Uddrag fra Zerohedge:

There is a longer preview of what the Fed will likely say and do tomorrow, but up front we wanted to recap the main points from Goldman’s call this morning with Josh Schiffrin, the bank’s co-head of US and global rates.

- Tomorrow will be brief and to the point: the fed was unhappy with markets reaction to July hike (percived as dovish and potential pivot) … “we are hiking 75bps and are single minded in resolve to bring down inflation”

- Dot plot to offer quasi forward guidance, showing restrictive policy until around 2025 (recall in aug fed hammered home the idea that cutting rates in ’23 was the wrong takeaway)

- Rhetoric + dots will show us headed for fed funds rate >4% for some time

Here is flow trader John Flood chimes in that the base case is

- 75bps hike

- Hawkish commentary and dots 4.0-4.25% for 2022 and 4.25%-4.5% for 2023.

Today, the Terminal rate again ticked to 4.5% today. Which is why as Flood warns, “if 2023 dot comes in higher than this 4.5% mark the stock mkt will NOT like it.”

Of course, the good news is that most of this is already priced in: here is a quick snapshot of what the market has already priced in: 75bps fully, and 18% chance of a 100bps rate hike.

For those who have been sleeping under a rock this summer, Goldman’s Michael Nocerino recaps the market action over the past month:

SPX reached a high of 4325 back on August 16th after tapping up against the 200dma only to immediately fade [just as BofA’ Michael Hartnett said at the time would happen]. At that point, markets were running hot rallying over 16% off the July 14 lows to that August 16th technical stall (NYC was also hot with 10 days over 90 degrees in July). Markets have since retraced ~10% from that most recent peak, but overall the summer season has proven to provide solid returns of 6% after starting the year down nearly 23%. Now that we Fall back, one thing that hasn’t cooled is inflation.

FOMC tomorrow is the focus, but at this point I don’t think anyone is going to be fooled by at least a 75bps hike (market is pricing in only a ~20% chance of a 100bps). Once the capitulation happened into late August, we started to see HF positioning tick higher (See our PB data) with LO’s starting to put some cash back to work. This continue into the CPI print and our flows confirmed the move with LO’s leaning in with a heavy buy skew. Post CPI, everything unraveled as our flows flipped aggressively for sale, with HF positioning back in 2nd percentile and LO’s with record amount of cash on the sidelines.

That brings us to today where we’ve seen our second day of muted price action with flows neutral as the fact remains that US real rates are now the highest they have been for a decade and US mortgage rates at levels not seen since 2008. So what can we expect and what’s is going to take to get us to a soft-landing and investors back on their feet?

With all that in mind, here is an official preview of what the Fed will do tomorrow, courtesy of Newsquawk:

75 OR 100: The FOMC is expected Wednesday to hike the FFR by 75bps to 3.00-3.25%, with risks of a larger 100bps hike after the super-hot August CPI data shattered expectations for any imminent downturn in inflation. While the angst around CPI is deafening, it’s worth highlighting the decline in long-term inflation expectations (via UoM and NY Fed surveys), lower prices paid components in September Philly Fed and Empire State releases, and also the more contained August PPI data (which will keep the Fed’s preferred inflation gauge, Core PCE, more anchored) as factors that may temper some of the extreme hawkishness, ergo votes for 100bps.

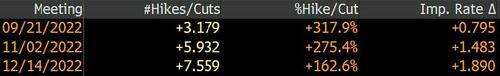

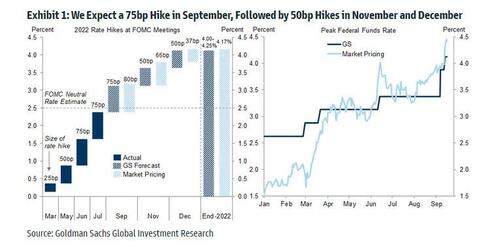

MARKET PRICING: Markets took down implied 100bps September pricing to near 15% in wake of the decline in the UoM consumer inflation expectations survey, although crept back up to 20% as of Monday. Money markets have priced in just shy of 150bps of hikes across the September and November meetings, with 190bps priced through December, taking the 2022-end rate into a 4.00-4.25% range up from 3.75-4% before CPI, while 215bps of tightening is currently priced into the terminal rate (March 2023) taking rates towards the top-end of the 4.25-4.5% range up from 3.75-4% pre-CPI. Markets are currently pricing a 2023-end Fed rate at 4%. In its preview, Goldman writes that it expects the FOMC to deliver a third 75bp rate hike on Wednesday, taking the funds rate to 3-3.25%. “The bond market is pricing a roughly three-in-four chance of a 75bp hike and a one-in-four chance of a 100bp hike instead. We expect the pace of tightening to then slow to 50bp in November and December, which would leave the funds rate at 4-4.25% at the end of 2022.”

