“Life is about losing everything. Gracefully..”

The headlines say it all this morning… Everything from negative oil prices, to Richard Branson offering Necker Island as collateral to bail his airlines – too late; Virgin Oz (which was high on our list of likely airline failures) went down last night. I’m reading about farmers pouring milk down the drains even though we’re crying out for it. Unemployment going through the roof.

If I were the Italian prime minister, I would be reading “The Last Bluff”, the story of how Greece flirted with financial catastrophe and its plan to exit the Euro. It’s a good plan when facing an “all or nothing” crisis-meeting to be forewarned for the moment you storm out the room. (Or, slam down the phone – as will probably happen at Thursday’s virtual EU meeting.)

It’s what you aren’t reading in the news that’s most important.

We assume financial disasters are triggered by financial foolishness; some grandiose investment mistake, a butterfly flapping its wings, or greedy bankers. Not this time.. This time it really is different.

The COVID shock has been sudden and severe. Governments and Central Banks have thrown the kitchen sink at the problem (some less accurately than others). Financial markets are behaving like they think it’s a quick fix.

The scare stories in the media don’t help. The fact the hospitals have coped is great news – after we were primed to expect disaster. But have you noticed how suspiciously some people eye you as you pass on your daily walk? They reckon if you come closer than 2 meters, you’ve effectively already murdered them. Panic buying (bananas have disappeared in Hamble), is another example.

But fear of the virus is not really the problem. Its fear of the future.

This is hitting everyone, every individual on the planet at the most basic level. Everyone is considering just how bad this might get. And never forget – most consumers are only a couple of pay-checks short of financial disaster. Not their fault – that’s the way the system is biased. If we all had lots of money, none of us would be rich.

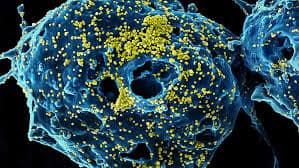

Although the virus rates appear to have peaked, we still don’t know when we can fully reopen economies. We don’t know about second waves, or RNA mutations, or whether herd immunity is real or not. There are no guarantees about a Vaccine in 6-9 months, new treatments or drugs. Some reports think social distancing could continue for years – spelling the end for aerospace and tourism which account for 14% of global GDP. There will be crisis for a host of other sectors also.

We know all that…

But are markets really accounting from the damage at the individual level?

If you want to form a picture of what’s really happening, you could pick up the phone and talk to your neighbours and friends. Ask them about how they are doing financially, and how confident they feel about the future.

Everyone can tell stories – few of them are positive.

Mine include one of my former crew who is an airline skipper, expecting their first child – salary cut and furloughed while the airline is likely to go bust. Another young friend has seen his income tumble by 80% leaving him and his very young family in crisis as the struggle to pay the mortgage on their tiny London suburban house that cost just slightly less than Necker.

Friends with small businesses are fuming about the seas of Red Tape they are encountering trying to access government loans and the Furlough scheme. One of best chums could well be bust well before the bailout comes – and it won’t be his fault that companies that owed him money cant’ pay, won’t pay or have gone bust. Even the optimists are worried. Universities are looking over-extended into the crisis. A chum in private medicine reckons his organisation will be nationalised.

From the graduates who joined the market last year to the mightiest financial titans among the Porridge readership – you will all know people who are genuinely struggling. Add your own stories of financial pain to the picture, magnify then across the UK, the US and the Global Economy, and you get a glimpse of just how deep the COVID depression is likely to go. The collapse in confidence is issue that’s really unprecedented about this crisis.

It means consumers won’t be consuming… Demand Shock.

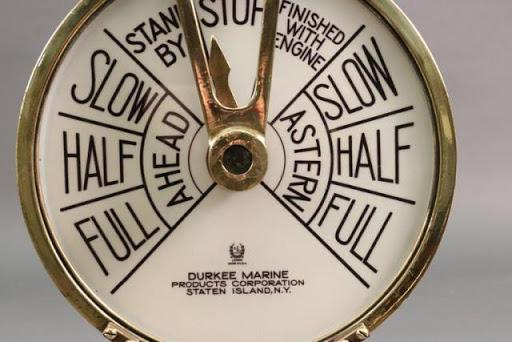

Over the coming months we are going to see global business adopt survival mode. It won’t be about reopening stores and factories. It will be about paring costs to the bone to withstand a massive, potentially long-term, global depression. There is no point talking about V-shapes, or a Nike-tick recovery. This is shaping up to be the ultimate economic shakedown. This could become economic FULL STOP.

That is why the authorities have thrown the rules out of the window, desperately trying to keep economies functional with unlimited money drops and support. But, it wont be all they have to do. There are simply not enough helicopters to save everybody. We are going to see deepening financial hardship with potentially millions unable to pay mortgages, credit cards, student loans, and bills. Governments will need to consider massive debt writeoffs, which could mean the de-facto nationalisation of banking systems to cope.

Most nations are too dollar linked to survive intact. To avoid a global sovereign debt crisis beyond the most fervid imaginations of Bosch, we’re likely to need a vastly empowered and financied IMF to cope – IMF’s $1 trillion lending power is not all it is cracked up to be. Dust off these plans about global sovereign debt forgiveness!

Of course… things are never as bad as we fear they might be… most of the time.

OIL

Very quick comment on oil as this is very well covered in the press. The supply storage issues that drove WTI crude as low as negative $40 last night could well be magnified and repeated next month. Oil keeps pouring out the ground, and no one particularly wants it. It has to go somewhere, and the US is running out of space.

Some say Oil’s a good proxy for global recovery, hence the money we’re seeing flow into Oil ETFs – but that’s a really bad way to play oil. Buying longer dated oil futures isn’t looking so attractive. If you are think of a speculative punt in oil – read this first: Sub-zero Oil prices threaten big-losses for ETF investors.

The really interesting question about oil is which US Producers have taken the biggest hits from the current crisis. I suspect a swathe of mid-size US oil firms just bit the dust. I guess we will find out when the banks announce rising provisions against oil industry losses. More pain.