Resume af teksten:

Federal Reserve har sænket renten med 25 basispoint til en interval mellem 3,75% og 4%, mens afviklingen af balanceoppustning afsluttes. Beslutningen, taget på baggrund af økonomisk udvikling og inflationspres, modtog modstand fra to embedsmænd med forskellige holdninger til rentesænkningen. December-rentenedsættelse er usikker, ifølge Jerome Powell, som påpegede voksende bekymringer over jobmarkedet. På trods af inflationsrisici og handelskonflikter mener markedet, at svækkelsen af arbejdsmarkedet kræver flere rentenedsættelser frem over. Forventninger til fremtidige politiske skridt påvirkede dollarkursen og obligationsrenter globalt. Samtidig justerer Fed sin tilgang til reservehåndtering ved at købe statsgæld. Dette skridt er designet til at opretholde stabilitet, mens de sigter mod fremtidig vækst uden at slippe yderligere likviditet løs.

Fra ING:

The Fed has cut rates again, but given tensions between its inflation goal, which remains above target, and its employment goal, it has warned that a December rate cut is not guaranteed. We still think they will end up lowering rates further

Jerome Powell speaks after the Fed cuts interest rates by a quarter point

25bp cut and QT being brought to an end

The Federal Reserve has cut the Fed funds target rate range by 25bp to 3.75-4% as expected. There were two dissenters – Stephen Miran (a Fed Governor), wanting a 50bp cut, and Jeffrey Schmid (Kansas Fed President), wanting a no-change outcome. There is nothing really surprising there. Miran voted 50bp last time, and Schmid has been the most hawkish official for some time. A second key decision at the meeting is that they will also stop shrinking their balance sheet from 1 December. They will reinvest all maturing Treasury securities that are on their books, while any maturing agency MBS will be reinvested in Treasury bills.

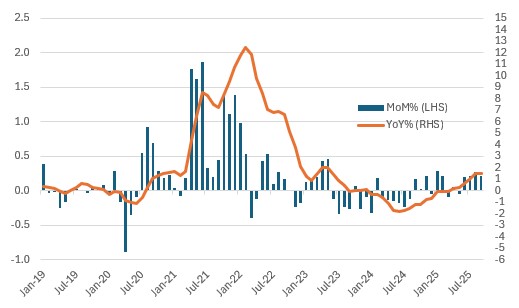

Core goods price inflation

Source: Macrobond, ING

Chair Powell suggests no guarantee of a December rate cut

In terms of the press release, they described the economy as expanding at a ” moderate pace ” while acknowledging that ” job gains have slowed this year ” and that “inflation remains somewhat elevated ” This assessment is the same as the last statement from September. They also repeat that ” downside risks to employment rose in recent months “. The statement also repeats that they are ” prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals “.

From that perspective, there is nothing really different to how they saw things 8 weeks ago at the September FOMC meeting. Then they were projecting a further rate cut in December, with another rate cut next year. However, Chair Powell suggested that there are a range of views about what happens in December and warned that a rate cut then is “ not a forgone conclusion… far from it” . Inflation remains a concern, with the sense that tariffs could yet materially come through, but the jobs outlook looks more challenged.

Despite this, the market continues to believe that a rapidly cooling jobs market will require more aggressive action. Around 85bp of further cuts, taking the Fed funds rate down towards 3%, are priced into Fed funds futures contracts for the end of 2026 versus the 100bp discounted before those comments.

We still look for a December move with two more cuts in 2026

In terms of the risks around this, the positive story is that looser financial conditions (lower Fed funds rate and Treasury yields, coupled with dollar weakness) support economic activity, and clarity on trade results in corporates starting to put money to work again, with a resumption of hiring and capex spending. In such an environment, inflation pressures are likely to be more of an issue, and we may get just perhaps one more cut.

The more negative take is that tariffs increasingly affect prices, squeezing household spending power and corporate profit margins. While it lifts inflation in the near term, the downturn in economic activity intensifies, with job losses becoming more widespread, dampening medium-term inflation. If we experience an asset price correction, either in home prices or equities, this will require much more aggressive action to support the economy, with policy rates cut to perhaps 2%.

