Fra Zerohedge:

Source: Bloomberg

Policy makers from the world’s central banks are suddenly raising cautionary flags at the potentially unsafe investing environment stoked by their efforts to flood economies with ultra-cheap money.

- “While vulnerabilities related to low interest rates have the potential to grow, thus calling for caution and continued monitoring, so far, the financial system appears resilient” — Federal Reserve, Nov. 15.

- “Very low interest rates, coupled with the large number of investors which have gradually increased the duration of their fixed income portfolios, could exacerbate potential losses if an abrupt repricing were to materialize” — ECB, Nov. 20.

- “This type of environment can lead to an increase in risk‐taking, to assets being overvalued and to indebtedness increasing in an unsustainable manner” — Riksbank, Nov. 20.

- “Many investors are focused on the search for yield and could be tempted to take on greater risk” — Bundesbank, Nov. 21.

Most notably, Bloomberg reports that the spate of recent financial stability assessments began Nov. 15 with the Fed, which warned that low rates could encourage riskier behavior such as eroding lending standards.

A prolonged period of low rates could also “spur reach-for-yield behavior, thereby increasing the vulnerability of the financial sector to subsequent shocks,” it said.

However, as Bloomberg notes, despite central banks’ qualms about side effects, there’s little sign that they’ll do any more than issue warnings.

“The Fed since September, the ECB as well, the BOJ, even the central bank of China is starting to provide some more easing,” Kevin Thozet, an investment strategist at Carmignac Gestion, told Bloomberg TV on Wednesday.

That’s contributed to “a bull market of everything in 2019.”

Still, with a decoupling between stocks (soaring) and everything else (even global liquidity most recently)…

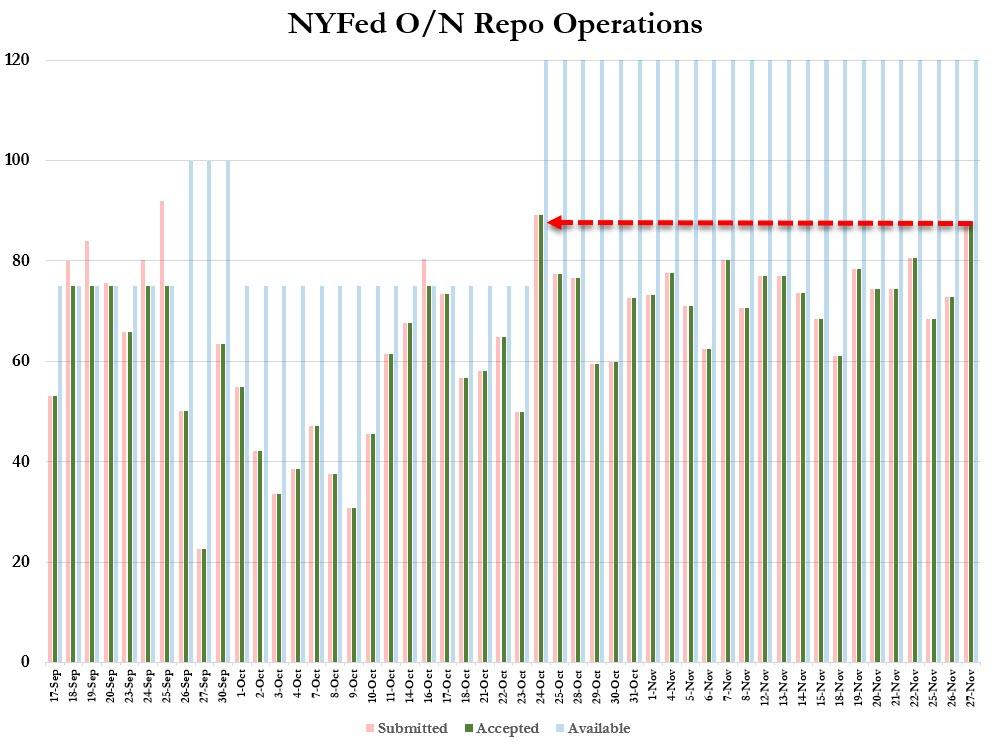

…Standard Chartered Plc, CEO Bill Winters, warns that the Fed’s recent difficulty in calming the repo market is instructive.

“We haven’t really had a test of the market, post-the financial crisis,” Winters said.

“I’m concerned that there’s a little bit more fragility in there than we’re aware.”

It was anything but transitory…