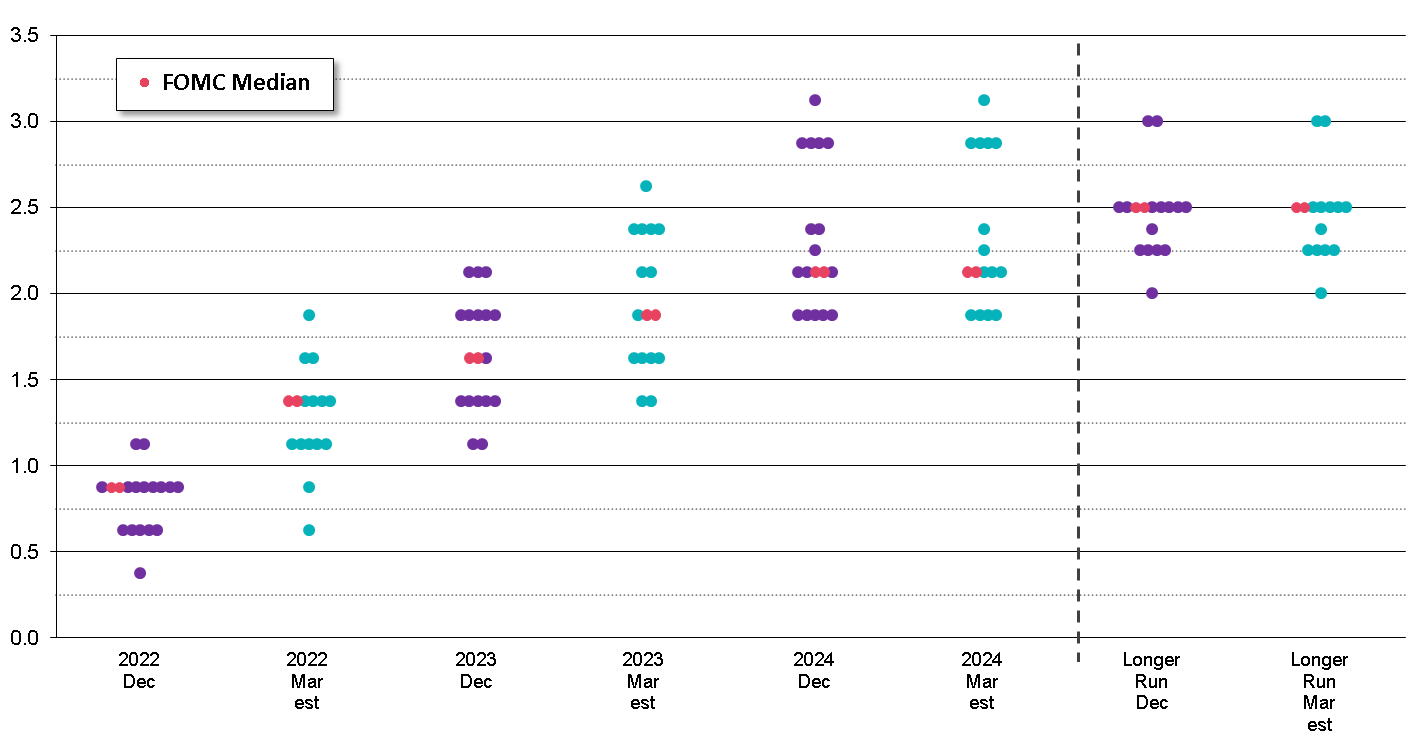

To help mark your card, NatWest Group PLC offered this handy chart of the latest dots, from the December meeting, in purple. Its own predictions are next to them in turquoise:

The dots for this year and next will have to shift — and much will depend on exactly how much. If there is a surprise in the offing, I suspect it may be in the longer-term forecasts. NatWest has the FOMC continuing to coalesce around a terminal rate of 2.5%, which implies that inflation will come under control relatively swiftly. A move here would shake a lot of assumptions, and it looks — to me at least — like a plausible outcome.