A quick caveat from Goldman here: “a third “unusually large” hike would represent a reversal from the plan Chair Powell laid out in his July press conference to slow the pace of rate hikes in order to reduce the risk of overtightening. We see little net surprise in the economic data during the intermeeting period: activity growth has remained soft, and inflation and labor market data came in firmer than expected one month and softer the other.”

GUIDANCE: The broad-based upside seen in the August CPI (Core +0.6% M/M, +6.3% Y/Y, with services gaining momentum) broke what could have been more evidence toward a series of lower readings, a condition that would have allowed the Fed to start considering a slowdown in the pace of tightening. With the dovish runoff now closed, at least in the near term, the likelihood of the Fed hiking until the economy crashes, a ‘hard landing’, has increased further and markets have shifted to reflect that notion. Aside from risks of 100bps in September, another 75bps in November looks more likely. Fed officials have stressed their data-dependence and have on the whole been coy to tie their hands to guidance on the rate path. We can expect a reiteration in the statement, “the Committee… anticipates that ongoing increases in the target range will be appropriate.” Powell will likely be pressed on his preference for the November meeting in the press conference. Absent guidance, the data-dependent stance will instead see greater attention put on the SEPs.

DOT PLOT: The SEP (‘Dot Plot’) will be updated, since their last iteration in June, to show both a higher year-end and terminal rate with some desks in wake of CPI forecasting new dots that could reach heights of 4% (prev. 3.4% median in June) and 5% (prev. 3.8% in June), respectively, reflective of both the worsening inflation outlook and stubbornly tight labour market. Fed Governor Waller, to wit, “right now there is no tradeoff between the Fed’s employment and inflation objectives, so we will continue to aggressively fight inflation.” However, there is no clear consensus among analysts for the terminal rate, but forecasts are seen more common around 4.25%, with some dovish estimates pencilling in a terminal beneath 4%. A few are also forecasting rate cuts heading into 2024 and 2025.

Bloomberg compiled the following economist survey between September 9th-14th, meaning not all responses will incorporate the August CPI data, thus, these can be considered somewhat stale, with expectations for the Fed Funds and inflation dots having nudged higher since the data. Note this is also the first SEP release containing 2025 estimates.

Median dot expectations:

- FEDERAL FUNDS RATE: exp. at 3.9% in 2022 (prev. 3.4% in Jun), 4.1% in 2023 (prev. 3.8%), 3.6% in 2024 (prev. 3.4%), 2.9% in 2025, 2.5% in longer run (prev. 2.5%)

- CHANGE IN REAL GDP: exp. at 0.5% in 2022 (prev. 1.7% in Jun), 1.4% in 2023 (prev. 1.7%), 1.7% in 2024 (prev. 1.9%), 1.8% in 2025, 1.8% in longer run (prev. 1.8%)

- UNEMPLOYMENT RATE: exp. at 3.7% in 2022 (prev. 3.7% in Jun), 4.1% in 2023 (prev. 3.9%), 4.2% in 2024 (prev. 4.1%), 4.1% in 2025, 4% in longer run (prev. 4.0%)

- PCE INFLATION: exp. at 5.2% in 2022 (prev. 5.2% in Jun), 2.6% in 2023 (prev. 2.6%), 2.2% in 2024 (prev. 2.2%), 2% in 2025, 2% in longer run (prev. 2.0%)

- CORE PCE INFLATION: exp. at 4.5% in 2022 (prev. 4.3% in Jun), 2.8% in 2023 (prev. 2.7%), 2.3% in 2024 (prev. 2.3%), 2% in 2025

BALANCE SHEET: Fed officials are also likely to be increasingly cognizant of the restrictive effects of quantitative tightening (QT), both from a monetary perspective and a smooth market functioning view, with liquidity conditions in the Treasury market sitting at uncomfortable levels from a historical standpoint. These concerns have brought uncertainty about whether the Fed will go ahead with previous stated plans to consider MBS sales. Note, the runoff (allowing existing holdings to mature without reinvesting) has now accelerated to an annual pace of USD 1.1tln, while desks see the balance sheet shrinking to USD 8.4tln by year-end and USD 6.6tln in December 2024, based on the current plans.