By Joseph Carson, former chief economist of Alliance Bernstein

Federal Reserve Chairman Jerome Powell has played down the current runup in inflation, arguing it is associated with the reopening of the economy. And as the low inflation readings of one year ago drop out, the twelve-month calculation (i.e., the so-called base effect) of reported inflation is likely to move up in the coming months.

Yet, Mr. Powell’s “base effect” inflation argument is nonsense. For the “base effect” argument to be correct, the twelve-month reading of reported inflation should be markedly lower when the economy was closed than what occurred before the pandemic. But that’s not the case.

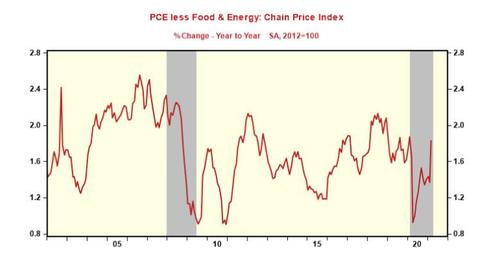

Last week, the Bureau of Economic Analysis reported that the twelve-month change ending in March 2021 in the core personal consumption index (the Fed’s preferred price index) was 1.83%. That compares to the 1.87% reading for the year ending in February 2020 and 1.7% for the year before that.

The 1.83% reading for twelve months ending March 2021 essentially matches the average inflation rate of the two prior years. And that 12 month period includes the three months (April to June) when the economy was closed, and GDP plunged a record 31% annualized. How could there be a “base effect” on reported inflation when the base year has the same inflation rate as it did before the pandemic?

Mr. Powell’s “base effect” inflation argument has not been questioned or challenged by analysts or reporters. Regardless of that, investors need to ignore the Fed’s rhetoric and treat upcoming price increases as “new” inflation.

As nonsensical as the explanation for the uptick in inflation, so too is the remedy. Demand has always been the primary force behind broad inflation cycles. Yet, Mr. Powell argues that product price inflation will ease once manufacturers increase output and eliminate “supply bottlenecks,” and home inflation will slow once builders build more homes.

It’s hard to see how more supply (or growth) will slow inflation anytime soon. Federal Home Loan Mortgage Company (Freddie Mac) estimates that the US needs almost 4 million new homes to meet demand. That could take two to three years. Also, it’s hard to see how increasing product output will solve the inflation problem. The supply-side argument solution; fight inflation with more demand and more commodity inflation.

The Fed’s mantra has always been “inflation is everywhere and always a monetary phenomenon.” But nowhere in Mr. Powell’s statements or comments do you find any monetary policy role for increased inflation or any responsibility for containment. Investors forewarned.