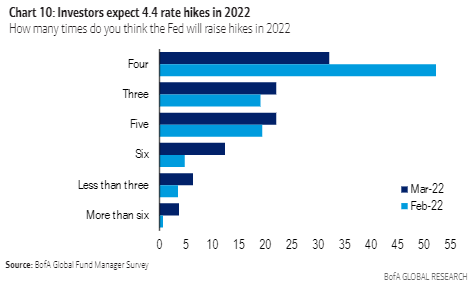

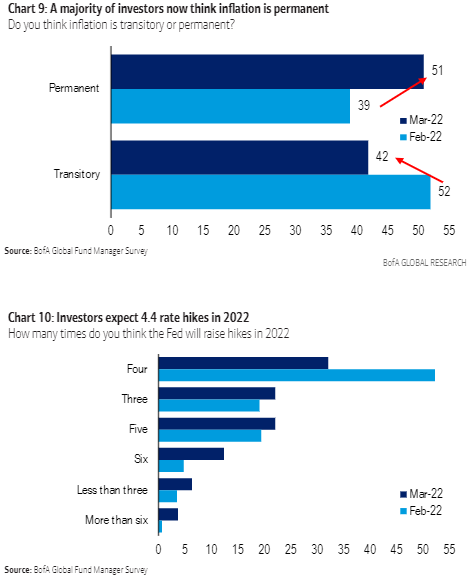

NatWest’s prediction that the FOMC will steer toward five 25-basis-point hikes for this year seems reasonable. Fund managers, as polled by Bank of America Corp. for the monthly global fund manager survey, broadly agree. Having braced for four hikes with some confidence last month, the chance of five or six hikes has since risen sharply:

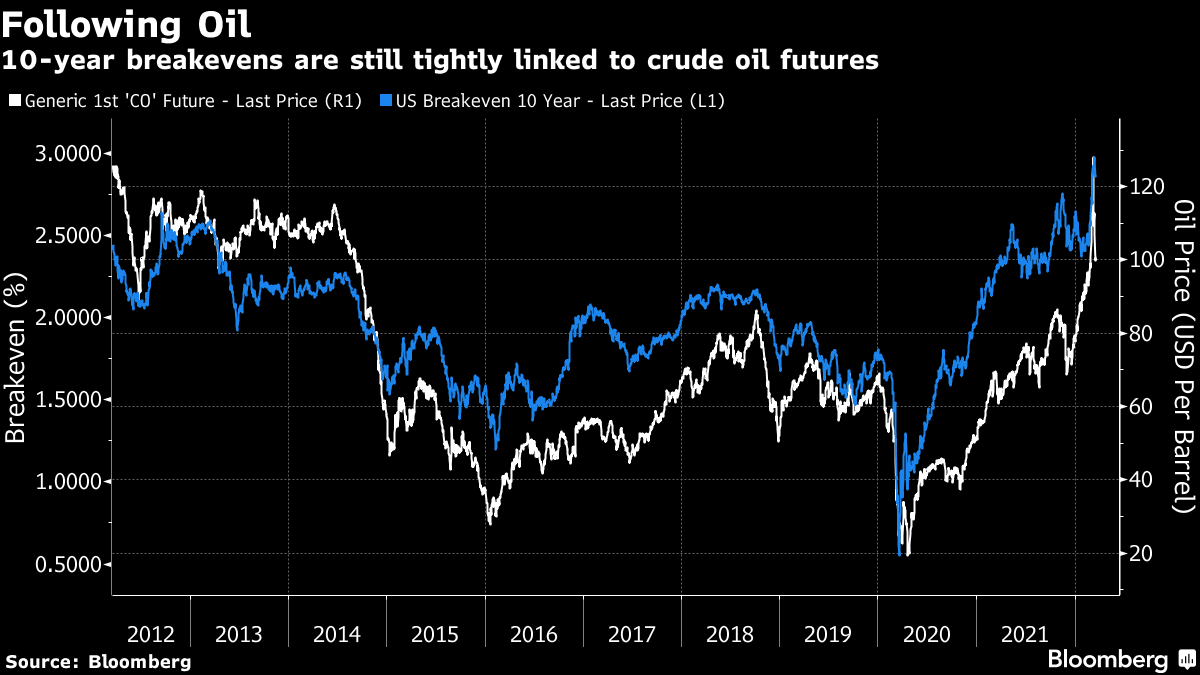

The sheer range of expectation more or less guarantees an emphatic reaction to whatever the dots reveal. Meanwhile, the oil price is wreaking havoc with market-generated forecasts of inflation. Rises in the oil price now should have no effect at all on average inflation over the next 10 years. If there is any slight effect, a higher price will mean a higher base now, and should create lower expectations for the future. But in practice, bond market inflation breakevens tend to follow the oil price. When oil is whipsawed by an invasion threatening supply, and then a Covid outbreak in China threatens demand, that makes some of the bedrock market assumptions become dangerously volatile. This is how 10-year breakevens and the Brent crude oil price have tracked each other over the last decade:

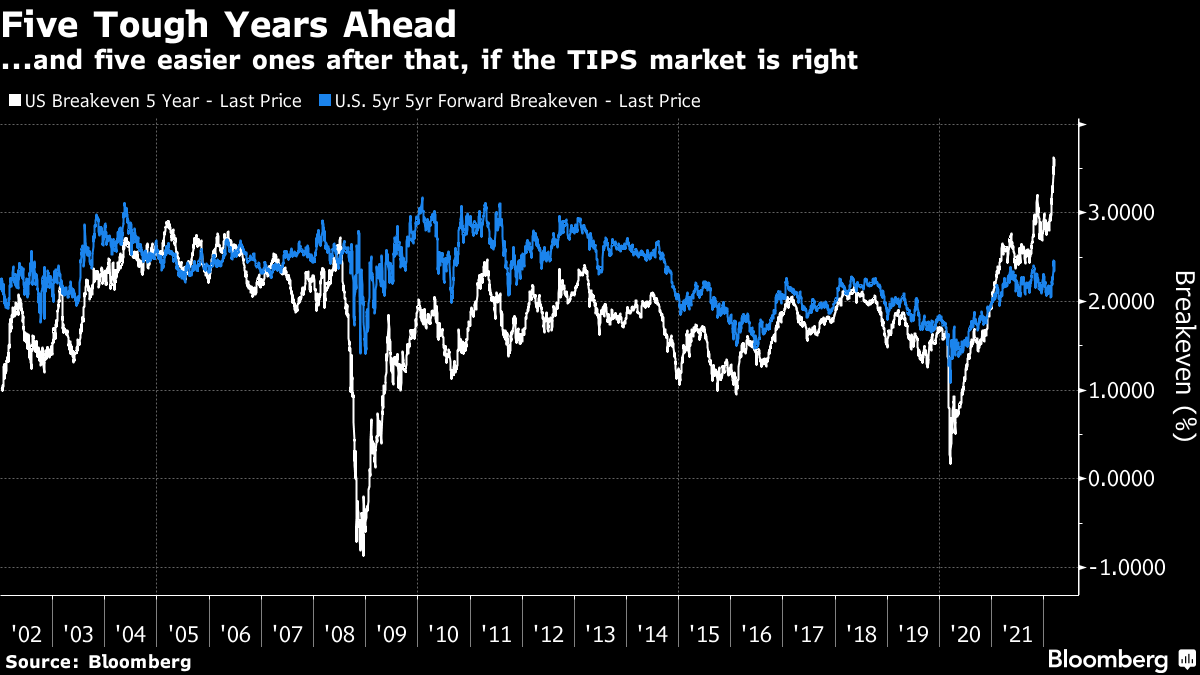

Much depends on where the oil price comes to rest. Meanwhile, looking at inflation breakevens in detail, the market projection is growing ever stronger that inflation will be high over the next five years, and then subside. The five-year/five-year breakeven, currently forecasting inflation between 2027 and 2032, rose to its highest in years following the invasion, but it’s falling ever further behind projected inflation for the next five years.

