ØU: i dag, tirsdag, kl. 14.3o kommer der data for USA detailhandelssalg i august, som er afgørende for FEDs rentebeslutning

Uddrag fra Bank of America/ Zerohedge

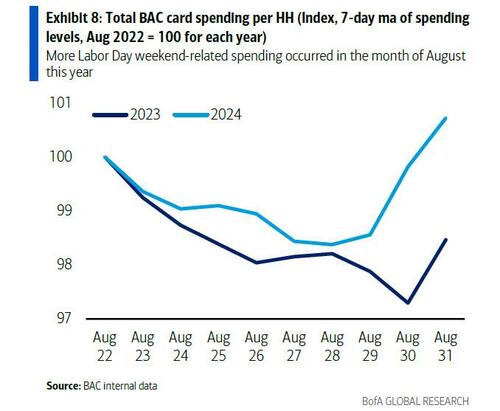

As BofA economist Aditya Bhave writes, even though total card spending as measured by BofA’s aggregate card spending, was up 0.9% in August, this was largely due to the early Labor Day holiday in 2024 (Sept 2) vs 2023 (Sept 4) which means more Labor Day related spending took place in August.

However, that particular boost will be eliminated by the Census Bureau’s seasonal adjustments, and as Bank of America proposes, when accounting for seasonal adjustments, card spending per HH was actually down 0.2% month-over-month (m/m) in August.

This translates into a 0.1% decline in the Census Bureau’s August estimates for both retail sales ex-autos and the core control group (retail sales ex autos, gas, building materials and restaurants). And since these figures are well below consensus, if the Fed is indeed waiting until the last minute to make up its mind, then 50 it is.

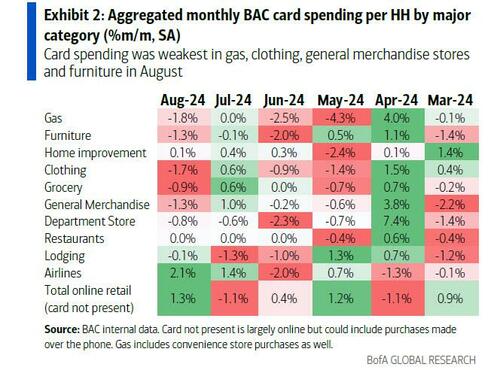

Looking at the details, gas, clothing, general merchandise and furniture were especially weak in August.

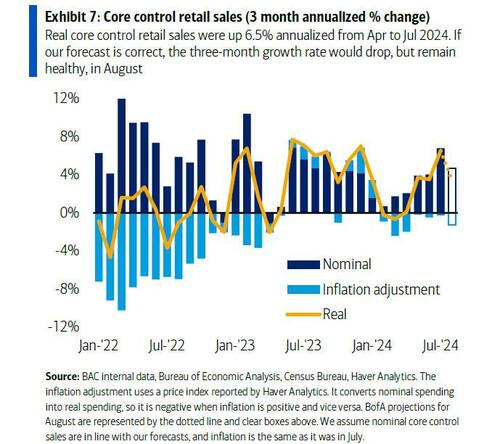

To be sure, real (inflation-adjusted) core control retail sales were up a remarkable 6.5% annualized from April to July. So according to BofA, little payback would be neither surprising nor concerning to us, however with the market on edge over any and every data point, a big miss tomorrow could send odds of a 50bps rate cut from 70% currently to 100%.

In any case, if the BofA forecast is correct, the three-month annualized real growth rate would drop to a still healthy 3.4%…

… which to BofA’s economists would be indicative of continued spending resilience among US consumers, and they “view it as supportive of our soft-landing outlook for the economy. In equal measure, if spending were to rapidly deteriorate, we would see much higher recession risks.”

So will the retail sales miss predicted by BofA card spending data be sufficient to trigger a 50bps cut? The bank itself does not think so, and expects the Fed to cut rates by 25bp in September, as “the Fed would look through a modestly weak result, attributing it to monthly data volatility or payback.” But what if the result is not just modestly weaker? The bank concludes that “it would take an extremely weak report, say around -1% on core control, and/or large downward revisions, to trigger a 50bp cut.”

Not even BofA’s downbeat card spending data suggests such a big miss.