Fra Danske Bank:

Spending over Easter down significantly compared with 2019

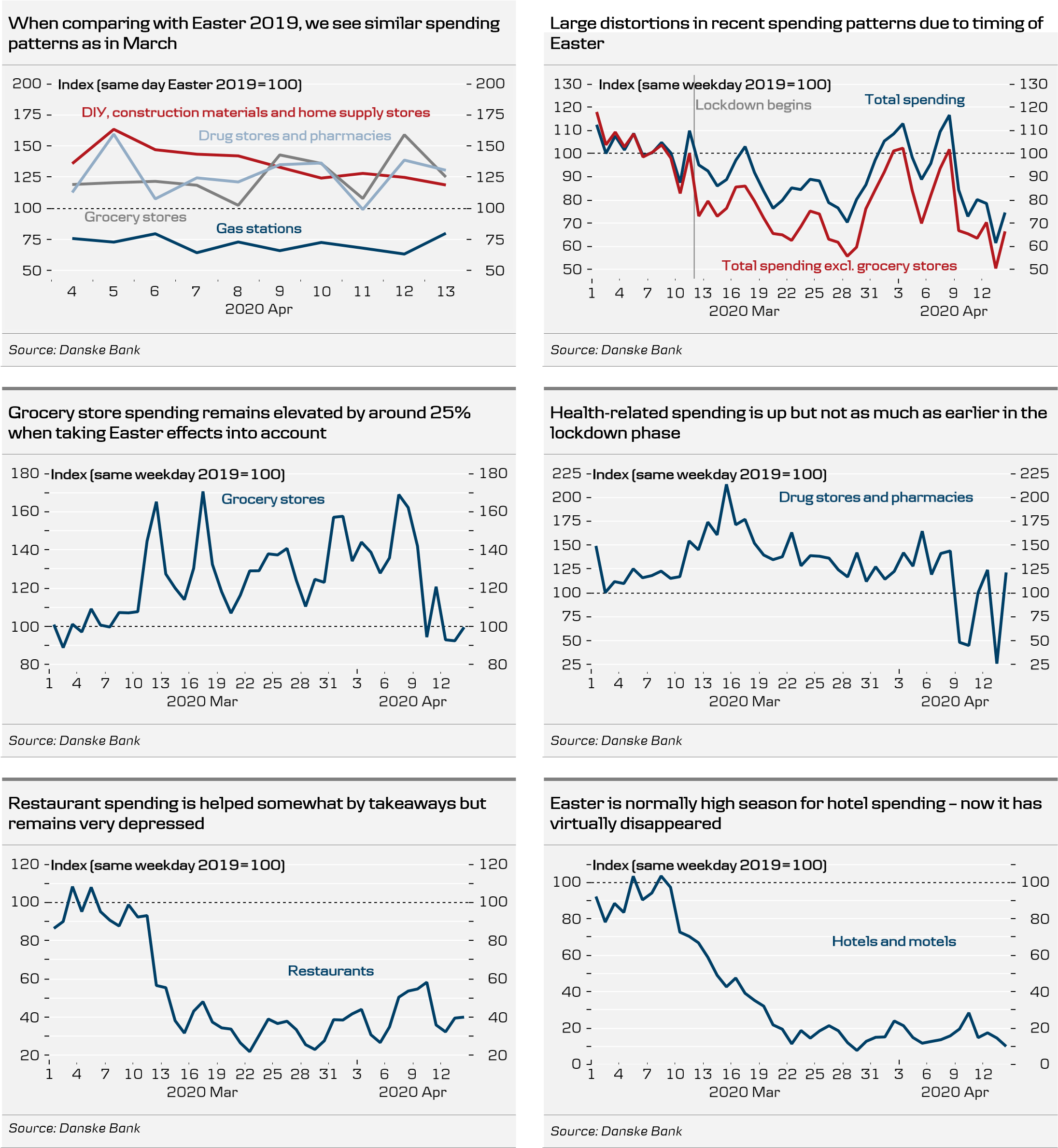

- Danish spending data up to and including 14 April shows that overall spending continues to be depressed, in line with the pattern we have seen since the lockdown started on 11 March.

- Easter being one week earlier in 2020 than in 2019 affected overall spending patterns. Compared with Easter 2019, spending is down by around 10% and around 25% excluding grocery stores.

- Spending in grocery stores remains elevated by around 25% compared with Easter 2019. Likewise, DIY spending continues to be up, although there are signs that the heightened activity has come down a bit.

- We are still seeing extremely depressed activity in most of services and entertainment – in line with the lockdown. Restaurant spending seems to be helped somewhat by takeaways but around 60% of spending here has disappeared.

- As the lockdown is gradually lifting, with more retail stores opening up this week and services such as hairdressers opening on Monday 20 April, we expect spending to pick up. By how much is the key uncertainty for coming weeks.

- On the following two pages, we detail the developments in spending by type. Note that some categories display large Easter effects.