That confidence in the market measures may not be shared by the fund managers allocating money. The BofA survey found that the invasion has helped flip sentiment. A majority now thinks inflation will be permanent. Before the invasion, they still on net believed it would be transitory:

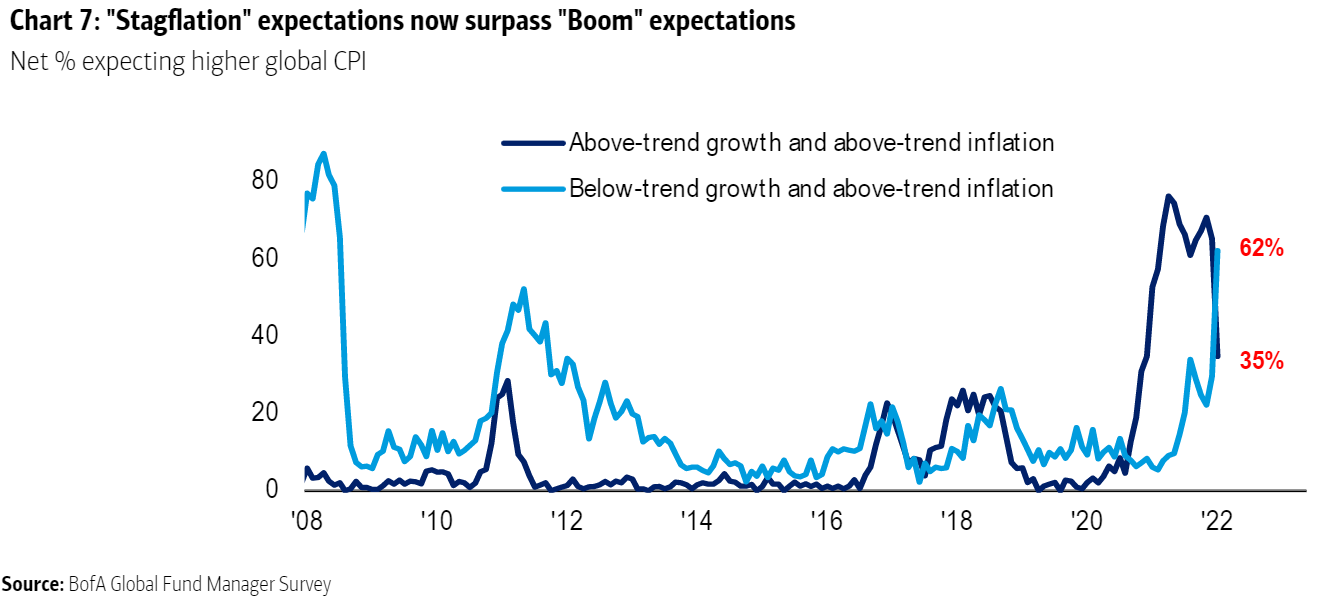

The timing of the last two surveys, shortly before and after Russian forces entered Ukraine, makes it very useful for gauging the impact the invasion has had on investor sentiment. It certainly seems to be quite a turning point. Now, fund managers are braced for stagflation, rather than a reflationary boom:

