Derivatives reflect risk of heavy selling that could overwhelm smaller players

Retail investors have been flocking to equity markets as an unrelenting five-month surge in valuations suggests stocks are immune to the damage being inflicted on the economy by the Covid-19 pandemic.

The seemingly endless rally in US stocks gives the impression that prices are endorsed and supported by the entire professional investment community. After all, despite the vocal concerns over valuations having split away from underlying corporate and economic fundamentals, few fund managers have been willing to challenge the market by placing outright shorts.

But the outlook is much more nuanced in the derivatives market that sophisticated investors use to express more refined views.

Retail investors should take note.

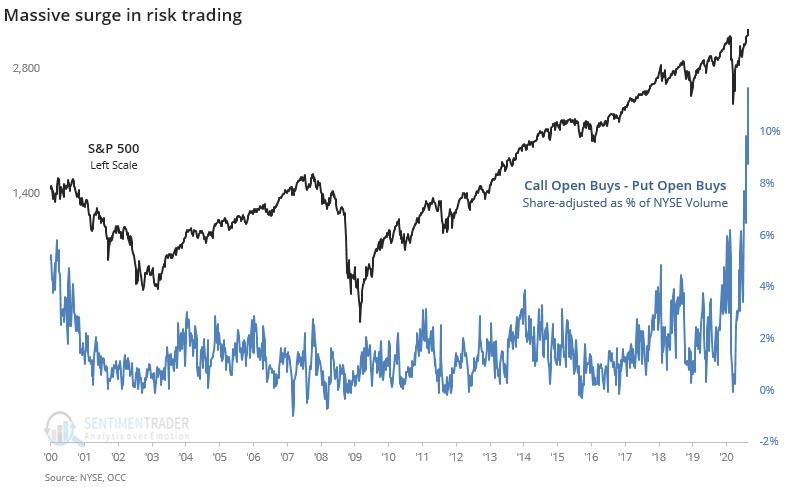

It is hard to overstate the extent of today’s risk-taking in US financial markets.

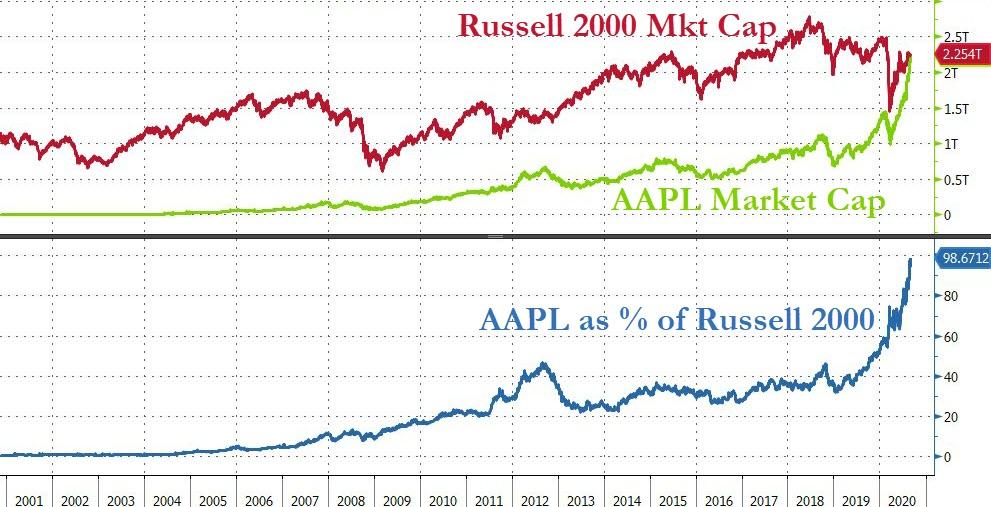

Dramatic single-name surges (think Apple and Tesla) have amplified stocks’ continuous march higher, producing a series of records for the tech-heavy Nasdaq and the S&P 500 index, in particular.

Agile millennial-friendly investment apps such as Robinhood and fractional equity-ownership programmes have also taken hold, part of a bigger phenomenon of lowering barriers to entry for small investors. Meanwhile, special purpose acquisition companies are springing up at a rapid pace, with operating spaces and expertise that are often defined poorly, if at all. Nearly $24bn has been raised so far by these blank-cheque vehicles, exceeding the 2019 record by 70 per cent.

This multi-faceted demand for risky investments has coincided with a dilution of the management of risk in conventionally diversified portfolios. Increasingly, the mitigation role traditionally played by government bonds is being replaced by a significantly higher use of corporate debt. This all comes during a period of record-setting corporate bond issuance at exceptionally low yields, affording thin compensation to investors taking on more exposure to potential defaults in a bankruptcy-prone environment.

Much of this could be seen as market deepening were it not for one troubling fact: corporate and economic fundamentals have yet to reflect a sustained and convincing recovery from Covid-related damage.

- The bounce in consumption is moderating.

- Initial US jobless claims are back at the one million level for a second straight week.

- The recovery in mobility, retail traffic and other high-frequency indicators has eased.

- Bankruptcies are rising.

- And with Congress yet to agree on a new relief package, the risks are rising that short-term disruptions will become deep, long-term scars.

Rather than a well-thought-out bet on the future, stocks reflect many investors’ resolute faith in a consistently favourable and predictable liquidity environment. It is a backdrop anchored by reliable stimulus from central banks – a condition that was further reinforced by last week’s speech from Jay Powell, the Federal Reserve chair. Many analysts interpreted it as a hard-wiring of what was until now seen as data-dependent dovishness by the central bank.

On the face of it, the derivatives market tells a similar tale. Those who would normally short the market on concerns of excessive valuations appear to have no desire to be steamrollered once again by favourable liquidity and the strong “buy-the-dip” conditioning that comes with that. However, that comes with important qualifications.

Over the past few weeks, the fear of missing out on an unceasing equity rally has increasingly been expressed through call options — contracts that give the right to buy at a fixed point in future — rather than straight equity longs.

That limits the amount at risk and gives users the ability to capture rallies.

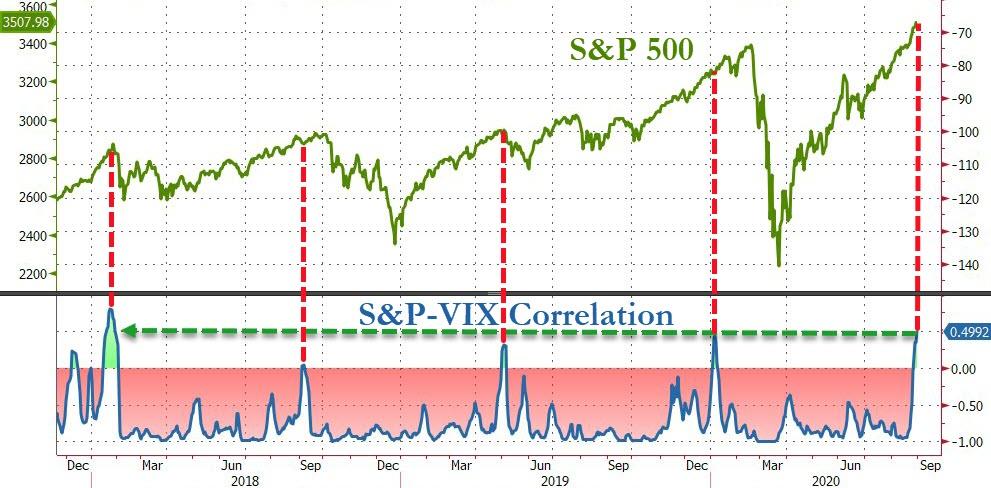

It has been supplemented by more downside “tail protection” aimed at safeguarding portfolios from sharp drops. With that, the Vix volatility index has decoupled from equity indices, adding to signals that a large market correction, should one materialise, would encourage more professional selling that could overwhelm the buy-the-dip retail investor.

This is a potentially troubling situation for central bankers, regulators and economists.

Yes, it would take a big shock for markets to move significantly lower — such as a renewed sharp economic downturn, a considerable monetary or fiscal policy mistake, or market defaults and liquidity accidents. But should such a move occur, the likelihood of further market turmoil would be high, especially given the current lack of a short base to buffer the downturn