Fra Zerohedge/ Buzzfeed:

Shares of the world’s biggest banks are tumbling in premarket trade Monday morning after Buzzfeed last night published a lengthy report based on a cache of thousands of leaked SARS – suspicious activity reports – filed by the world’s biggest banks, including JP Morgan, and Deutsche Bank, which were both prominently featured.

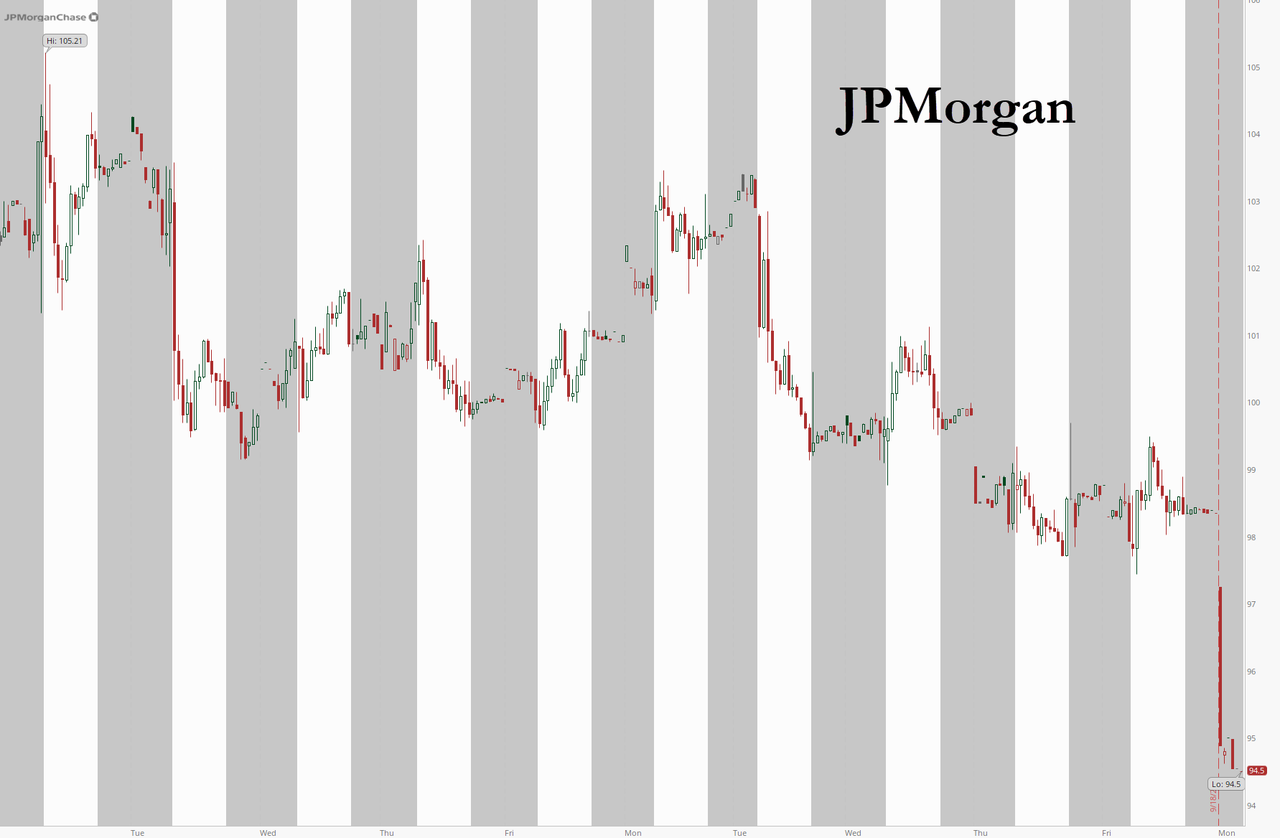

JP Morgan shares tumbled 3.5% to their lowest levels since July.

European banks bore the brunt of the selling on Monday, given that many European megabanks featured prominently in the reporting. Deutsche Bank tumbled 8.3% as the report relitigated parts of the Mueller probe and the bank’s involvement with the Trump family, and members of the Trump inner circle. Reports in the files revealed at least $1.3 trillion in suspicious transactions passed through the bank between the late 1990s and late 2010s.

European banks are having their worst session in six months, as HSBC falls 4% to lows unseen in decades. HSBC and Standard Chartered both featured heavily in the report, as transgressions involving both banks from around 2012 were cited as helping spur a massive surge in banks filing SARs.

As a result of dredging up these years-old allegations, HSBC shares – already battered by uncertainty in its biggest market, Hong Kong – have slumped to their lowest level since 1995.

DB, meanwhile, was shown to have processed $1.3 trillion in suspicious transactions between the late 1990s and 2017. All told, the documents obtained by Buzzfeed and shared with the ICIJ showed the banks moving more than $2 trillion in suspicious funds between 1999 and 2017.

The Stoxx Europe 600 banks index dropped 4.6% at its lows, the biggest daily drop in more than 3 months.

European banks are now down roughly 43% so far this year. One banking analyst noted that although the allegations represented in the story are years, even decades, old, the sprawling report is “yet another bad-report card for the banking sector,” wrote Zurcher Kantonalbank analysts in a note to clients.