Deutsche Bank mener, at det mest sandsynlige udfald af valget på tirsdag er en blå sejr, a blue sweep, hvor Biden bliver præsident, og hvor Demokraterne får flertallet i Senatet. Det kan føre til en stimulipakke næste år på 2000 milliarder dollar og skabe en vækst på 5 pct., mens ledigheden vil falde markant. Men en blå sejr ventes ifølge Biden at føre til ekstra skatter på 2500 milliarder dollar over de næste ti år – dog ventes skatteplanen ikke at blive sat i kraft, før coronakrisen er overstået.

Election could bring sweeping changes to the economic outlook

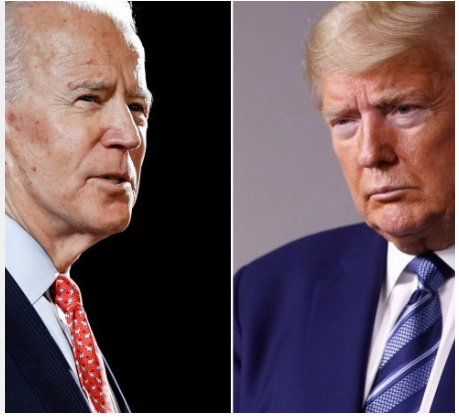

While all elections have implications for the economic outlook, the two candidates for this year’s contest have historically divergent views on pretty much all important aspects of the economic policy landscape.

We consider the implications for the economic outlook of the four possible combinations of president and Senate.

A blue sweep, in which Biden wins the presidency and Democrats take control of the Senate, appears the most likely outcome according to polls and model projections.

This result would provide the most fiscal stimulus to the economy in 2021. While the Biden plan does detail about $2.5tn of tax increases over the next decade, we assume these will not be implemented until the economy is on firmer footing, likely late 2021 or early 2022.

Simulations of the Fed staff’s model show that an additional $2tn stimulus package could significantly boost the economy next year, lifting real GDP growth by about 5 percentage points, adding 3 million jobs, and lowering the unemployment rate by nearly 2 percentage points.

Given that the blue sweep scenario marks the most dramatic break from the status quo, we also detail the likely implications for trade and regulatory policy, and discuss the key political considerations and possible appointments to crucial economic adviser positions that could help determine the policy outcomes.

However, the second most likely outcome – a Biden win and a Republican Senate – is also the most negative for 2021 growth, in our view.

Fiscal stimulus is likely to be far more marginal and other key elements of the Biden agenda that could be implemented through executive orders or guidance on regulation are likely to be negative for near-term growth prospects.