Uddrag fra Swissquote:

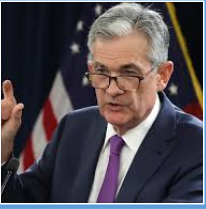

We could see the EURUSD gain further positive momentum this week, especially if Federal Reserve (Fed) President Jerome Powell delivers a dovish speech before the congress between today and tomorrow, and the latest CPI update from the US comes in sufficiently soft.

The first day of the testimony is always the most important day as we will get to catch the overall tone and the key messages. Some expect Powell to sound cautious regarding the progress on inflation and tell the US politicians to be patient until the Fed gathers enough evidence that inflation is on a solid path toward their 2% target. But there is a chance that he sounds slightly more optimistic and willing to cut the interest rates sooner rather than later pointing at the slowing economic growth and loosening jobs market – which will eventually help cooling inflation.

The US 2-year yield – which best captures the Fed rate expectations – sank below the important 4.70% support last week following a softer-than-expected jobs report from the US and needs a sufficiently dovish talk from Powell to consolidate and further fall. The market expects two rate cuts from the Fed this year, with a rising probability assessed to a September rate cut (nearly 80% before Powell’s testimony).

The US dollar index is under pressure since the beginning of the month, and could further fall with a dovish message from Powell – now that the safe-haven flows due to the French political risks are behind. At the current levels, the US dollar index is still in the bullish trend that has been building since the start of this year. The critical support to this year’s positive trend stands at 104.20, the major 38.2% Fibonacci retracement on this year’s rebound. A fall below this level should send the US dollar index into the medium-term bearish consolidation zone and support the major peers as a result.

Something must give.

The S&P500 and Nasdaq 100 hit fresh records yesterday and their journey is increasingly diverging from the economic data. The forecast for 12-month forward earnings for the S&P500 stands at an all-time high according to Bloomberg, the S&P500 companies are expected to deliver more than 9% EPS growth in Q2 and this number is expected to rise to double-digit territory later this year. Even the non-tech sectors are seen posting a positive growth. But Atlanta Fed’s GDPNow index predicts that the US economy may have grown just 1.5% in Q2, down from above 3% at the last quarter of last year and 5% the quarter before that. Something must give.