Fra Zerohedge/ Nordea:

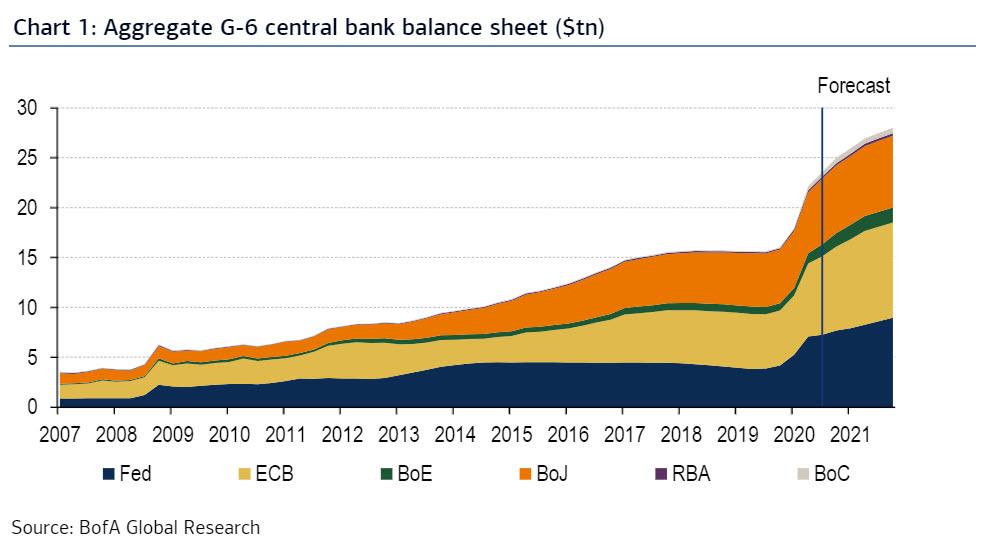

Two months ago we said that “the most important question in finance today” is whether what comes next after the historic liquidity tsunami which will see global central bank balance sheets hit $28 trillion next year…

… is inflation or deflation, a question which is even more critical and urgent today, yet which provokes even more market confusion, which can easily be seen in the record divergence between real rates (inflation adjusted current rates) which are at all time record lows, and breakevens (inflation expectations), which have been soaring for the past 3 months, a topic which we addressed earlier this week in “What’s Behind The Bizzare Break Between Breakevens And Crashing Real Rates.”

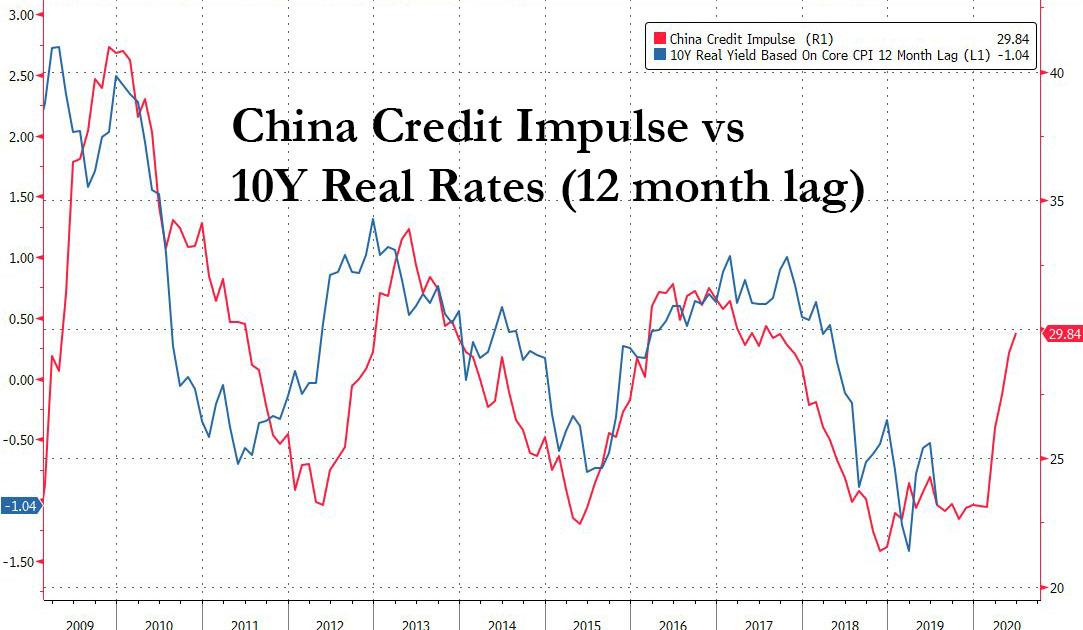

Yet one place where the all-important answer to this question that will define the global monetary system for the foreseeable future may be found is not in the US at all, but rather in China, as present in today’s chart of the day, showing the uncanny correlation between China’s credit impulse and (12 month lagged) US reflation, as measured by CPI-adjusted real rates.

