Uddrag af analyse fra Seekingalpha

Market concerns and why they are overstated

Despite the attractive strategy and competitive advantages of Pandora, the stock has sunk an abysmal -22% YTD. The main concern of the market seems to be future growth prospects, especially in the US, but I believe these concerns are vastly overstated.

Market concerns generally relate to the US, where Pandora generates almost 25% of its revenue. The central investment thesis for Pandora short-sellers (as I interpret it from articles, company conference calls, and bearish broker reports) seem to be that sales in the US will decrease soon, and that the development in other mature markets will emulate that of the US, meaning that sales should fall in Western Europe and developed Asia shortly after that. There are two important points of contention here:

1) Will Pandora necessarily become out of favour in the US in the short-term? (I certainly do not think so)

Anyone who follows the sector will know that the current retail environment in the US is fairly rough, as Macy’s, J.C. Penney, Sears and Kmart have all announced sweeping store closures in 2017. The “Death of Malls”-narrative has become ever more prominent, and in turns seem to be affecting companies that is relatively isolated from this phenomenon – namely Pandora. Pandora’s 304 US concept stores are almost exclusively present in high-end malls (70% in A-rated malls, 29% in B-rated malls, according to Pandora’s America division), which are set to see much lower closures rates than C and D-class malls.

On the contrary, while only 30% of US malls are considered A-class, they generate more than 75% of revenue according to Fung Global Retail & Technology, and they will thus likely benefit from developers doubling-down with significant re-investments in their resilient assets. Pandora does have presence in lower rated malls through third-party stores (more than 1500 third-party POS in total), but the company’s long-term vision is to reduce these significantly as part of their “Scale, then brand”-strategy. It is thus not Pandora’s intention to rely on lower-rated malls, making it less concerning that these are increasingly shut down.

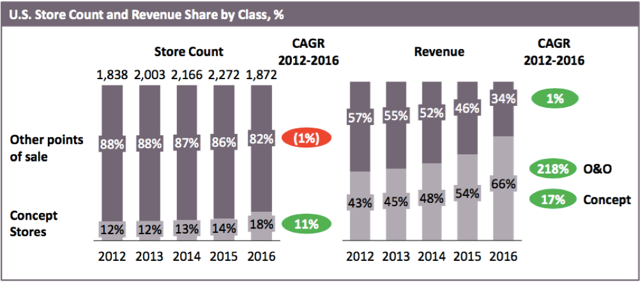

Source: Company presentation

Aside from the “Death of Malls”-narrative, investors seem to focus exclusively on like-for-like sales as opposed to total sales growth, asserting that Pandora will soon run out of network expansion opportunities and thus having to rely exclusively on same-store sales. This is a simplification, in my view, as the “Scale, then brand”-strategy enables Pandora to undertake a “second round of expansion” by either upgrading their third-party network POS to a dedicated shop-in-shop or open their own concept store in the area.

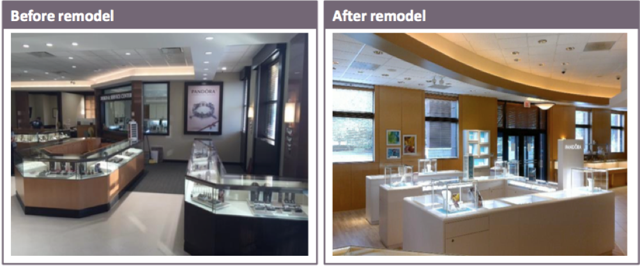

As is visible from the graph above, Pandora concept stores generate much of the revenue and are, according to Pandora, also significantly more productive in terms of sales per sqft. compared to third-party stores. Dedicated shop-in-shops are likewise more productive, as the shop-in shops have a nicer light environment, touch-and-feel display and a dedicated Pandora staff. Pandora envision to rely on these two types of stores in the long-term, as they enable Pandora to maintain full control of the brand and offer customers a uniform brand experience.

Source: Company presentation

Source: Company presentation

The last point that short-sellers seem to tout is the “Charmageddon”-narrative, suggesting that charm bracelets are a fad that will die out sooner or later, thus killing off Pandora’s growth story. While this has been a theme since Pandora’s IPO in 2012, short-sellers gained legitimacy with the weak performance of charms (up 1% in local currencies) and bracelets (down 7% in local currencies) in Q1 2017. There are, however, two reasons for this drop, one that should woo investors and one that should make them somewhat cautious.

First, Pandora has elected to promote heavily their other product categories such as rings, necklaces and earrings at the expense of charms and bracelets. This is, in my view, a smart marketing allocation, as the company can only transition to a global jewelry giant by having a full-scale assortment for every customer need. It likewise reduces risk in the, in my view, unlikely case of a “Charmargeddon.”

