Fra Zerohedge:

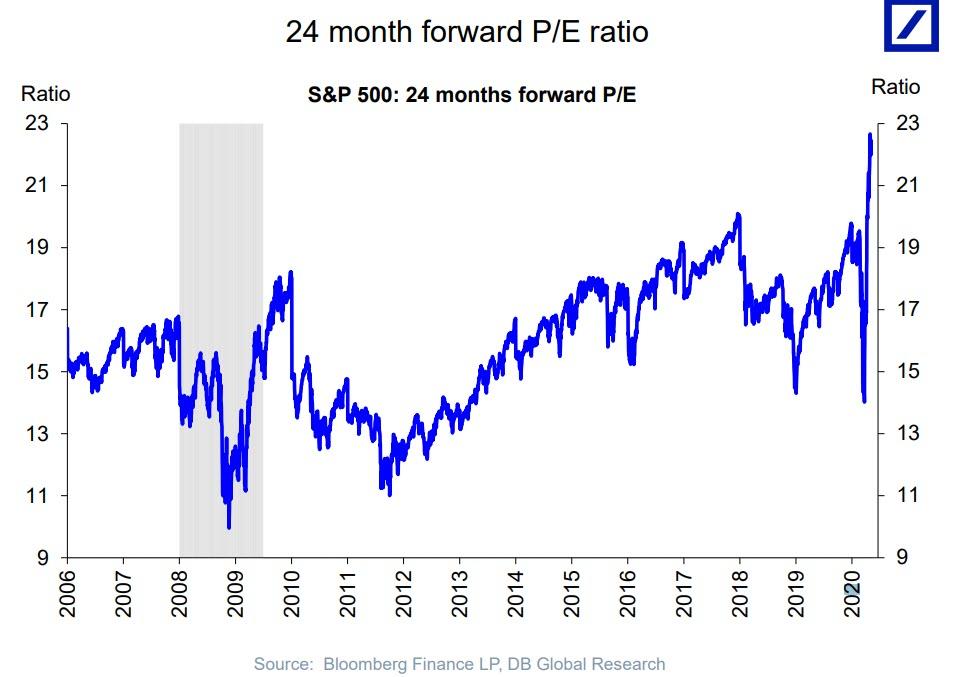

The chart showing the 2 year (not 1 year) forward P/E multiple on the S&P500, i.e., based on EPS from Dec 31, 2021, is now so ridiculous it barely fits in the chart let alone is worth to comment on.

And while one can argue that nobody cares about fundamentals in a world in which the economy, profits and markets all exist in a state of what BofA called a “Schrödinger Equilibrium” created by the Fed, Credit Suisse equity strategist Jonathan Golub just has trouble believing that we now live in a world in which PE multiple have reached a persistently higher plateau.

As he writes in his daily note to clients today, “we’ve repeatedly made the case that more cash flow-rich companies, in a less volatile environment, would lead to a new regime of persistently higher multiples and the secular outperformance of growth and long-duration (less volatile) equities.”

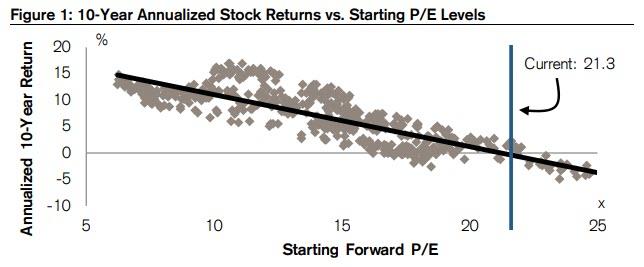

Golub then counters that while “bearish investors would (correctly) point out that future returns are highly influenced by starting valuations, with higher P/Es leading to weaker performance, as multiples de-rate toward long-term averages”, he would, in turn, respond that “valuations have little influence over the near-term” (the chart above makes that quite clear).

And just to underscore his point, Golub shows that whereas valuations indeed have little impact on 1-year stock returns…

… they certainly impact the market’s return over the coming decade. And as the second chart shows, when starting at the currently lofty valuation, returns over the next ten years tend to be more or less the same: 0%.