The world is past the era of growing crude oil demand, BP said in its annual energy outlook report, which was released today.

The message of the outlook, according to media reports, is that oil consumption may never recover to pre-pandemic levels, and not just because of the pandemic itself but because of factors that have been at play long before the coronavirus made the jump from bats to humans.

“Demand for oil falls over the next 30 years,” the company said in the report.

“The scale and pace of this decline is driven by the increasing efficiency and electrification of road transportation.”

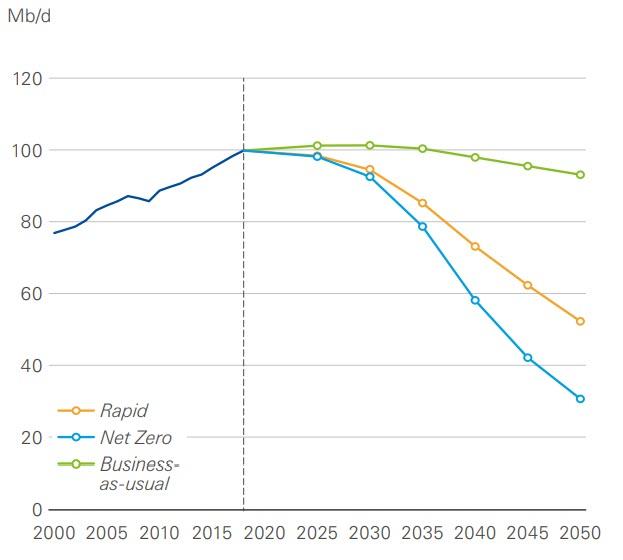

In the report, BP looks at three scenarios for the future of oil demand: Business-as-usual, Rapid, and Net Zero. None of them envisage growth in oil demand over the long term. The most optimistic one—from the oil industry’s perspective—is the business-as-usual scenario, which sees demand recover from the pandemic’s effects but plateaus in the next few years before beginning to decline.

Yet this scenario, which envisages government policies being adopted at the rate they have been in the recent past, may not be the most likely one. Many governments have pledged increasingly aggressive environmentalist agendas that will see policies applied much more quickly. If these scenarios play out, oil demand will never return to pre-pandemic levels, according to BP. This means demand will have peaked in 2019, at a level of about 100 million barrels daily.

Under BP’s Rapid scenario, demand for liquid fuels will drop to 55 million bpd by 2050, with the scenario also factoring in a 70-percent reduction in emissions from energy use by that year. Under the Net Zero scenario, emissions will be reduced by 95 percent by 2050, which would result in liquid fuel demand shrinking to 30 million bpd.

* * *

Full BP Global Report below: