fra Zerohedge:

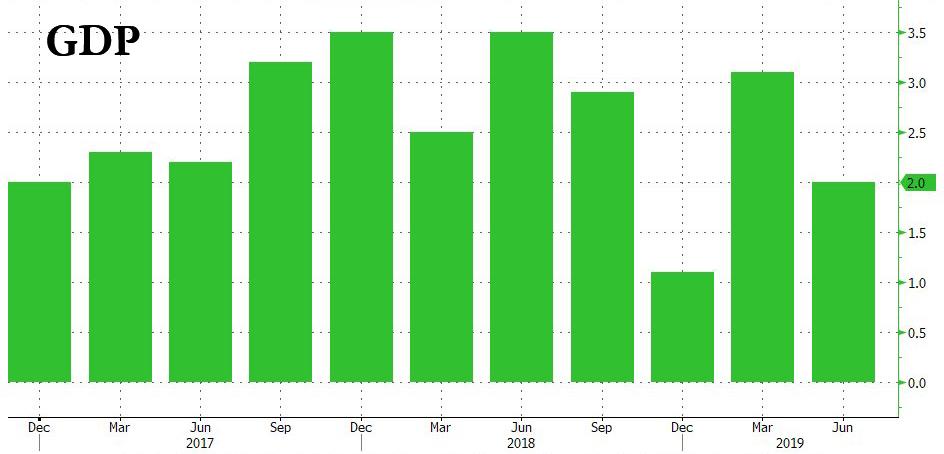

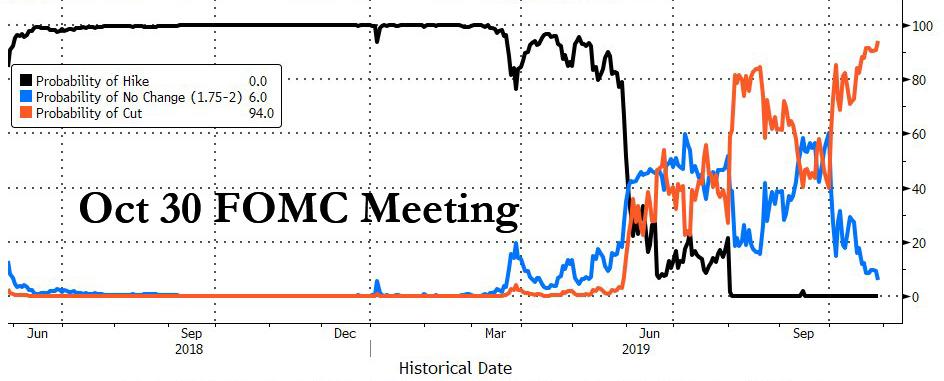

US equity futures and European bourses are unchanged as traders hunker down ahead of two key events: today’s Q3 GDP print, which at 1.6% expected, would be the second lowest print of the Trump presidency, but far more important will be today’s “hawkish cut” by the Fed, which the market prices in with 94% certainty, but the question is what happens after this 3rd consecutive “insurance” cut, and will the Fed admit the US is headed for a recession with more rate cuts this year of ahead of the 2020 presidential elections.

Global shares slipped off 21-month highs on Wednesday as the fully-priced in prospect of a rate cut was offset by reports a Sino-U.S. trade deal may not take place in November, but a possible $50 billion merger between Fiat-Chrysler and PSA capped European losses. US equity futures struggled for traction after the S&P 500 slipped from a record on Tuesday.

With stocks hitting an all time high just before lunch on Tuesday, broader sentiment was undermined after Reuters quoted a U.S. official as saying an interim trade agreement between Washington and Beijing might not be completed in time for signing next month. That weighed on trade-sensitive tech and commodity shares in Europe, and MSCI’s world equity index edged down after five successive sessions in the black.

Europe’s Stoxx 600 Index was unchanged, rebounding from an earlier drop, as banks weighed on the gauge, with Deutsche Bank tumbling more than 6% after reporting a loss for the second consecutive quarter, while Banco Santander SA also pulled down Spain’s benchmark index after earnings. The Stoxx 600 Bank Index was testing its 200-day moving average as earnings from Deutsche Bank and Credit Suisse weighed down the sector. The gauge is down 1.4% on Wednesday, flirting with the key support level, with Deutsche Bank down 5.6% and Credit Suisse falling 2.4%. Santander was also down 5.2% as the stock goes ex-dividend and earnings also lack investor excitement. The SX7P index was just able to trade back above the long term average in October for the first time since May.

European stocks were supported, however, by the auto index which rose 0.7% after news that PSA Group and Fiat Chrysler Automobiles NV were in talks for a merger that would create one of the world’s biggest companies. Fiat Chrysler and French PSA shares jumped 7-8% each. CMC Markets chief market strategist Michael Hewson, said the deal news had not sharply lifted shares because regulatory hurdles remain, not least the French government’s stake in PSA. “We’ve seen a lot of companies exploring M&A and I struggle to understand why this deal in particular is any more probable than the one with Renault,” he said, said referring to Fiat’s failed attempt to acquire another French carmaker. M&A aside, Germany’s Volkswagen provided a reminder of slowing global demand, and cut its 2019 sales outlook. Its shares slipped 0.7%.

Earlier in the session, Asian stocks retreated, snapping a four-day rising streak, as investors digested a raft of quarterly earnings while awaiting the Federal Reserve’s rate decision. Markets in the region were mixed, with Australia leading declines and India advancing. Material and technology were among the weakest sectors. The Topix added 0.2%, supported by Shiseido, Fujitsu and Shimano. Sales at Japanese retailers jumped in the month before October’s sales tax hike. The Shanghai Composite Index closed 0.5% lower, with China Merchants Bank and Kweichow Moutai among the biggest drags. China is facing a wall of maturing debt with a record amount of local-government notes due in 2020. India’s Sensex climbed 0.5%, heading for its highest close in almost five months, amid optimism that companies have weathered the worst of an economic downturn. A report that the government is considering scrapping a dividend tax also buoyed sentiment.

It’s been another very busy day for earnings, where highlights were as follows, from Bloomberg:

- Total SA’s third-quarter profit beat analyst estimates and cash flow held firm.

- Airbus SE cut its full-year delivery target and said cash flow will be lower than expected.

- Deutsche Bank AG saw earnings from trading debt securities and currencies drop 13%, compared with gains at all big Wall Street peers. Revenue from its remaining businesses fell 4%.

- Credit Suisse Group AG posted better-than-expected top line growth and profit.

- Standard Chartered Plc generated 19% more revenue in Europe and the Americas in the third quarter.

- Volkswagen AG lowered its outlook for vehicle deliveries this year on a faster-than-expected decline in auto markets around the world.

- Sony Corp. boosted its profit outlook for the year.

Besides today’s poor GDP print, which is expected to shrink from 2.0% to 1.6%, the second lowest since Trump became president…

… caution has also crept in before the U.S. Federal Reserve announcement at 2pm. While rate futures price a 94% probability of a 25 basis-point cut on Wednesday (with some warning that this may not even happen)…

… markets are fixated on what message the central bank will send, and December rate cut expectations have ebbed in recent days. “The Fed could be quite hawkish in terms of ‘this is it’ and send a message markets don’t really want to hear. They are pricing the Fed on a full-blown cutting path and that may not be what the fed wants to convey,” Hewson said, noting still-robust U.S. growth and booming stock markets.