Now, frequent Zero Hedge readers will be quite familiar with the topic of China’s credit impulse which year after year we have said that it is “all the matters” whether both China and the world face a reflationary wave, as discussed in:

At the risk of repeating ourselves, this is what we said back in 2017:

… as we have explained for years, starting back in 2010, when it comes to the global credit impulse, it was, is and will be all about China: without a massive surge in debt creation over and above the prior year, and thus a boost to annual impulse, the global economy virtually always rolls over. As UBS calculates, credit impulse has a strong correlation with global domestic demand growth: the average DM correlation with domestic demand is 0.67 (and as high as 0.75 for the US) whereas for EM it’s only 0.23. The correlations for Poland (0.67), Turkey (0.66), Brazil (0.6) and South Africa (0.55) are all decent but India (0.15) and China (0.1) are very low, possibly because of problems with the GDP data.”

The bottom line: absent a new, and even more gargantuan credit expansion by Beijing – which is not likely to happen at a time when every single day China warns about cutting back on shadow banking and loan growth – the so-called recovery is now assured of fading. It is just a matter of time.

And, as the chart above shows, there is a 12 month lag between China’s credit impulse and US real yields, which as we shown in recent days, determine virtually everything, from the price of gold and stocks, to the value of the dollar, to – of course – nominal interest rates.

In fact, if the correlation shown above is maintained, one can extrapolate that within the next 6 to 9 months, US real rates will soar by roughly 150bps, which if one assumes breakevens remain unchanged, will push 10Y yields north of 3%, a level that will certainly lead to a market crash (the 10Y nominal spiked above 3% in Sept 2018 when stocks crashed on fears the Fed was eager to cool the overheating economy).

Of course, a reflationary outcome is precisely what every establishment entity wants, from central banks to politicians across the globe. In fact, as BofA’s Michael Hartnett writes in his latest Flow Show note “bigger government (expansion of monopolistic public sector), smaller world (breakdown of global supply chains), dollar debasement (inflation solves excess indebtedness) all secular reasons to raise inflation hedges big-time heading into 2021.”

Why should ordinary equity investors care about any of this? Because as Hartnett summarizes, “consumers, China, inflation all putting upward pressure on bond yields – which is what ends bull markets.”