As Pandora is heavily dependent on branding and advertising, it is unsurprising that this allocation has led to meek growth for charms and bracelets but strong sales growth in the other categories in Q1 2017 (Rings: 41%, Necklaces: 57%, Earrings: 57%). Second, Pandora flagged, even before the valentine collection 2017 was in stores, that the collection had not been as innovative as they had hoped, and that would therefore weigh down on the season’s traditionally strong charm and bracelet sale.

While it’s slightly concerning that a fashion company felt that its product offering was weak, it’s important to note that Pandora has taken action by establishing an additional design team in Milan, Italy, and divert more advertisement attention to the bread-and-butter charm products.

2) Will the development in other markets necessarily follow that of the US? (Again, hardly a given)

It seems foolish to discount Pandora’s global future growth based on recent softness in the US market (which has its explanations, as shown above). While the US market is not delivering the staggering growth rates we have been used to, other markets certainly are. In local currencies (LC), France grew 15%, Italy grew 23%, Australia grew 18% and, most importantly, China grew 125%. These four markets generated 30% of revenues in Q1 2017, more than the c. 24% that the US generated.

It’s interesting that the stock is down 22% YTD on fears of a Pandora-specific slowdown in the US, a market troubled by an across the board difficult retail environment, whereas the strong growth shown in other markets are highly discounted and presents a buying opportunity. Especially interesting is the Chinese market, as Euromonitor Research puts the country’s jewelry market at twice the size of the US, the second biggest in the world. While already posting record growth here, Pandora still has ample opportunity for store expansion. Pandora currently has 117 concept stores in China, very few relative to 114 stores in much smaller Australia.

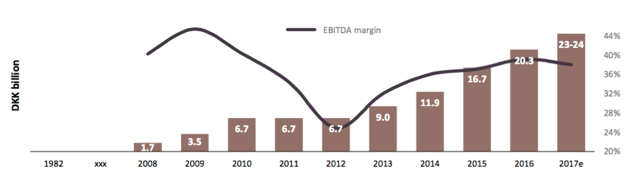

Given the multiple growth avenues for Pandora, be it through store-upgrades in the US, increased product diversification or network expansion in unsaturated markets, Pandora should be able to carry on its impressive growth history. It therefore also seems unreasonable that the current stock price, using a reverse DCF, indicate expectations of low single-digit growth and significantly deteriorating EBITDA-margin.

Valuation:

At the time of writing, Pandora trades around 710DKK/share, which corresponds to a very low 12-month trailing P/E of 13.5x. This is half of Tiffany’s 26.7x trailing P/E, despite Tiffany’s posting -3% sales growth for the past two years compared to Pandora’s 21% and 40% growth in 2016 and 2015, respectively. Tiffany’s also have a significantly lower EBIT-margin of 16.2% in Q1 2017, less than half of the 33.3% EBIT-margin Pandora enjoyed in the same period.

I believe this suggests that Pandora’s impressive growth track record is being massively undervalued by the market. On top of the available capital gains, Pandora is issuing dividends of 9DKK each quarter in 2017, implying a dividend yield of 5.1% at current valuation. This is in addition to a buyback of DKK 1.8bn, which at current valuation responds to a 2.25% yield. That’s a total 7.5% shareholder return in 2017!

With attractive cash returns and a massive multiple discount relative to key peer Tiffany’s, Pandora looks like a good buy. This is underlined by a reverse DCF to check the market’s expectations to the stock, and whether these are appropriate (disclaimer: they are overly pessimistic).

Using a cost of capital based on current debt cost of 2%, market-risk premium of 7% and risk-free rate of 0.5%, the current share price of c. 710DKK indicates that the market expects only 5% growth in the short-term as well as a massive EBIT-margin deterioration of roughly 500bps relative to guidance (36% guidance and 31% to reach 710DKK share price). EBIT-margins has been steadily increasing for the last 5 years, and it’s understandable that market participants doubt Pandora’s ability to further expand this.

However, Pandora are still making active investments in Thailand to increase scale in production, suggesting that they will at least be able to maintain margins by offsetting other adverse movements by further scale. Similarly, Pandora has delivered sales growth of 35%, 33%, 40% and 21% over the last four years (see 5-year highlights in 2016 annual report), and an immediate drop to mid-single digit growth seems overly pessimistic, especially in the light of the avenues of growth available to Pandora.

By using, in my opinion, more reasonable assumptions on sales growth (gradual ramp down from 20% to 3% in the long-term) and EBIT-margins (gradual ramp down from 35% to 32% in the long-term) yields a stock price of DKK 1152 and an upside from current stock price of 62.5%.

Conclusion

With its proven strategy, solid competitive advantages and a growth story with multiple levers, Pandora is an enormously attractive buy at current valuation levels. In my view, Pandora has multiple years of strong double-digit growth left thanks to potential store upgrades in the US and solid traction in the world’s biggest jewelry market, China. With current valuation levels requiring only mid single-digit growth to be sustained, as well as a sizeable margin deterioration, the Pandora stock has enormous upside potential (62.5% in my DCF). Buying Pandora will thus add growth at a reasonable price to your portfolio.