Uddrag fra Merill:

Five Triggers To Monitor For A New Equity Bull Cycle

Risk assets have come under some stress recently as an upside surprise to August’s consumer

inflation numbers have led investors to price in more resolute Fed tightening and therefore

higher interest rates for longer. Barring a significant pullback in core inflation (unlikely in our

opinion), portfolio returns in the quarters ahead are likely to underwhelm, and market volatility

should rise, as growth and corporate earnings disappoint.

Our long-held view remains that investors should rely on a disciplined approach to asset

allocation during periods of uncertainty and fade the tendency to time market developments, as

the opportunity cost is vast. However, to aid in the process of rebalancing and potentially putting

cash to work in the quarters ahead, investors should be mindful of signs that could ultimately

indicate the beginnings of a new equity bull cycle. This week, we explore five triggers specific to

this cycle that investors should follow, a combination of which could lay the foundation for the

next sustained equity market uptrend.

Trigger 1—Core inflation moves closer to the Fed’s target: With inflation well above

its 2% target, the Fed is (rightly so) continuing to tighten monetary policy at a historic

pace. Core inflation is currently at 5% to 6% levels and is likely to glide lower as we move

through 2023. However, Equities are likely to begin a new cycle when the Fed pivots to a

balanced focus on inflation and growth as opposed to its singular focus today on crushing

inflationary pressures. It may do this if inflation has moved reasonably closer to its target

(perhaps in the 3% range) and is directionally trending lower. Given that monetary policy

works with a lag, Fed officials may assume at some point that cumulative tightening

already in the system will eventually get them to a 2% inflation target.

Trigger 2—Labor market weakness peaks: Despite tightening financial conditions

and growing concerns about the economic outlook, the labor market has remained

exceptionally tight this year. The unemployment rate remains low at 3.7%, and wages are

rising at a brisk 5%. There are, however, some signs of it cooling, with many prominent

companies announcing plans to freeze hiring and even to institute layoffs. While jobless

claims have been trending lower since July, our expectation is that they will begin to rise in

the months ahead as the economy further loses momentum. A sustained rise in jobless

claims is likely to cool wage pressures at the expense of the economy, adding to the volatile

and uncertain environment for risk assets. Once the adjustment in the supply/demand

imbalance in the labor market has run its course, jobless claims should eventually peak when

employers see improving prospects for top line growth and hire again, providing a tailwind

for Equities.

Trigger 3—Corporate earnings downgrades stabilize: Earnings surprised to the

upside in Q2, with over three-quarters of companies in the S&P 500 Index beating

consensus estimates. But looking forward, cracks are emerging in the earnings picture as

downgrades are finally beginning to come through for the back half of 2022. Consensus

estimates for Q3 decreased by an above-average rate of 5.4% from June 30 to August 31,

marking the largest decrease in estimates during the first two months of a quarter since

Q2 2020. Estimates are also falling for 2023, but they remain far above our forecast

levels which assume a decline of 8%. Importantly, equity markets, to a large extent, may

not yet be factoring in weakening earnings dynamics.

Trigger 4—The U.S. dollar weakens: The U.S. Dollar Index is hovering near multi-decade

highs and several factors supporting dollar strength are unlikely to fade in the near term.

Tightening monetary policy, a global slowdown, geopolitical tensions and growing investor

risk aversion are keeping the dollar elevated, as it is generally seen by investors as a “safe

haven” during times of economic uncertainty. For the dollar to turn around, we would likely

need some combination of a peak Fed tightening cycle, less stress in the global financial

system, some stability in leading indicators for global growth, and a potential return of

investor risk appetite.

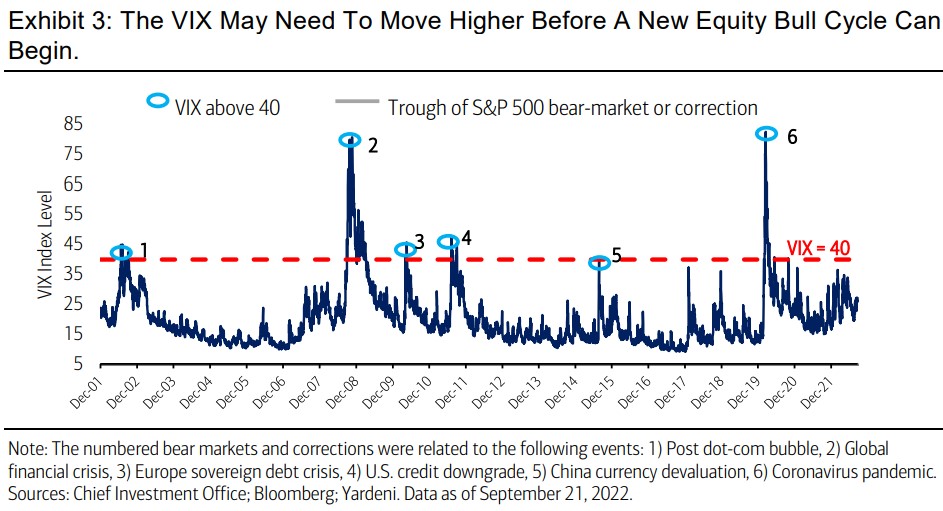

Trigger 5—Volatility spikes: Technical indicators like the Chicago Board Options

Exchange (CBOE) Volatility Index (VIX) are not yet at a level that would be considered a

turning point for Equities. One reason volatility, as per the VIX, may be low is that investors

still assume that the Fed may take its foot off the brakes when the economy deteriorates

more broadly. In our view, volatility is dormant but not dead and is likely to rise when the Fed

counters this investor perception by keeping policy tighter for longer. In the past, when the

VIX has topped 40, a trough in an S&P 500 bear market or correction has closely followed

(Exhibit 3). During major equity market selloffs like the 2008/2009 Global Financial Crisis and

the beginning of the pandemic, the VIX went as high as 80. But the VIX only reached a high

of around 35 this year during March and has since collapsed to 27, suggesting that more

volatility may be ahead before we can contemplate a new Equity uptrend.

Conclusion

Reviewing these factors in aggregate, it is our view that there may be more market churn

before Equities eventually converge back into a secular bull market trend. For long-term

investors, reset periods such as these are good opportunities to put capital to work in a

disciplined manner. Investors could consider adding to risk assets in seasonally weak periods

like September and October and then again as earnings estimates start to get reset toward

the end of 2022. There could be opportunities in the first half of 2023, as the Fed begins to

balance both its inflation and growth mandates (in words and certainly in action).