Fra Zerohedge/ Deutsche Bank:

Coronavirus: The Under-40s Dilemma

Last week, Deutsche Bank’s Jim Reid made a striking observation, one which threw all coronavirus comparisons to the Spanish Flu, and the coming second wave of the pandemic, in for a loop.

Specifically, Reid cited a paper that influenced market thinking in the early days of the Covid-19 pandemic looked at the effect of non-pharmaceutical interventions like social distancing and school closures during the Spanish flu (link here). The paper found that the US cities that implemented these measures tended to have better economic outcomes over the medium term. This offered historical support to the argument that there wasn’t such a big trade-off between economic activity and public health, because you needed to suppress the virus to enable consumers to be more confident and for businesses to operate as normal.

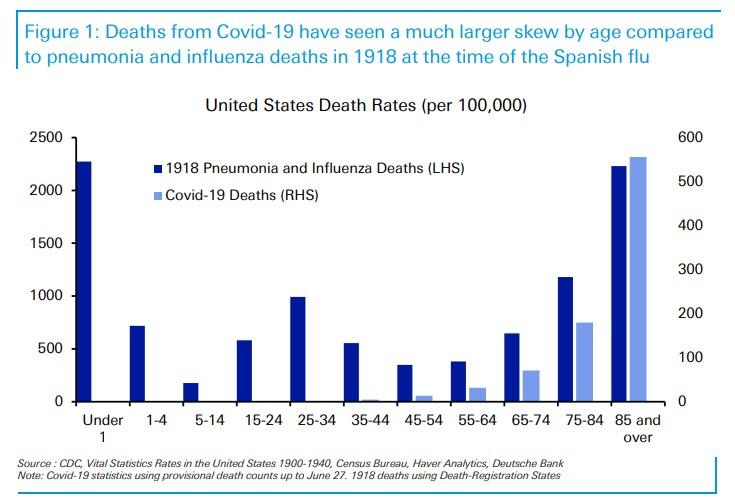

However, a major difference between Spanish flu and Covid-19 was the age distribution of fatalities, as shown in the chart below:

Now, in a follow up observation from Reid, the DB credit strategist points out another coronavirus peculiarity: the fact that the virus leads to virtually no fatalities of people below 45.

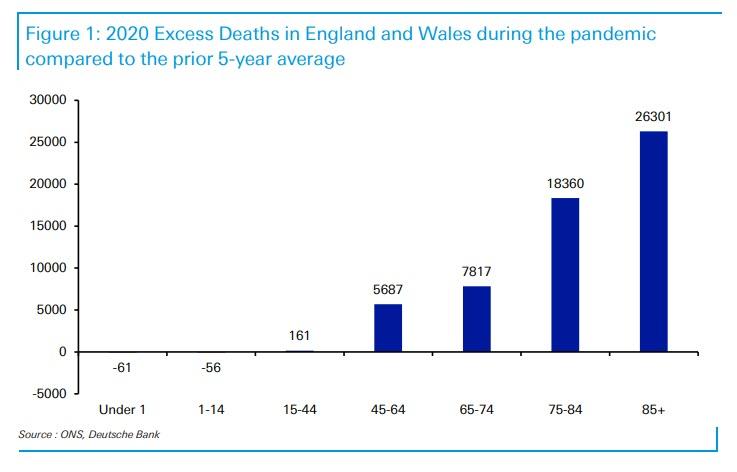

As Reid writes, the UK has been one of the worst-hit countries in the world when it comes to fatalities per head from Covid-19. The country has seen around 60,000 excess deaths relative to the previous 5-year average. But given the scale of these numbers, Reid points out a “remarkable fact” that among those aged under around 40, deaths have been roughly the same as for the previous 5-year baseline (using England and Wales data). This backs up previous observations on how age-discriminant Covid-19 has been.

It’s not just the UK: in Sweden (pop. 10.25m), where there was no lockdown, huge international criticism of its strategy, and one of the highest fatalities per head in the world – only 70 people under 49 years old have died of Covid-19, out of 5,482 total virus deaths (1.3%) so far. For context, average annual deaths in Sweden over the last 5 years for under-49-year-olds have been 3,417.

And yet, while the coronavirus has lead to virtually no excess deaths in younger age cohorts, it is the younger strata of society that are the most impact by the economic shutdowns that have resulted in tens of millions of unemployed Millennials.

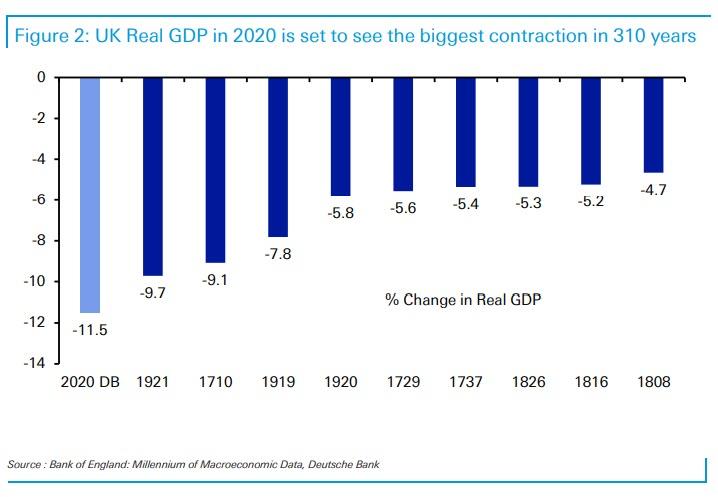

Indeed, as the second DB chart below shows, lockdowns will likely lead to 2020 being the worst year for the UK economy for 310 years.

As Reid provocatively puts it, “younger people will be suffering most from the economic impact of Covid-19 for many years to come, we wonder how history will judge the global response.” That said, since the economic crisis resulting from Covid-19 has also unleashed full-blown helicopter money as well as the biggest round of corporate bailouts of insolvent and zombie companies in history, we are confident that the tsunami of global moral hazard – which will leave tens of millions of young workers without a job – will allow central bankers to sleep soundly at night.

Reid’s conclusion: “the debate is more nuanced than a 250-word email can capture (e.g. the potential long-term implications of Covid-19 on individual health, the need to protect healthcare systems, etc.), but it’s a good discussion to have.”

Alas, the die has already been cast and it is now far too late.