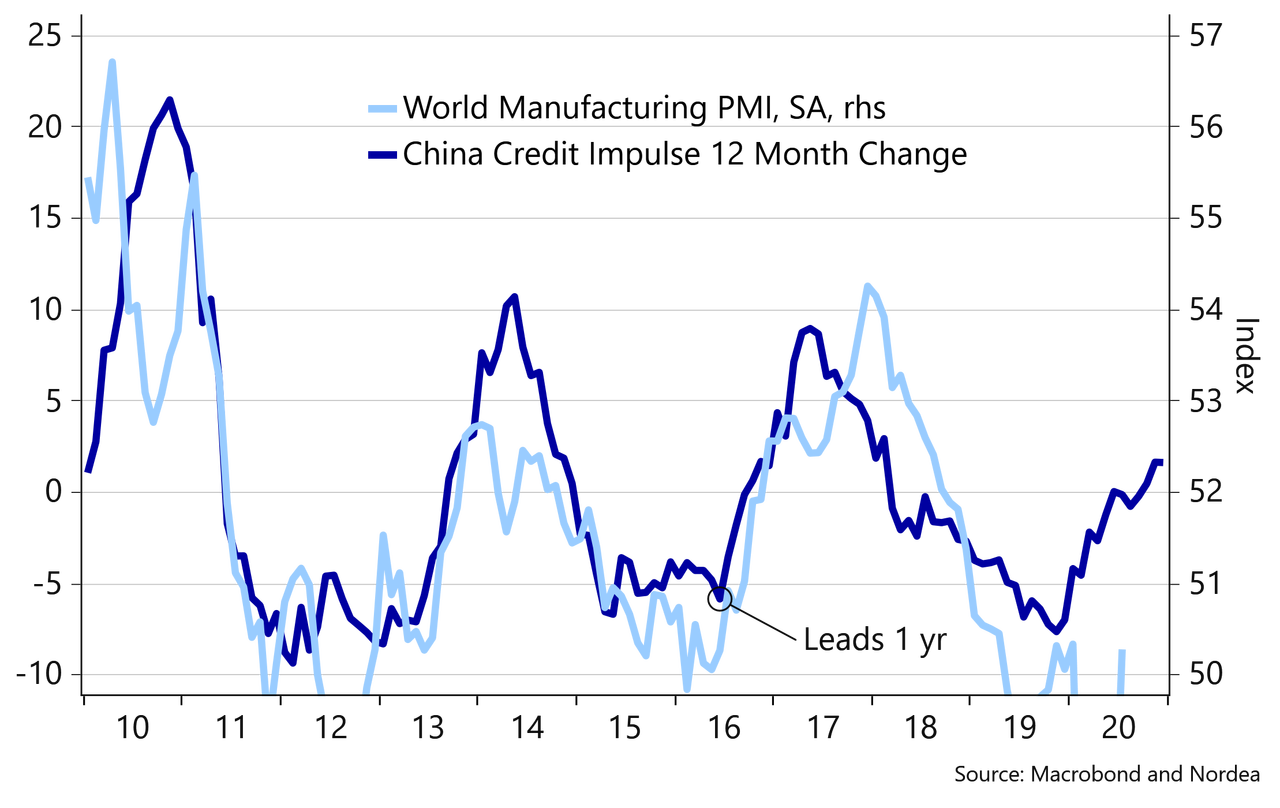

But wait there’s more, because in addition to the positive feedback loop sparked by the Fed, as PrismFP’s Mark Orsley noted, Nordea’s Andreas Steno Larsen today writes that the announcement of a Covid-19 vaccine could be the “reflationary event of the century.” Similar to us, Larsen looks at China’s credit impulse only instead of its impact on real rates, he focuses on global PMI, which naturally is expected to surge (with a 1 year delay) once the credit impulse spikes.

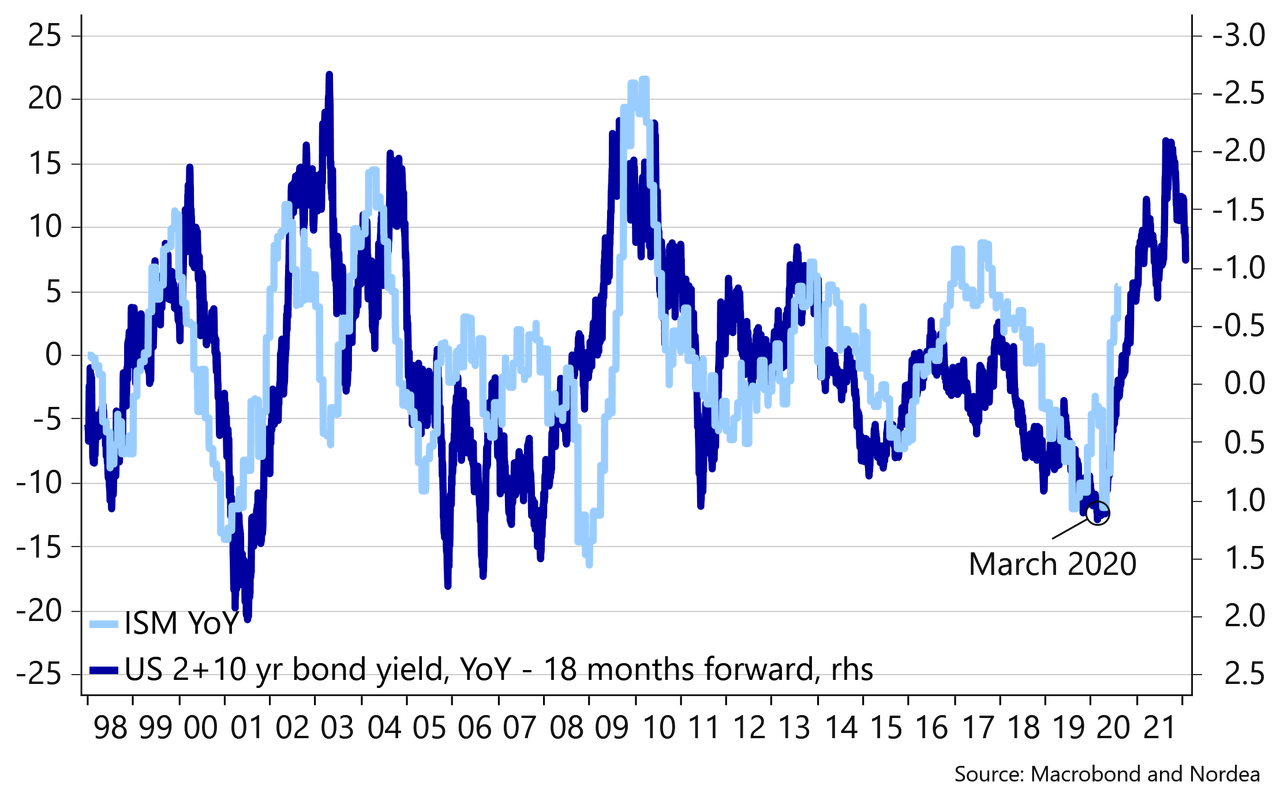

Translated to the US, where monetary stimulus is still potent, Larsen then predicts that this Chinese reflationary surge would “show up in markedly higher ISM readings than what we have already seen. 70-75 readings are not out of this world to think of; after all it just means that three out of four survey participants find an improving environment compared to the month prior. Not unlikely given that we were all locked into our cellars in March/April.” As one would expect, there is also a very close link between the annual change in the ISM and yields (again, with a modest lag):

“So, how far can we go if the yield reflation is allowed to run its course”, is the question asked by the Nordea strategist as we go back full circle to the only question that currently matters.

Well, according to Steno Larsen, “the current global PMI already points at >1.5% readings in the 10yr US Treasury yield” although as he then quickly points out, “this is probably a bit farfetched to think of as the Fed has launched a pamphlet of curve flattening measures since the outbreak of the COVID-19 crisis. Usually, we would argue that the Fed would need to massively ”outprint” the US Treasury to create a true curve-steepener environment.”