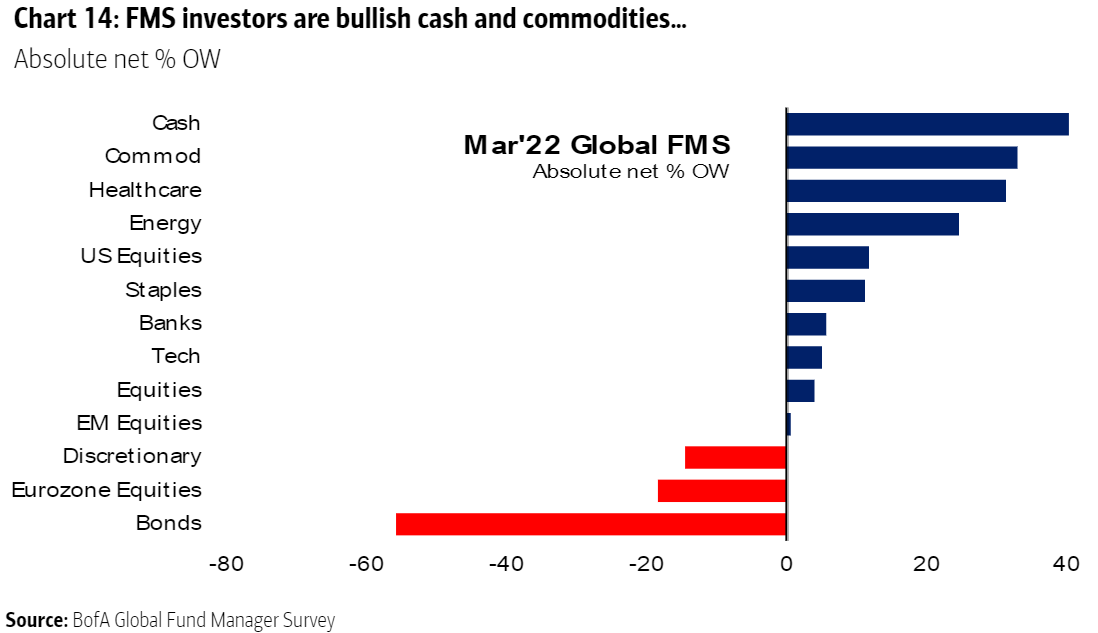

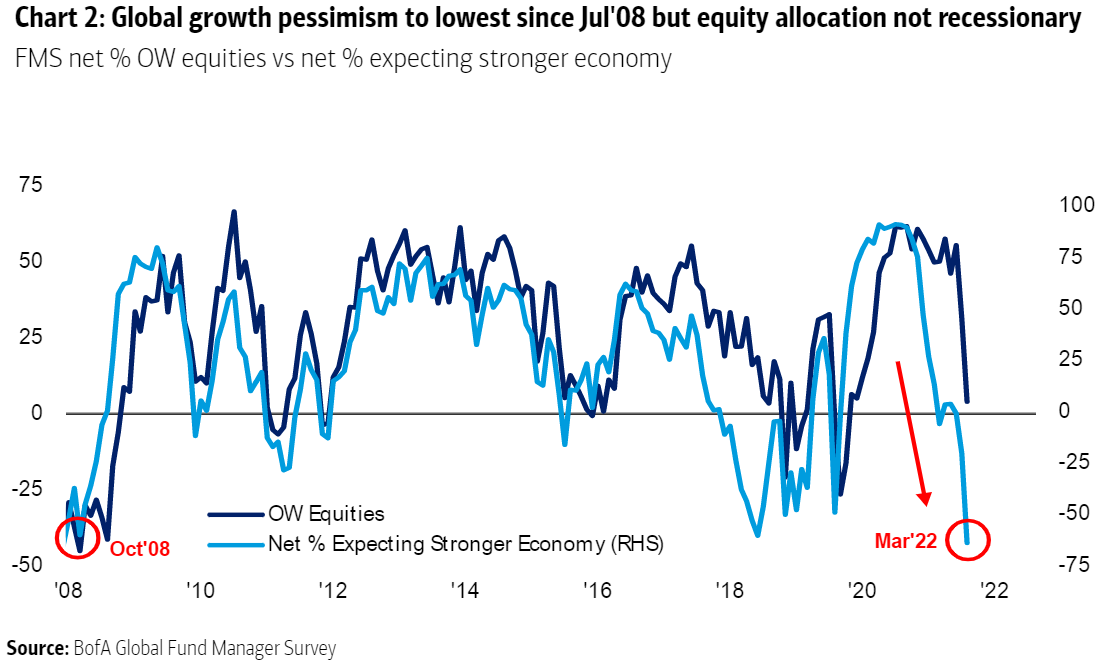

Optimism on global economic growth has tanked in spectacular fashion, and weightings to equities have also dropped — but the managers still say they are slightly overweight in equities overall. That may reflect their opinion on bonds:

