ABN Amro hæfter sig ved, at formanden for den amerianske centralbank på det nylige pressemøde fokuserede meget på politikerne og Kongressen. Der er behov for mere direkte støtte til økonomien, og den skal komme fra Kongressen og ikke fra centralbanken. Mange mener, at centralbankerne er den vigtigsteb aktør under coronakrisen, men der kommer altså andre toner fra amerikanske Fed.

Uddrag fra ABN Amro:

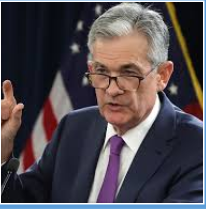

Fed puts the ball in Congress’ court

Blurring the monetary-fiscal boundaries – Indeed, in his press conference, Chair Powell was surprisingly outspoken about fiscal policy, making statements that Fed governors in the past would have refrained from. Most strikingly, and contrary to the usual concerns expressed over government debt sustainability, Powell said that now ‘is not the time to be concerned on federal debt’, and in his opening statement, he emphasised that the Fed has ‘lending powers, not spending powers’, and that ‘direct fiscal support may be needed for many.’ Reading between the lines, we think Powell is putting the ball squarely in the court of Congress and fiscal policy, while indirectly signaling that the Fed will accommodate such spending through its ongoing asset purchases.

Fed View: Stronger rate guidance in the pipeline – The FOMC refrained from making any policy changes at the 28-29 April meeting, keeping the fed funds rate at its effective lower bound of 0.00-0.25%, and maintaining that it would continue to purchase assets in unlimited quantities. The accompanying statement contained a commitment to keep rates at current levels until it is “confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.”

The language of this commitment is rather weak and vague, and Chair Powell in his press conference appeared to acknowledge this when questioned about it, stating that the question of guidance is under active discussion in the Committee, and hinting that stronger guidance would be forthcoming when there is more certainty over the outlook.

The statement reiterated the commitment to purchasing assets “in the amounts needed to support smooth market functioning,” though, contrary to our expectations, it refrained from providing more explicit guidance on the pace of purchases, only stating that the Committee “will closely monitor market conditions and is prepared to adjust its plans as appropriate.”

We think the Fed will continue to slow the pace of purchases over the coming weeks, though it could well increase that pace again should bond market volatility return – in the event, for instance, of a new fiscal support package from Congress. Alternatively, it could step up purchases again if there is a significant correction in risky assets, which leads to a resumed tightening of financial conditions.