Fra Zerohedge

Germany’s Bundesverband der Deutschen Industrie (BDI) warned Thursday that economic growth in Europe’s largest economy was “stuck in a recession,” with little hope of an economic rebound.

BDI said economic growth in Germany would continue to decelerate in 2020 as there are no signs of improvement in the struggling manufacturing sector.

“Industry remains stuck in recession, and there are no signs for the sector bottoming out,” BDI President Dieter Kempf said Thursday.

BDI forecasted economic growth at 0.5% in 2020, adding that adjusted growth will print around 0.1%.

Kempf said the government needs to increase public investment in infrastructure as a countercyclical buffer against the slowdown. He also said tax cuts are needed for corporations.

The warning from BDI comes as Germany’s economic growth rebounded slightly in the fourth quarter but slowed last year to its weakest level in six years as trade tensions escalated, exports plunged, and a steep downturn in the automotive industry was seen.

Official government statics show Wednesday morning that GDP growth rate in the last three months of 2019 was 0.6%, the lowest since 2013’s 0.4% expansion.

Germany narrowly avoided a recession late last year as GDP contracted in the second quarter and expanded by 0.1% in the third.

Industrials and exports power the economy, and with a global manufacturing recession still underway with a declining China – the hopes of a massive rebound in Europe’s largest economy are limited this year.

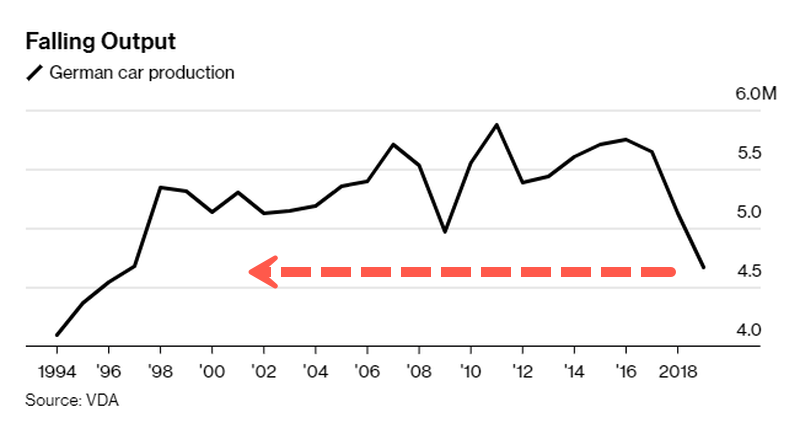

At the center of the global industrial slowdown is the auto manufacturing industry. Germany has yet to diversify from building cars and is still heavily exposed to global crosscurrents that persist.

Nearly 400,000 jobs could be cut from the German automotive industry in the next ten years as the slowdown in the economy is likely to continue.

BDI’s warning of a deepening manufacturing recession is bad news for everyone who bought stocks with the hopes of an economic rebound in early 2020.