Another very useful question asked fund managers to name what they believed the strike price of the “Fed Put” would be — in other words, the level to which the S&P 500 would have to fall to force the Fed into giving up on tightening money, and coming to the rescue of the stock market instead. There was a wide range of estimates, but the consensus puts the level at 3,636. That implies the Fed would let the market fall more than 24% peak to trough, and that it would need to fall another 14% from where it is now to change the Fed’s course:

As the chart shows, this still implies that the Fed would act when the stock market remained above its levels from immediately before the pandemic, so expectations may continue be too bullish for stocks.

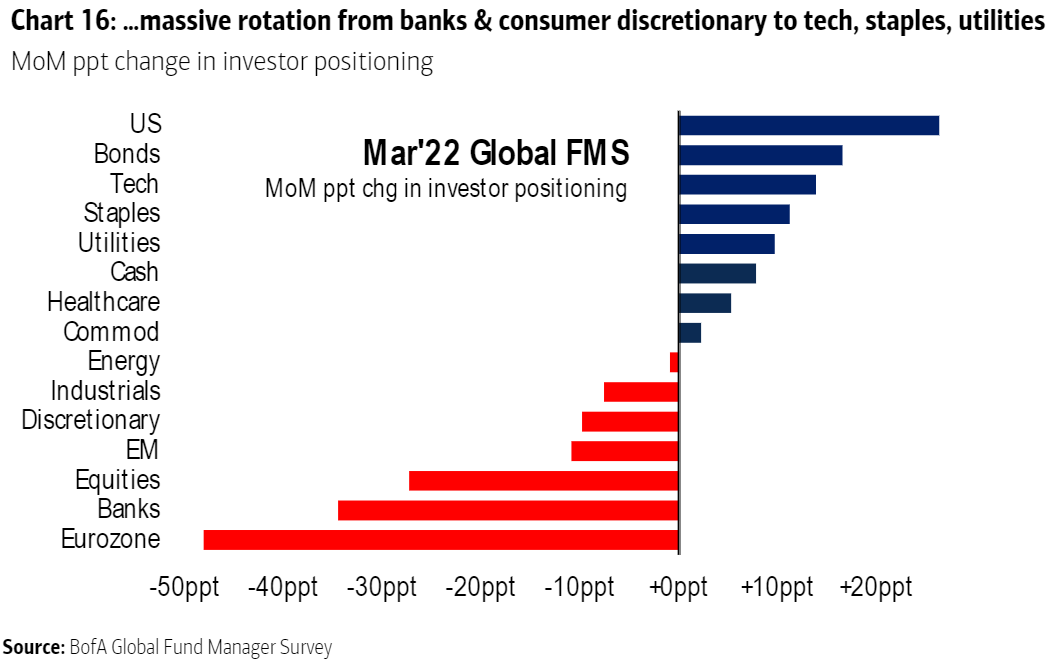

Investor response to the invasion has been dramatic. There has been a sharp swing out of the eurozone and into the U.S., and into those equity sectors that are currently regarded as lower risk, including technology:

But while this swing was huge, it only took asset allocation further in the direction it was already going. Compared to benchmark allocations, asset allocators are massively underweight in bonds, and the eurozone, while they are heavily overweight in cash and commodities. That gives them optionality in the event of further surprises, while a big weighting in commodities is prudent if inflation indeed keeps rising.