Our view is that the inflation backdrop is looking less threatening than it did in early summer, with the slow tariff pass-through allowing disinflationary pressures from lower energy costs, slowing housing rents and cooling wage growth to mitigate the effect. At the same time, the jobs’ outlook is more concerning. We expect a December rate cut, and while we retain a moderately upbeat outlook, we think it will take at least two more rate cuts next year and further dollar weakness to achieve the required platform for growth.

The Fed moves to using T-bill buying more actively as a means to managing reserves

The Federal Reserve now plans to buy T-bills more actively as a means of adjusting reserves. This makes sense and is in line with our thinking. They will allow the MBS roll off to continue, offset by buying T-bills, leaving the overall impact on bank reserves balanced. That also allows them to increase reserves through T-bills buying if needed, just as they did in 2019 when things got tight. There is plenty of ammunition to do so as T-bills holdings are puny right now. Effectively, MBS bonds will still roll off the curve. Technically, then, they are not actually stopping QT. They are stopping the shrinkage of their balance sheet. The balancing factor here is the buying of T-bills – that’s what keeps the balance sheet from shrinking. MBS continues to roll off, albeit very slowly. The pace has been running at USD$15-20bn per month.

The backstory is one of prior heavy net issuance of bills, which has been affecting money market conditions. The Treasury cash balance has continued to grow, while reserves declined. Repo has been tightening up, and the funds rate has risen, partly due to competition among the various places where players can place cash. In the end, it’s a relative-value trade; upside pressure on repo — and, by extension, SOFR— presents a tempting bucket for liquidity. That said, the reserves position looks broadly balanced as is. And the Fed is neither providing nor withdrawing liquidity from the system to any great extent. However, Chair Powell did point to the gradually increasing use of the repo facility (where the Fed provides liquidity to the system). Not large, but a beginning of some tightness.

Long-end rates did not react well to all of this. T-bills buying is of no benefit to longer bonds as a stand-alone measure. MBS bonds confirmed as still rolling off. Also, longer tenors reacted to muted anticipation of a Fed cut in December from Chair Powell. The US 10yr yield had been hugging the 4% area, but post the various announcements and tone, it is back up at 4.05% and looking up rather than down for a change.

Dollar gets a lift from Fed discord

The initial release of the FOMC statement saw the dollar edge a little higher – presumably on Jeffrey Schmid’s dissent in favour of unchanged rates. But the dollar got a much broader lift during the press conference when Powell made the point that a December cut was not a foregone conclusion and that there were strongly differing views about future policy.

The fact that short-dated US rates may not be on a glide path to 3.00/3.25% has upset risk assets – be they equity markets or the newfound interest in emerging markets. A re-pricing of the Fed cycle will likely provide continued support to the dollar until, that is, we get a much clearer insight into the US labour market.

EUR/USD probably risks a move down to the 1.1500 area, and unless the Bank of Japan sounds surprisingly hawkish at tomorrow’s meeting, USD/JPY risks a move up to 155. The recent repricing of both the Bank of England’s and, now, the Fed’s cycles means it’s been a bad day for GBP/USD. Higher US yields will also drag UK Gilt yields higher – an unwelcome move for the UK government. 1.3140/50 is a big support area for GBP/USD, below which the move could extend to 1.2950/3000.

Emerging market currencies might be a little more insulated as we head into what should be a positive set of discussions between Presidents Trump and Xi tomorrow. And we doubt today’s less dovish reassessment of Fed policy will be enough to call an end to the strong interest in carry. Yet today’s message from the Fed that the policy rate may be closer to neutral than the market previously believed looks set to provide a brake to further nominal gains in EMFX.

And maybe, we should pay closer attention to Chris Waller’s speeches again. His most recent comments did hint at today’s outcome, after all.

Hurtige nyheder er stadig i beta-fasen, og fejl kan derfor forekomme.