Fra Zerohedge:

Fra Zerohedge:

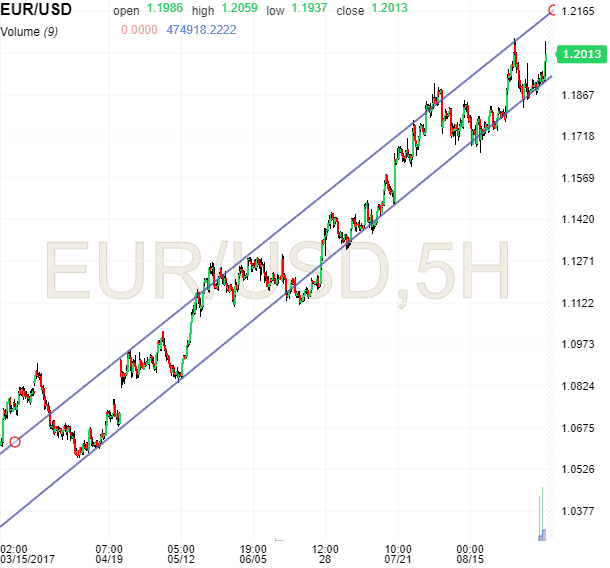

Having concluded that Draghi’s speech was on the margin dovish, not least of all due to Draghi’s parting shot at Euro bulls, saying that “nothing will derail ECB’s will to deliver inflation”, a refreshed version of “Whatever it takes”, the EURUSD has since slumped from session highs, and was back under 1.20, in fact filling the entire post-Draghi gap, driven in part by the release of the ECB’s currency forecasts, which are far below the spot rate going all the way to 2019.

This is what the ECB now forecasts:

Bilateral exchange rates are assumed to remain unchanged over the projection horizon at the average levels prevailing in the two-week period ending on the cut-off date of 14 August. This implies an average exchange rate of USD 1.13 per euro in 2017 and of USD 1.18 per euro over 2018-19, compared with USD 1.09 in the June 2017 projections. The effective exchange rate of the euro (against 38 trading partners) is 2.1% higher in 2017 and about 4.4% higher over 2018-19 than assumed in the June 2017 exercise.

While this is a somewhat paradoxical considering the ECB’s favorable outlook on the European economy, the market has taken this latest indication of what the ECB sees as “fair value” and sent the EURUSD lower, even as Bund yields continue to slide, while 10Y Italian BTPs have slumped back below 2% after the Draghi presser.